Search

Search

Many financial institutions see fraud reduction as a risk management function, but they often don’t connect it to the customer experience—or understand how it can be leveraged for growth through customer education about current fraud scams. Customers care about a secure experience, and they can and want to play a key role in helping companies identify fraud. However, antiquated, reactive approaches to fraud prevention can make the connection between the customer experience and fraud reduction difficult to quantify or address.

In June 2022, Arizent and American Banker conducted an online survey of banks, wealth management, money transfer, and financial technology organizations. The survey was the third in a series conducted on behalf of Guidehouse and sought to understand organizations’ approaches to monitoring and preventing fraud.

Nearly three of four firms (73%) think they are using a proactive approach to fraud prevention. Not everyone in the organization, however, is equally confident about that stance. Only 55% of executive managers describe their organization’s approach as proactive, substantially fewer than employees from areas like IT (74%) and compliance (87%).

Executives apparently perceive something that others in the company are more likely to miss: That the performance metrics and tools most companies use to measure fraud may be overly reactive. For example, more organizations rely on transaction data—a metric that only becomes available after fraud has occurred—than any other type of fraud indicator. By contrast, fewer than half use timely metrics such as ongoing technology assessments and pre-authorization risk analysis to measure their success—it’s these latter metrics and tools that are more likely to prevent fraud before it happens.

Firms could drive a more proactive approach by using better fraud metrics In addition to using insufficient metrics to measure the occurrence of fraud, many companies also hamper their fraud-reduction efforts by using the wrong metrics to gauge their success (see Figure 1).

Figure 1. Outcomes Companies Measure as Evidence of Success From Fraud-reduction Efforts

Other common performance indicators, such as fewer instances of fraud detected internally and lower expenses attributed to fraudulent activities, suffer from a similar flaw: Unless companies have the right tools and key performance indicators in place to detect fraud, these indicators may not be reliable. For example. fraud attrition could decrease simply due to lower sales volumes. Blanket attempts to control fraud through increased reviews or more stringent processes can backfire by introducing unnecessary friction.

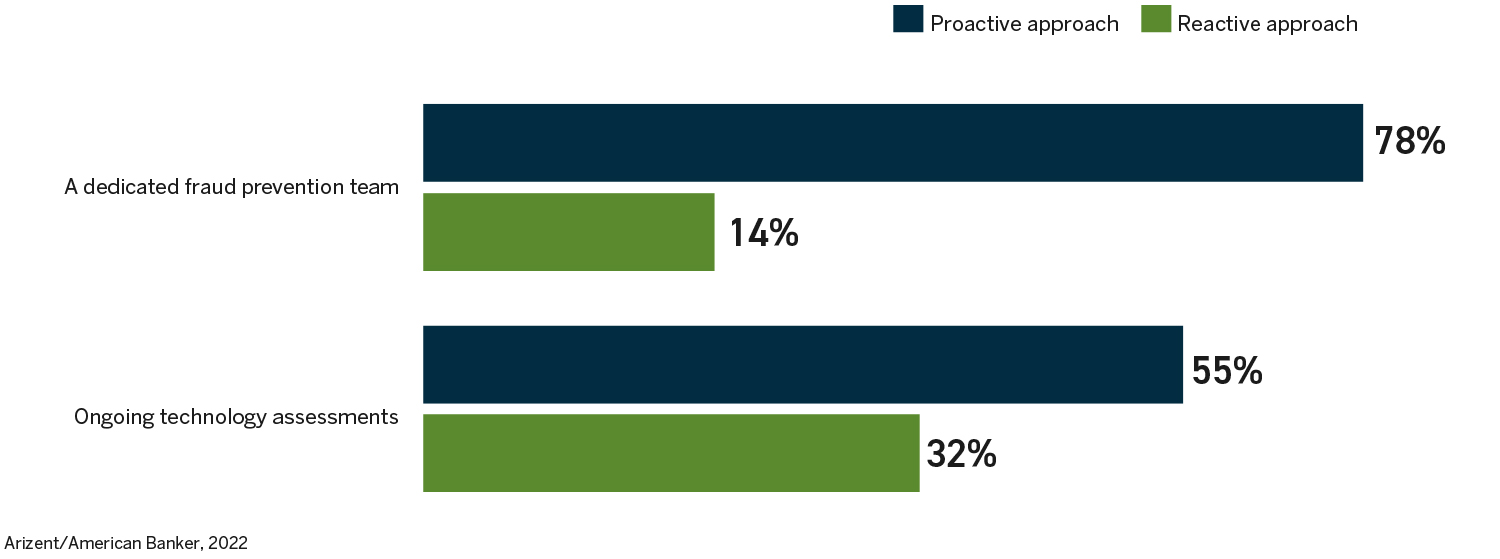

Organizations that take a more proactive approach to fraud management tend to devote dedicated, ongoing resources to the issue. Our research found that companies with a proactive approach are much more likely to employ a dedicated fraud strategy team (78%) and conduct ongoing technology assessments (55%) than organizations with a more reactive approach (14% and 32%, respectively) (see Figure 2). These methods are more likely to yield actionable and ongoing performance metrics that identify and accurately quantify the number and type of fraud attacks taking place, as well as the speed and effectiveness of the organization’s response to them.

Figure 2: Proactive Versus Reactive Approaches to Addressing Fraud Management Strategy Gaps

Leveraging more insightful fraud risk information does more than improve fraud prevention—it also improves the overall customer experience. Just as disconnected efforts to reduce fraud can make it more difficult for legitimate customers to interact with an organization, connected and comprehensive efforts can help companies figure out where they are inadvertently setting up roadblocks for legitimate customers.

— Ajay Guru, Partner, Guidehouse Financial Crime Fraud & Investigative Services

This research was conducted online during June 2022. To qualify, the 105 respondents had to work at a bank, in wealth management, for a money transfer, or for a fintech organization. Qualified respondents also had to be at least a key contributor to fraud strategy.

About Guidehouse

Guidehouse is a leading global provider of consulting services to the public and commercial markets, with broad capabilities in management, technology, and risk consulting. We help clients address their toughest challenges and navigate significant regulatory pressures with a focus on transformational change, business resiliency, and technology-driven innovation. Across a range of advisory, consulting, outsourcing, and digital services, we create scalable, innovative solutions that prepare our clients for future growth and success.

Arizent delivers actionable insights through full-service research solutions that tap into their first-party data, industry SMEs, and highly engaged communities across banking, payments, mortgage, insurance, municipal finance, accounting, HR/employee benefits, and wealth management. They have leading brands in financial services, including American Banker, The Bond Buyer, Financial Planning and National Mortgage News, and in professional services, such as Accounting Today, Employee Benefits News, and Digital Insurance.

For more information, please visit arizent.com.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.