Search

Search

UAE leaders recognize that carbon capture, utilization, and sequestration (CCUS) efforts will play an important role in their goal of achieving net-zero CO2 emissions by 2050. The nation has been a pioneer in decarbonizing heavy industry through CCUS technology, completing the Al Reyadah Project in a joint venture in 2016—the first commercial-scale CCUS facility in the Middle East.

The UAE has set an ambitious target of reaching 5 million tons per annum (MTPA) of CCUS capacity by 2030. The bulk of that is committed through Abu Dhabi’s National Oil Company (ADNOC), which plans to significantly expand its CCUS operations to include capturing CO2 from its own gas plants. This work includes the recently awarded Habshan CCUS project, which should yield CCUS capacity of 1.5 MTPA to bring the UAE’s total CCUS capacity to 2.3 MTPA.

Complicating those goals, though, are the European Union’s Carbon Border Adjustment Mechanism regulations, which place carbon prices on imports of some goods originating outside the EU. This will impose a challenge on UAE exports of steel, aluminum, ammonia, and other products of carbon-intense, hard-to-abate industries. With 14% of the UAE’s exports of steel, aluminum, and fertilizers being subject to those regulations, UAE-based companies must reduce their carbon intensity to avoid potential tariffs that affect their competitiveness on the global market.

Steel, cement, and petrochemical sectors could benefit most from CCUS as a primary decarbonization solution due to their high CO2 emissions and the feasibility of integrating CO2 capture with existing processes. These sectors can also use low-carbon hydrogen for cleaner production, but CCUS remains essential to address emissions that hydrogen alone can’t eliminate. CCUS is also a fundamental component of blue hydrogen production. The UAE has committed to producing over 400 kilotons of blue hydrogen per year by 2031. Given its importance, decarbonizing this sector through CCUS is imperative to meet the UAE’s climate goals.

Without a carbon pricing mechanism, though, incentives for investing in CCUS are limited. In the absence of that economic driver, heavy CO2 emitters are less inclined to make the substantial initial investment needed knowing they will face reduced financial returns and higher uncertainty over future regulatory costs. While corporate environmental, social, and governance drivers combined with the current government net-zero imperative can support some investment, the overall regulatory framework remains undeveloped—resulting in limited potential for CCUS adoption.

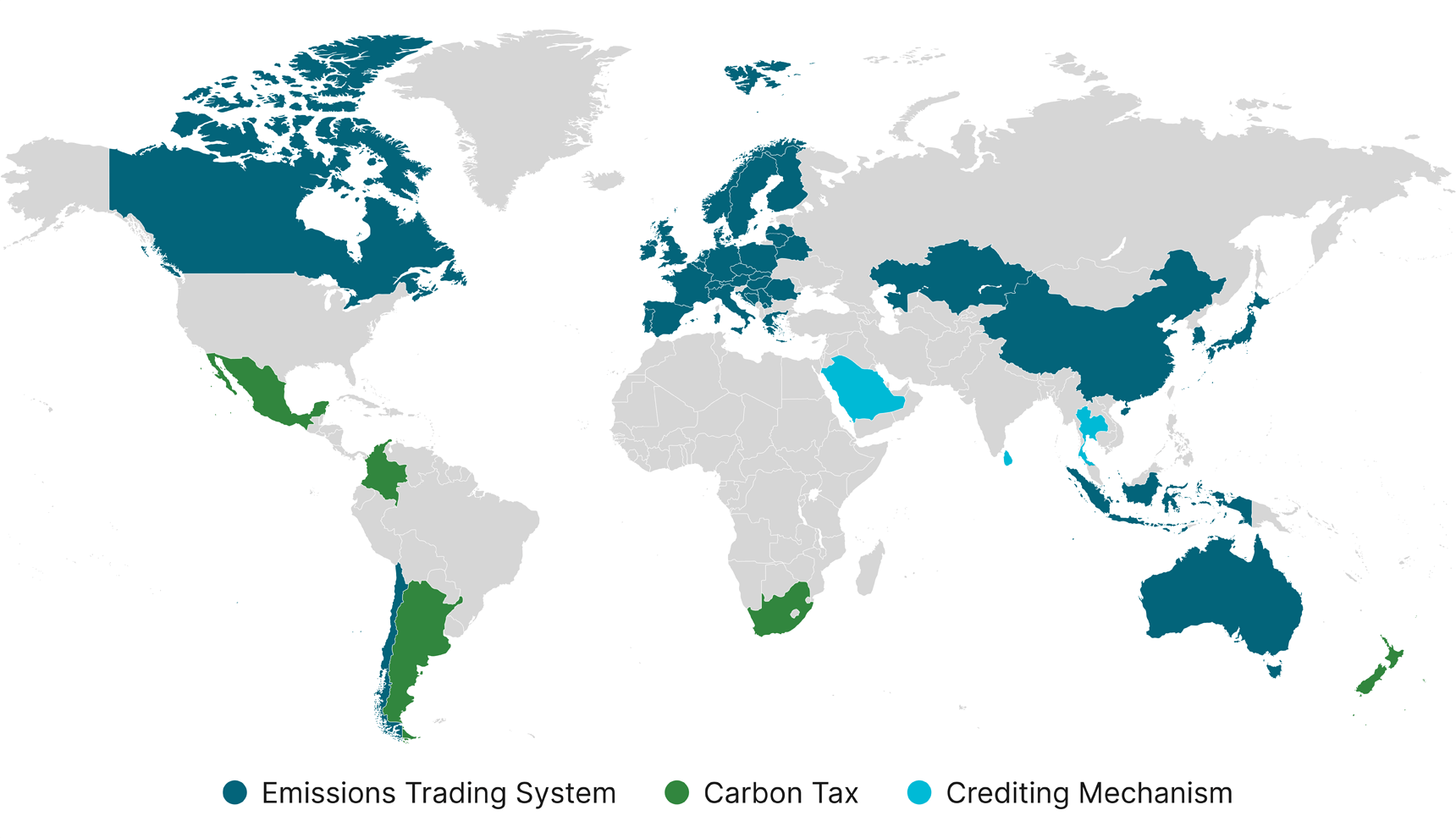

Putting a price on carbon has been the most influential factor globally in stimulating action on CO2 emissions and incentivizing the rollout of CCUS technologies. Carbon pricing options include direct forms such as carbon taxes, emissions trading schemes, and tax credits as well as indirect forms such as greenhouse gas emissions standards, fuel and energy taxes, renewable energy support systems, and energy efficiency certificate trading schemes.

Figure 1. Carbon pricing mechanisms around the world (Source: World Bank1)

When considering the geographic scope for implementing a carbon pricing scheme (irrespective of the mechanism chosen), we’ve determined that the UAE has three main options:

A UAE-wide cap-and-trade carbon pricing scheme may seem most suitable, but it wouldn’t have sufficient scale to justify the associated administrative complexity given the relatively small number of market participants within the UAE. Implementing a carbon tax would increase industrial sector cost burdens and be at odds with current government initiatives to incentivize industrial activity through energy subsidies and other support mechanisms.

A voluntary carbon credit market could offer flexibility, encourage private sector participation, and help companies meet their social responsibility goals. Because its voluntary nature limits its ability to drive CCUS investment, though, it would be more effective when paired with mandatory carbon pricing schemes.

The best approach for the UAE would be to create a carbon pricing mechanism based on standards that set a carbon intensity (CI) benchmark for key products such as fuels, steel, aluminum, cement, and glass. This would motivate companies to produce below the established CI benchmark and earn subsidies or tax credits such as the incentives offered by Abu Dhabi’s Energy Tariff Incentive Program.

Those incentives could also help offset the costs associated with using the services of a Carbon Transmission and Storage Company (T&SCo)—an essential way to implement CCUS technologies within industrial clusters most effectively. In the U.S., a federal tax credit provides incentives at varying rates for carbon capture and storage, enhanced oil recovery, and direct air capture and storage. The California Low-Carbon Fuel Standard establishes annual CI benchmarks that decrease each year through 2030, with companies able to earn or purchase credits based on how close their particular fuel’s CI is to the benchmark. In these examples, the federal tax credit can be combined with the California credits, providing additional incentives to CCUS project developers.

Building on the strong foundation established by the Al Reyadah Project and ADNOC’s ambitious CCUS plans, UAE leaders can advance their decarbonization efforts by identifying and developing strategic CCUS clusters. Similar to the development of hydrogen hubs, clustering CCUS infrastructure around existing heavy industries and ports can maximize efficiency, reduce costs, and streamline transportation and storage of captured CO2. By enabling shared infrastructure, leaders can reduce the overall costs and risks associated with CCUS projects.

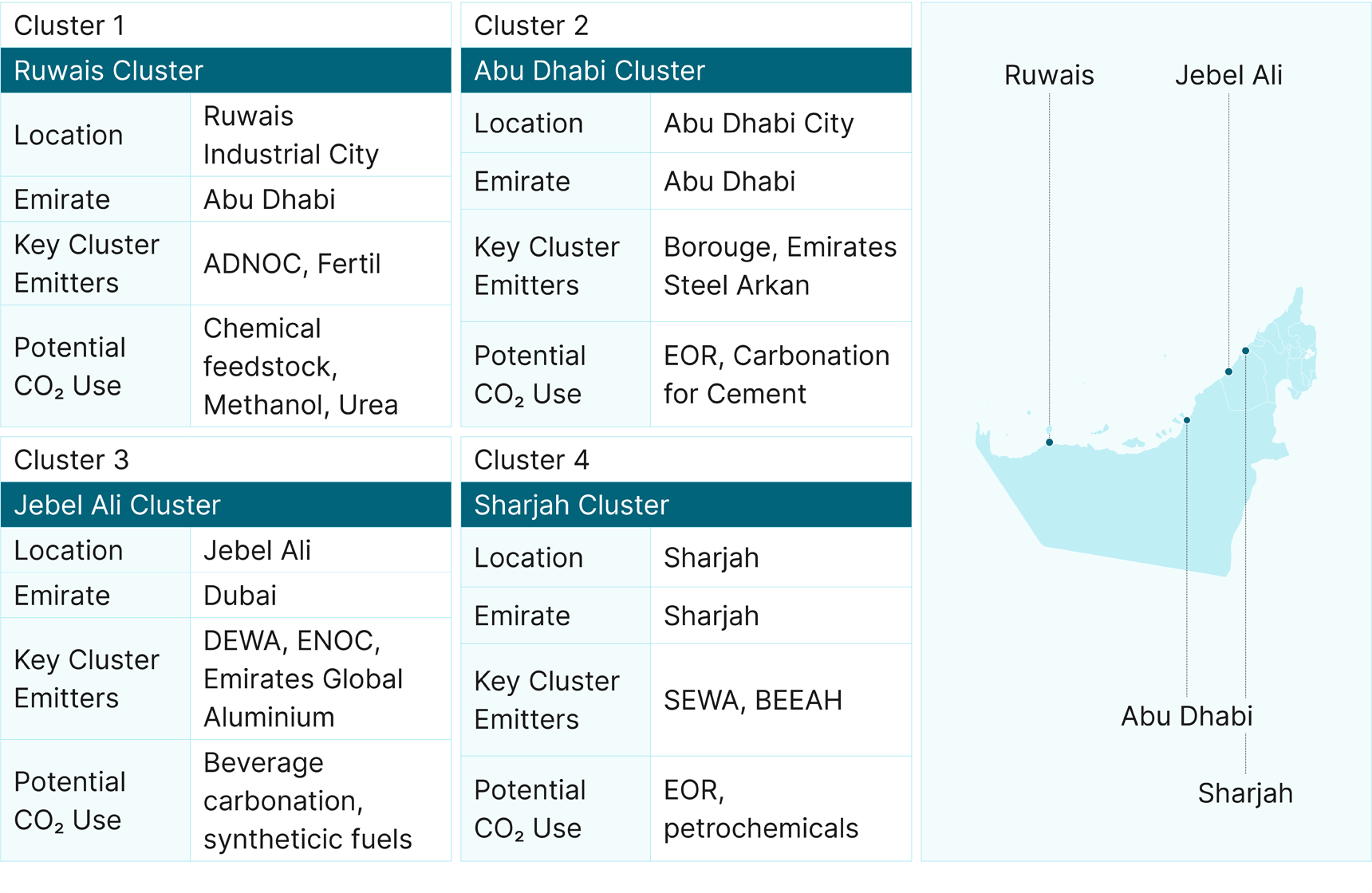

By assessing which regions have high CO2 emissions, proximity to geological storage sites, and existing infrastructure for CO2 transport and utilization, we’ve identified four that present the greatest potential for serving as CCUS clusters.

Figure 2. Proposed CCUS clusters in the UAE, with example emitters.

Figure 2. Proposed CCUS clusters in the UAE, with example emitters.

Because Ruwais Industrial City is a significant hub for ADNOC’s refining and petrochemical operations, it presents substantial opportunities for integrating CCUS. Example key CO2 sources beyond ADNOC’s refining include Fertiglobe’s fertilizer production and Borouge’s petrochemical operations. The captured CO2 can be used for enhanced oil recovery, petrochemical process feedstock, urea and other fertilizer production, and conversion into value-added chemicals.

Abu Dhabi Industrial City—the site of the Al Reyadah CCUS project—is ideal because it contains heavy industry CO2 sources such as cement, petrochemicals, and steel factories. The captured CO2 can be used for enhanced oil recovery in ADNOC’s nearby oil fields, conversion to chemicals such as methanol, synthetic fuel production, and concrete curing processes [Insert Al Reyadah Source].

Jebel Ali Free Zone offers another prime location for a CCUS cluster thanks to its extensive industrial base, including, for example, Dubai Electricity and Water Authority’s power and desalination plants. The captured CO2 from these sources can be used for enhanced oil recovery, construction material carbonate production, beverage carbonation, and other industrial end uses. The location’s proximity to Jebel Ali Port enhances its potential for exporting captured CO2 and related products.

Sharjah Industrial Area hosts a diverse range of manufacturing and industrial activities, such as Bee’ah’s waste-to-energy facilities, Sharjah Cement, and Sharjah Electricity and Water Authority’s power plants. The CO2 emissions from these sources can be captured and used for enhanced oil recovery, chemical and plastic production, beverage carbonation, and enhanced plant growth in greenhouses.

By orchestrating creation of these clusters, the UAE can establish a robust CCUS infrastructure network that supports its broader decarbonization goals. Strategic planning and stakeholder collaboration across these areas will help motivate further investment in CCUS projects.

For CCUS to become a workable decarbonization solution in the UAE, a robust regulatory landscape must be established. Effective regulations ensure that CCUS operations are carried out safely. They also minimize environmental and health risks by ensuring that all transport, capture, and storage systems are compatible and efficiently interconnected across different jurisdictions.

Regulatory frameworks and financial incentives alike must take into account the range of CCUS market models, which include dedicated T&SCo models, integrated operator models, and distributed or third-party transport and storage models. The Al Reyadah Project has adopted an integrated operator model, where the entire CCUS value chain from capture to transportation to utilization is all contained within a single operation. While this efficient, vertically integrated model can support dedicated projects, it’s not well-suited for large-scale CCUS deployment across multiple emitters and users.

We believe that by transforming the Al Reyadah Project into a dedicated T&SCo model (similar to the Northern Lights project in Norway), the UAE can centralize its CO2 transportation and storage operations and use existing oil and gas infrastructure to minimize costs and streamline logistics. Low-carbon standards and incentives would make it financially feasible for companies to engage with the T&SCo, guaranteeing it a consistent revenue stream. This model would support the UAE’s decarbonization goals while establishing a robust economic foundation for CCUS infrastructure to drive long-term sustainability and industrial growth.

Ways to address common challenges

To make CCUS a reality in the UAE, leaders will need to address key challenges posed by the three primary enabling activities required:

Considering its established strengths in infrastructure, technological prowess, and substantial investments in clean energy projects, the UAE is uniquely positioned to evolve CCUS deployment from a mitigation tactic to a foundational element of its sustainable industrial future. With proper strategic planning and coordinated execution, it can ensure that economic growth is achieved in tandem with environmental responsibility.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.