Search

Search

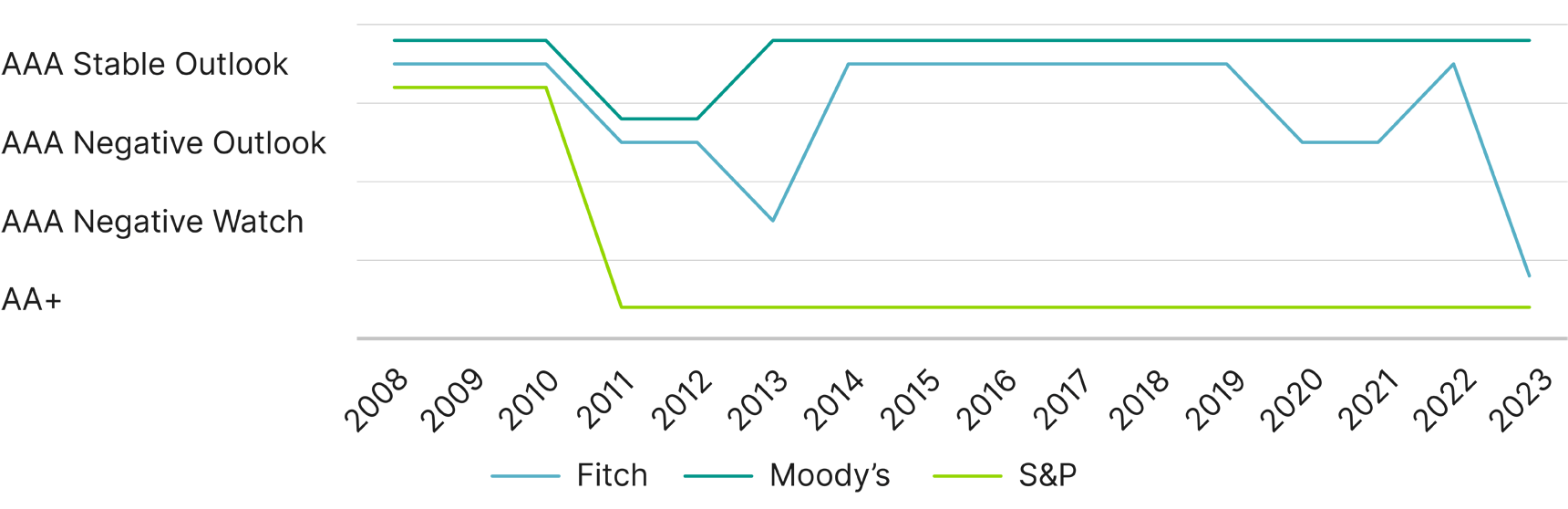

On August 1, 2023, Fitch Ratings, one of the Big Three credit rating agencies, downgraded the United States’ Long-Term Foreign Currency Issuer Default Rating from AAA to AA+. Fitch cited three reasons for the downgrade: an erosion of governance relative to other AA-rated and AAA-rated peers over the past couple of decades, an outlook of fiscal deterioration, and an expected growth of the government debt burden1. It was noted that the country’s political dysfunction also influenced the downgrade, with repeated debt limit standoffs between political parties, including the eleventh-hour debt-ceiling resolution in May 2023. This downgrade puts Fitch Ratings in line with S&P Global Ratings, which reduced the U.S. rating from AAA to AA+ back in 2011 for very similar reasons.

While the downgrade was a surprise to many, it's not unprecedented. On August 5, 2011, S&P Ratings downgraded the credit rating of the U.S. from AAA to AA+ due to the country’s rising debt burden and concerns over fiscal policy. This was preceded by S&P placing the rating on negative watch in July 2011. There were similar signals leading up to the August 1, 2023, decision:

Higher Borrowing Costs — The credit downgrade may lead to higher borrowing costs and an increase in rates across the board for various types of debt to compensate for the added layer of risk. This may limit financial institutions’ ability to invest in new technology and legacy system upgrades, acquisitions, and other opportunities.

Decrease in Foreign Investment — Because of the negative outlook on the economy and the increased perceived risk that the downgrade signals, there may be a decrease in foreign investment in the U.S. economy, which may slow economic growth and development.

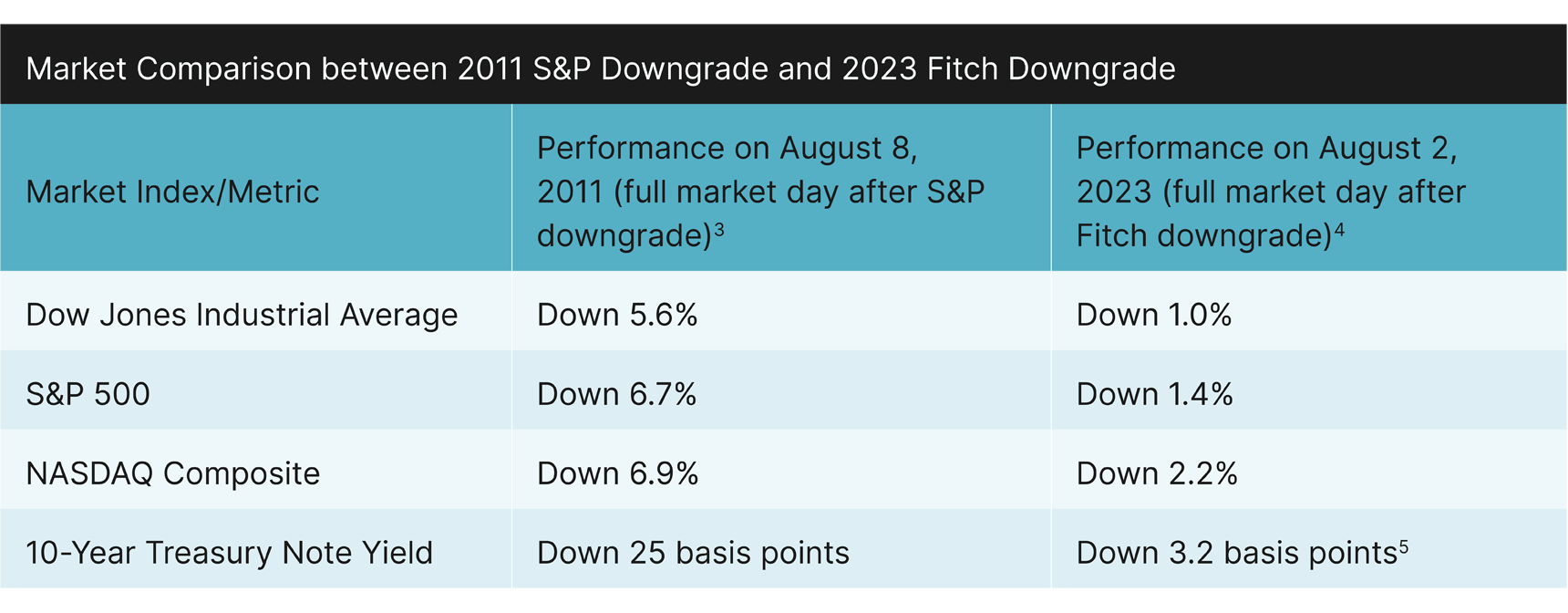

Market Volatility — In the short term, there was concern about a reactionary period of market volatility, which may affect stock prices and turn away investors. Based on the performance from the full market day after the Fitch downgrade, the major indexes experienced a drop, but not as significant as the drop seen after the S&P downgrade in 2011. The markets appear to have shrugged it off.

Policy Changes — While the government has voiced objection to the downgrade and disagrees with the rationale, there may need to be additional measures put to address the concerns of the credit agencies, which may lead to additional fiscal reform or regulatory changes. These changes at both the federal and state levels could impact financial institutions.

Establishing Precedent — Fitch’s recent downgrade, which now matches S&P’s credit rating of AA+, could sway other credit rating agencies to take a similar stance. An additional downgrade from Moody’s, the remaining Big Three credit rating agency bestowing a AAA rating on the U.S., could have deeper impacts across the markets. On July 13, 2023, Moody’s provided an update of its credit opinion and maintained their AAA rating for the U.S. due to exceptional economic growth.

Note: A negative outlook means a likelihood of downgrade over 12 months, while negative watch indicates a potential downgrade in six months. Graph as of August 1, 2023.6

While the Fitch downgrade has spurred many political and economic discussions and presented a murky outlook for the country’s fiscal future, overall, it appears unlikely to have profound negative impacts to the economy, consumers, and financial institutions. The downgrade was not a big drop in the rating, with the AA+ rating still regarded as high-quality. Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget, compared the downgrade from AAA to AA+ to a downgrade of your personal creditworthiness from extremely good to very good 7. Additionally, the U.S dollar remains strong, and recent signals have shown that the U.S. economy may avoid recession. Lastly, the downgrade was not too much of a surprise when compared to the S&P downgrade in 2011, as noted by the slightly muted reaction. The Fitch downgrade puts a spotlight on the growing concerns and issues with the country’s fiscal policy, but based on the response from the markets and economists, this was a political and reputational blow, not a deeply impactful change for financial institutions.

Guidehouse is a leading provider of consulting services to the public sector and commercial markets, with broad capabilities in management, technology, and risk consulting. Our professionals work with industry leaders to assess environmental factors (e.g., micro and macroeconomic changes, competitive advantages, and risk and control concerns) and develop/implement strategic plans to capitalize on an organization’s opportunities.

Contributing authors: Marc Strigel, Jason Chu

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.