Search

Search

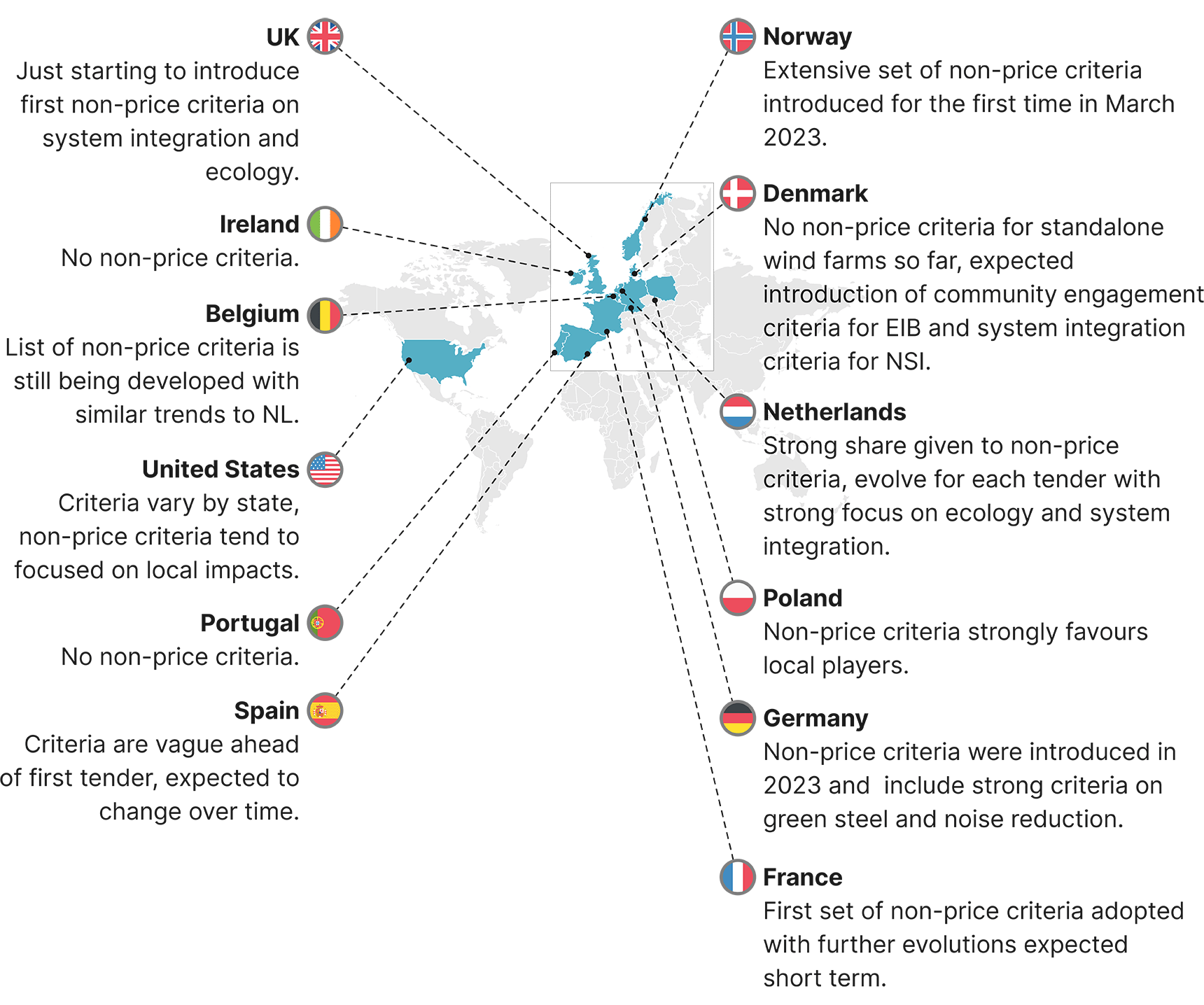

Five years ago, offshore wind projects relied on state-aid to come to fruition; the world’s first subsidy-free offshore wind farm was commissioned in September 2023 in the Netherlands. Governments around the North Sea, including Denmark, Germany, the Netherlands, and the United Kingdom have made offshore wind the cornerstone of decarbonization strategies while stimulating continuous improvement in the quality of the wind farms. This has led to an inclusion of qualitative criteria in leasing rounds, like risk management capabilities, ecological impact mitigation, circularity, international responsible business conduct, stimulating local content and supply chains, and the integration of offshore wind in the energy system1. Governments worldwide, including the United States and European countries, are hoping to capitalize on offshore wind by including a capped or uncapped financial auction component in the bidding process.

Developers have paid up to $1.1 billion in the United States and up to €3.8 billion in Europe to acquire development rights, indicating early signs of success in the market due to a clear, global pipeline of developments; close collaboration between developers, lenders, and the supply chain; and a rapid learning curve.

More recently, however, developers in Europe and North America have withdrawn from project developments or tried to renegotiate the terms. This comes at a time that the supply chain is struggling to keep up with the rapidly increasing demand both in terms of increasing global project pipelines, as well as the demand for bigger turbines.

In this article, we explore these seemingly contradictory developments in the offshore wind sector by assessing the drivers for offshore wind developers to pay millions or even billions for the rights to develop a site and the factors which have motivated developers to reconsider, renegotiate, or even halt their projects.

Developers are Willing to Dig Deep for Offshore Wind Development Rights

While the first subsidy-free offshore wind farm in the world was being tendered in 2018 in the Netherlands, an auction took place across the Atlantic Ocean for the development rights of three 500-km2 sites in the state of Massachusetts. Where developers in Europe were exploring the limits of their business cases, developers in the United States took it a couple of steps further and paid $135 million each just to secure the seabed leases of the three respective areas. Since then, multiple financial auctions (or auctions with a financial component) in the United States and Europe have taken the sector by surprise.

Financial auctions in the U.S. cleared with the maximum bids ranging from $130 million to a staggering $1.1 billion. Meanwhile, competitive auctions in Europe have seen a strong financial component as well. In the United Kingdom, the maximum option fee in the fourth auction round (UK Round 4) came in at £231 million per year, which is due for a minimum of three years and a maximum duration of 10 years. A contract for difference (CfD) scheme in Denmark with a capped total payment due to the state resulted in an approximate payment of €376 million over the first four years of operation, and in Germany, the process of negative bidding resulted in a maximum bid of €3.75 billion in 2023.

Not every auction is equally attractive to offshore wind developers. Only a couple of months after the Germany auction, the results of the 2023 Gulf of Mexico round in the U.S. saw only one out of three sites attracting developer interest and a maximum bid of $5.6 million. Furthermore, the latest CfD round in the United Kingdom failed to attract any offshore wind developers on account of the maximum strike price which does not reflect the current market conditions.

But How Much Money Exactly?

While it appears that the global market is seeing significant investments in the industry, it is difficult to compare the different sums across countries, as each auction is unique in terms of payment conditions, development scope, support mechanisms, and revenue regime.

However, considering the development and construction timelines of each leasing round, and assuming a discount rate of 6%, we evaluated the net-present value (NPV) for each of the bids and convert these to 2023 Euros (see figure below). In 2023, the offshore wind leasing round in Germany clearly demonstrated the highest willingness-to-pay of developers so far, while the Gulf of Mexico leasing round attracted only two relatively modest bids for one of the three available sites.

The nominal NPV metric can be a good indicator of the impact on the levelized cost of electricity (LCOE). Taking simplifying assumptions (outlined in Table 1) for the annual energy production, operational lifetime, and discount rate, we approximate LCOE impact of a €100 thousand/MW nominal NPV to be €1.8/MWh. Some of the financial bids in auctions up to 2023 are therefore expected to have an LCOE-impact of nearly €20/MWh.

Why Developers are Willing to Pay These Prices

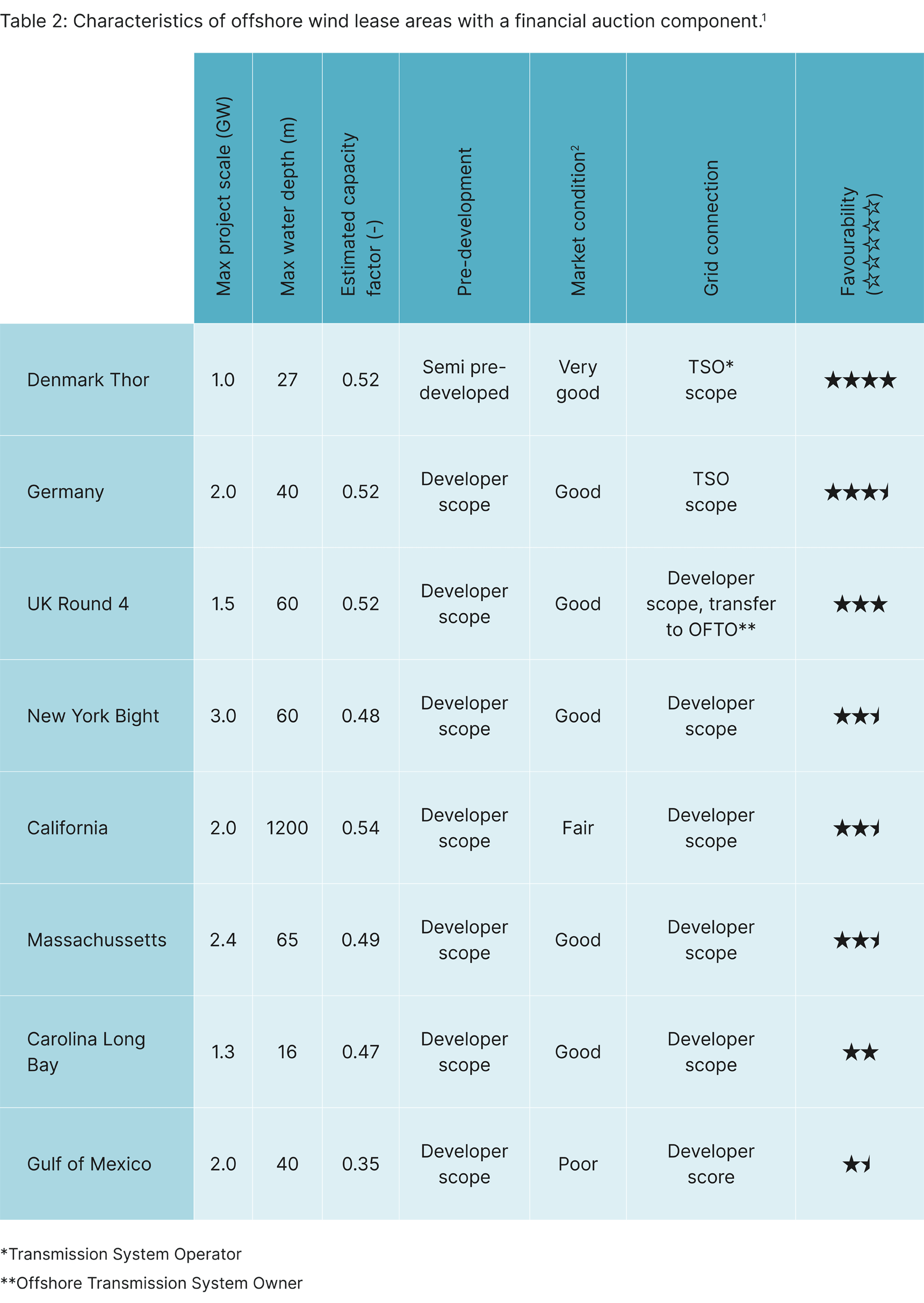

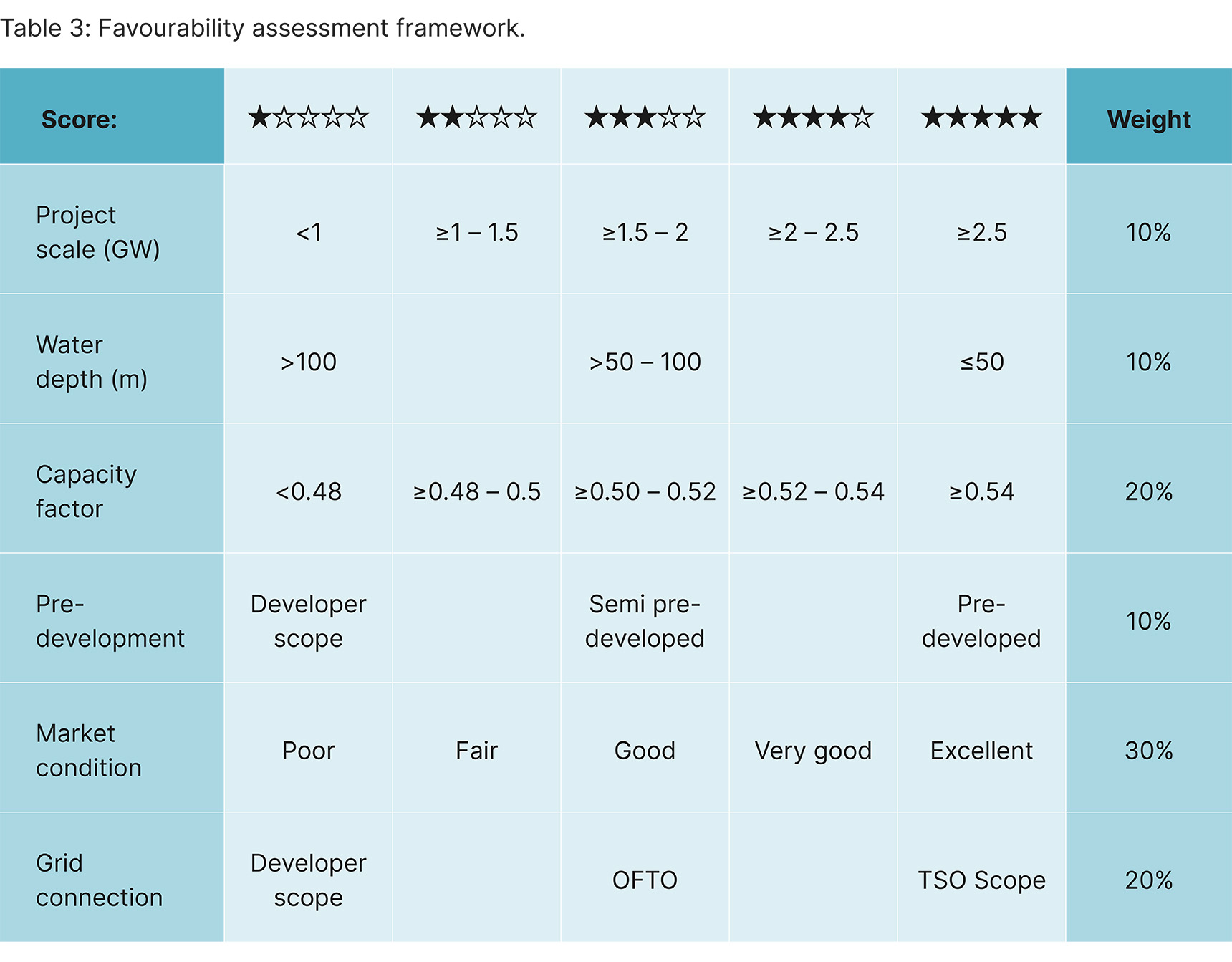

We’ve established how much developers are willing to pay, now we identify the drivers. Some of the drivers can be identified from the scope of the leases for which the auctions are held (Table 2). Comparing favorability of the leasing rounds with the willingness-to-pay in terms of NPV/MW, we can conclude that this assessment does not tell the full story. While the Denmark Thor wind farm probably has the most favorable development conditions, the total payment to the national government is capped, limiting the resulting NPV-per-MW. A large benefit of not having to develop, construct, and operate the grid connection in Germany is reflected in the financial bid of developers. Alternatively, the conditions of the New York Bight and UK Round 4 auctions were certainly not as favorable, though the NPV-per-MW seem to indicate otherwise.

In the United States, developers typically bid for power purchase agreements with state-owned utilities post lease auction. In addition, there may be additional benefits in the sale of renewable energy certificates (e.g., Offshore Renewable Energy Certificates, or ORECs, in the New York Bight auction). Some states, like California, provide a clear perspective for the future of offshore wind and the integration of renewables while other states do not.

Other drivers to pay these large sums of money just for the right to develop the sites may include decarbonization targets of the developers, market entry strategies (accepting lower hurdle rates), or the ability to build the wind farm on balance sheet financing basis (instead of non- or limited recourse finance, which typically requires up to 70% long-term fixed price electricity offtake agreements). While it may be riskier, developers with a large, robust asset base are able to spread this risk over their balance sheet.

Reconsideration, Renegotiation, and Cancellation

In October of this year, one of the global leading offshore wind developers announced halting two offshore wind projects in New Jersey, resulting in a value impairment of approximately $4 billion. The main reasons for cancelling these projects are additional supplier delays resulting in significant project delays, timing and likelihood of construction permits, and increased interest rates3.

Before this announcement, other developers had put developments on hold or were already renegotiating the terms of the offtake contracts. For example, a developer announced a halt on the 1.4 GW Norfolk Boreas offshore wind project in the United Kingdom due to rising costs4. Meanwhile, in Massachusetts, one developer has terminated its PPA, and two other developers are in the process of renegotiating their PPAs, also due to rising costs in the industry5,6. It seems contradictory that the same developer who participated in the highest euro-per-MW financial auction so far (in Germany) may cancel a project on the other side of the Atlantic Ocean due to rising costs.

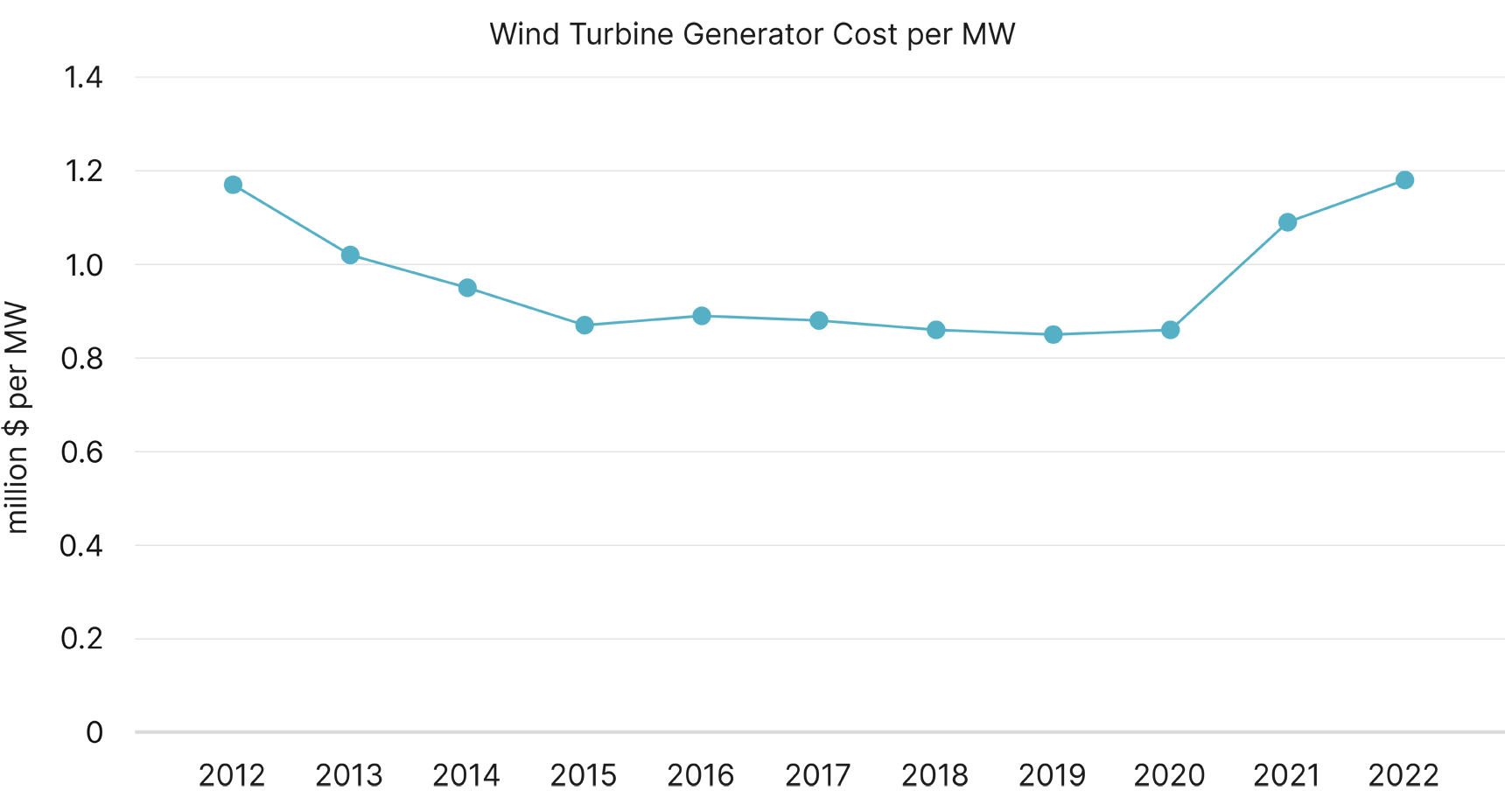

The projects which face termination or renegotiation all have one thing in common: fixed price agreements were contracted at a time when the industry looked very different than today, as the cost of building offshore wind has increased by as much as nearly 40% over the last three years. Additionally, macroeconomic conditions have changed drastically, with severe increases in the cost of capital. While these developers have likely done their due diligence and accounted for downside scenarios in their bids, developers have not anticipated the drastic turnaround in business case conditions which we have seen over the last couple of years. At the negotiated offtake prices, these four projects will likely not be able to realise acceptable returns.7 Penalties associated with termination are not enough to deter developers from termination and renegotiation.

The projects in Germany seem to indicate that developers have managed to secure offtake at prices high enough to compensate the increased costs, or, alternatively, have a strategic interest in securing renewable electricity. These developers, as opposed to traditional offshore wind developers, have large refinery and industrial assets which they are looking to decarbonize, with offshore wind energy as one of the potential enablers. A strategic approach to secure the renewable electricity required to decarbonize these assets may have been a driver for the high financial bids.

The industry has reached a critical point in the maturation of offshore wind. While developers are paying record amounts for seabed leasing rights and governments tend to increase financial award criteria, costs have increased as opposed to the expected, continued decrease due to the immense demand and ramp-up phase of the supply chain. One thing has not changed, and that is the importance of securing electricity offtake agreements to realize viable projects.

Safeguarding the Global Roll-out of Offshore Wind

Developers have demonstrated willingness-to-pay for offshore wind lease areas. Simultaneously, the offshore wind sector is facing challenges in rising costs, and supply chain and manufacturing bottlenecks. How can the sector and policymakers then safeguard a successful continued roll-out of offshore wind?

Developers need revenue security, preferably at long-term, fixed prices, and negotiating such offtake contracts with commercial counterparts has become standard practice and typically includes price risk hedging strategies. To further limit exposure, developers can focus on a more integrated approach to the system integration of offshore wind by investing in (flexible) electricity demand to offset offshore wind farm power production. Applying this strategy within an existing portfolio or asset base has enabled some developers to dig deep and secure lease areas already.

Policymakers often see offshore wind as a commodity on which they can capitalize while meeting their decarbonization targets. However, it is instrumental that policymakers take into consideration the cost, supply chain, and manufacturing challenges the sector are faced with. This should inform policies rooted in realistic offshore wind development roadmaps, achievable financial auction components, and support schemes.

While developers have demonstrated increasing willingness to pay for leasing rights, the sector is struggling to deliver projects at the current cost levels. Efforts are required from developers and policymakers alike to safeguard the global roll-out of offshore wind.

This article authored by Lennard Sijtsma

1. See Table 3

2. Market condition refers to revenue potential and stability in the respective auction, and political support for offshore wind. Relevant indicators include subsidy mechanisms, electricity market outlook, and renewable energy certificates.

3. “Ørsted Ceases Development of Its US Offshore Wind Projects Ocean Wind 1 and 2, Takes Final Investment Decision on Revolution Wind, and Recognises DKK 28.4 Billion Impairments,” n.d., https://orsted.com/en/company-announcement-list/2023/10/oersted-ceases-development-of-its-us-offshore-wind-73751.

4. Susanna Twidale, “Vattenfall Halts Project, Warns UK Offshore Wind Targets in Doubt,” Reuters, July 20, 2023, https://www.reuters.com/sustainability/vattenfall-halts-project-warns-uk-offshore-wind-targets-doubt-2023-07-20/.

5. Buljan, Adrijana. 2023. “Avangrid Terminates Long-Fought PPAs in Massachusetts at Cost of Almost USD 50 Million.” Offshore Wind. July 19, 2023. https://www.offshorewind.biz/2023/07/19/avangrid-terminates-long-fought-ppas-in-massachusetts-at-cost-of-almost-usd-50-million/.

6. Durakovic, Adnan. 2023. “BP and Equinor Could Cancel US Offshore Wind Projects.” Offshore Wind. August 1, 2023. https://www.offshorewind.biz/2023/08/01/bp-and-equinor-could-cancel-us-offshore-wind-projects/.

7. Offshore Wind Contract Disputes Proliferate as High Costs Jeopardize US Buildout.” n.d. www.spglobal.com. Accessed November 29, 2023. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/offshore-wind-contract-disputes-proliferate-as-high-costs-jeopardize-us-buildout-76164337.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.