Search

Search

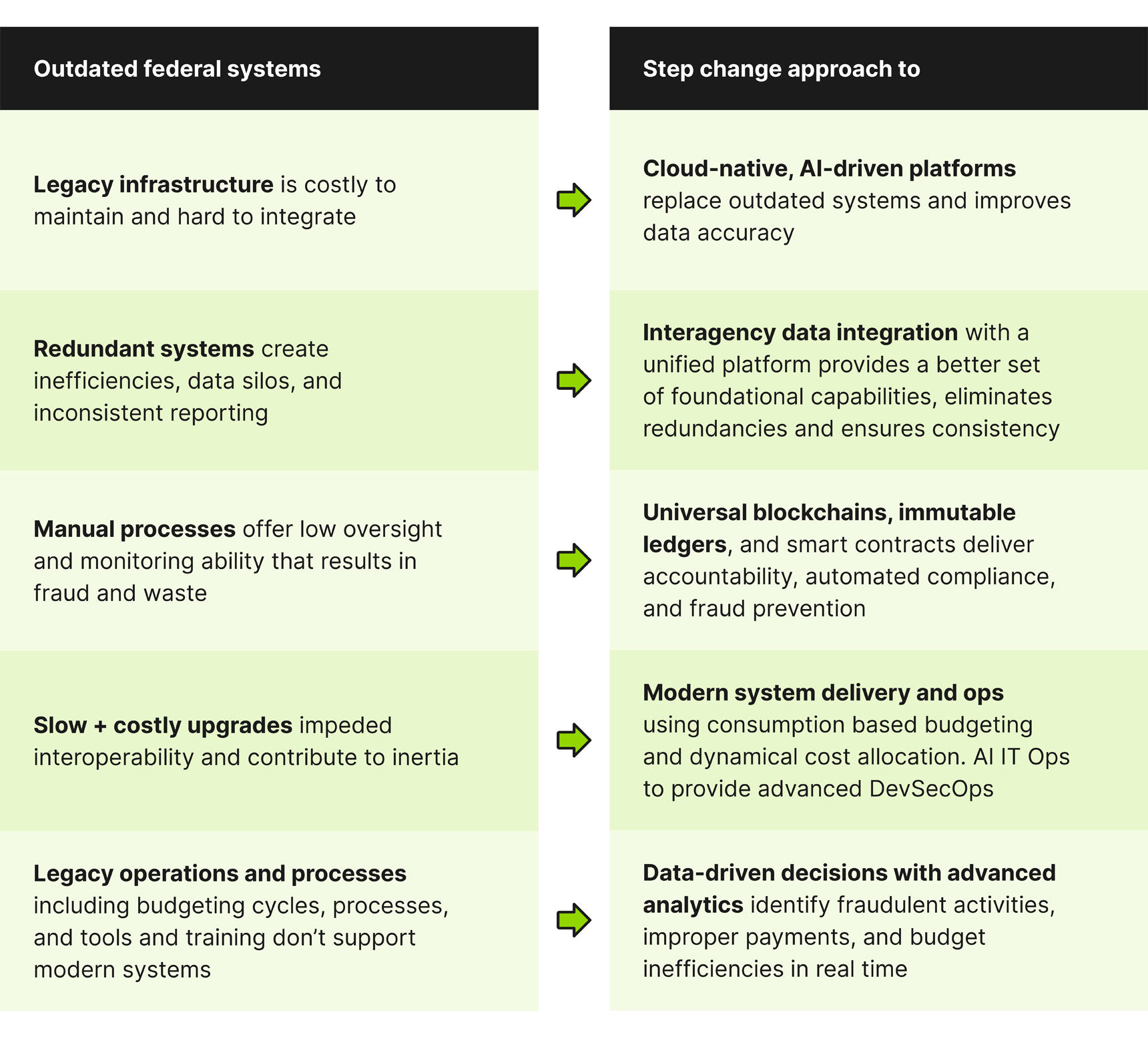

The U.S. federal government operates on outdated financial systems that hinder efficiency, transparency, and accountability. Despite incremental improvements, these systems remain fragmented, costly, and lack compatibility with modern hardware and software, leading to increased complexity and higher costs for updates and repairs. Additionally, finding skilled personnel familiar with outdated technologies can be challenging.

Federal agencies need a bold, step change transformation—leveraging modern technologies such as cloud computing, AI, blockchain, and advanced data analytics—to drive radical improvements in cost reduction, service quality, interoperability and financial integrity.

Many agencies are burdened by legacy infrastructure and technical debt, relying on decades-old financial platforms that are both costly to maintain and difficult to integrate with modern technologies. This reliance on outdated systems leads to inefficiencies, as overlapping systems across various agencies create data silos and can lead to inconsistent reporting. Furthermore, the technological obsolescence and manual processes in these systems enable fraudulent transactions and wasteful spending, exacerbated by the lack of real-time monitoring.

The slow and costly nature of upgrades further compounds these issues. Incremental improvements often fall short due to organizational inertia, lack of interoperability, and the high costs associated with patching outdated systems. Additionally, legacy operations and processes, including annual and multi-year budgeting cycles, tools, and training, do not support the delivery and operational needs of modern systems.

Historically, federal modernization efforts have adhered to an evolutionary approach, focusing on incrementally upgrading components of financial systems rather than undertaking a comprehensive redesign from the ground up. This method has resulted in costly, piecemeal upgrades that fail to address the underlying inefficiencies within the system.

As agencies continue to layer new technology on top of outdated infrastructure, technical debt has increased, further complicating the modernization process. This layering approach has further maintained the status quo in fraud detection and waste prevention, failing to eliminate vulnerabilities and leaving the system susceptible to ongoing issues.

To achieve rapid, transformative impact, the government must embrace a step change approach that includes the following:

Replace legacy systems with cloud-native, AI-driven platforms

Universal blockchain implementation for transaction transparency

Data-driven decision making with advanced analytics

Interagency financial data integration for full transparency

Modern system delivery and operations

Federal civilian agencies spend over $100B annually. With the Department of Government Efficiency’s intent to modernize federal technology and software to maximize efficiency and productivity, there is a deeper focus on cost transparency and optimization opportunities.

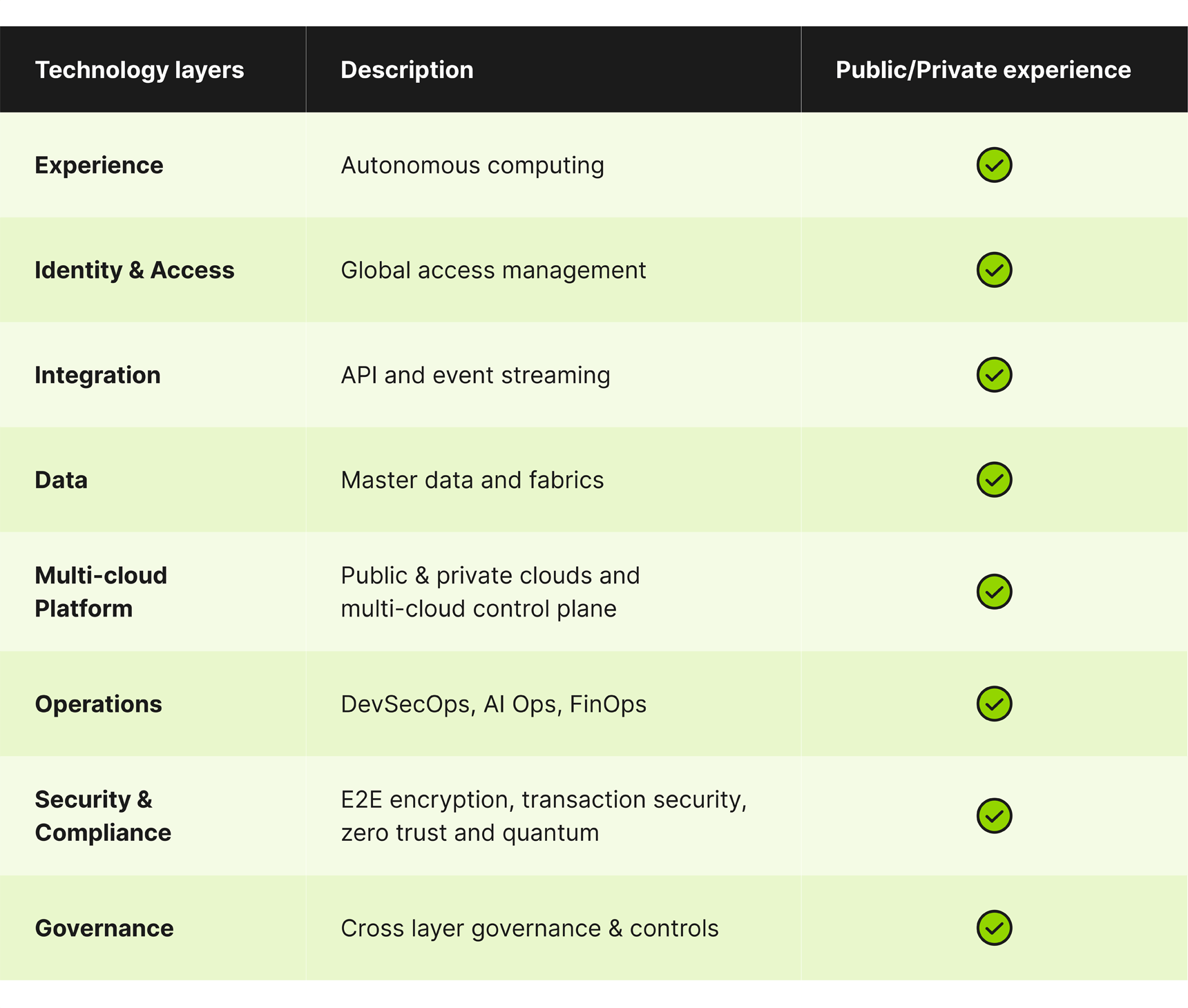

FinOps and TBM are two management practices that focus on transparency of IT costs. FinOps takes advantage of the extremely granular cost detail made available by public cloud service providers to enable conversations between engineering, finance and business in near real time. It can be used to identify and drive short term spend reductions within the portfolio or to inform longer term optimization initiatives.

TBM provides a framework for conversations on IT spend by the business, finance, and technology department by connecting general ledger entries to IT services and business capabilities. Both FinOps and TBM align IT spend to business capabilities and set the stage for realizing savings through the portfolio management process without disrupting essential functions. Using established processes and frameworks like IT Portfolio Management, FinOps, and TBM is crucial for providing transparency, identifying high-risk areas, eliminating duplication and inefficiencies, and appropriately rebalancing the portfolio.

Modernizing federal financial systems introduces new cybersecurity risks. A comprehensive cybersecurity strategy that also anticipates the challenges posed by advancements in quantum computing is crucial for safeguarding sensitive financial data.

This strategy must effectively counter cyber threats, insider threats, and the sophisticated tactics employed by nation-state adversaries and includes:

Zero trust architecture for maximum security

End-to-end encryption and secure data handling

AI-driven threat detection and response

Blockchain for immutable transaction security

Continuous compliance and regulatory adaptation

A step change transformation in federal financial systems promises significant benefits across multiple areas. First, cost savings can be achieved by eliminating outdated systems and redundant infrastructure, potentially saving billions annually. AI-driven automation further reduces manual processing costs, while blockchain technology helps minimize fraud-related losses. Second, quality of service improvements can be realized with faster and more accurate financial transactions, enhanced system delivery and support, and improved citizen services due to streamlined government spending.

In terms of fraud, waste, and abuse, AI-driven fraud detection can significantly reduce improper payments, while real-time transaction monitoring helps to proactively prevent fraud. Blockchain technology provides a tamper-proof record of financial transactions, ensuring integrity. Additionally, adopting a Zero Trust security model can prevent unauthorized access and improve cybersecurity resilience.

Adopting a collaborative approach to modernization, as opposed to the traditional siloed method where individual projects are conceived and executed in isolation, helps bring down communication barriers and fosters a shared vision across organizations. Agencies should also look beyond their walls and work with Congress in support of policies and laws that support modern financial technologies. Another important consideration is the input from the commercial sector where public-private partnerships can play a significant role in accelerating transformations. Agencies will benefit from the examples and learnings of organizations facing similar technology modernization challenges.

Equally important, and often overlooked, is the workforce’s readiness to adopt new technology and the process of change management. This involves preparing the workforce through upskilling and reskilling programs, identifying internal change champions to promote adoption and reduce resistance, establishing communication frameworks, and implementing adoption metrics to track progress and ensure effective implementation.

With billions of dollars at stake, the federal government cannot afford to continue its path of incremental change. Step change transformation is essential to reducing costs, improving service quality, and eliminating waste, fraud, and abuse. By embracing cloud computing, AI, blockchain, and data analytics, the government can build a modern financial system that ensures efficiency, accountability, and long-term sustainability.

Call to action:

5 steps for federal agencies:

The ability to navigate the balance between adopting advanced technologies, maintaining resilience, and addressing the essential compliance and security considerations is critical. A future-proof, efficient, and fraud-resistant federal financial system is within reach—but only by taking decisive action now.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.