Search

Search

The green hydrogen (H2) economy stands at the cusp of a transformative era, poised to redefine energy markets and drive sustainable innovation. Despite the absence of established markets and price-setting mechanisms, the potential of green H2 is immense. Current price estimates are predominantly based on production costs, overlooking the critical demand-side dynamics. To bridge this gap, it is imperative to understand the willingness to pay (WTP) for green H2 among potential offtakers. This insight will lay a robust foundation for developing viable business models, guiding policymakers in crafting effective incentive frameworks, and enabling investors to identify lucrative opportunities.

Recognizing that WTP varies across sectors and specific volumes of green H2 is the first step. Within a sector1, WTP can fluctuate due to regulatory quotas, which may drive higher WTP for certain volumes. However, these volumes are subject to change over time due to evolving quotas and market orientations. By comprehending the intricacies of WTP, companies can validate their business models and secure a competitive edge in this rapidly evolving market landscape.

As the green H2 economy begins to take shape, understanding the WTP for green H2 across various sectors is crucial. This analysis delves into the key drivers of WTP, highlighting the regulatory and market-based factors that influence these values. By categorizing WTP into four distinct levels, we can better comprehend the sectoral implications and opportunities for green H2 adoption.

Category 1: Very High WTP

The highest WTP level is driven by regulations that set explicit targets for green H2 adoption, reinforced by severe penalties for non-compliance. This regulatory clarity supports a high WTP, driven by the imperative to meet mandated targets. Although initial mandated volumes may be modest, the enforceable nature of the requirements ensures certainty in WTP assessments, with increasing volume over time. A prime example of this regulatory certainty driving WTP for green H2 is the ReFuelEU Aviation initiative, which mandates using renewable fuels of non-biological origin (RFNBO) and imposes severe penalties for non-compliance.

Category 2: High WTP

At this level, regulatory drivers uphold ambitious decarbonization objectives but with less stringent mandates, or lower penalties, on green H2 usage. Additionally, market-based drivers such as decarbonization targets established by manufacturers or end-users can lead to high WTP values. Although the WTP may not reach the highest levels, the associated volumes are larger, offering a significant opportunity for market entry at competitive green H2 prices. This is seen in sectors such as maritime transport, where the penalties on non-fulfilment of H2 decarbonization targets specified by FuelEU Maritime regulation are lower than those laid out by ReFuelEU Aviation. In the steel industry, certain offtakers have already committed to procuring green steel, which the industry further encourages through a green steel labelling scheme3 that allows manufacturers to communicate and pass on the additional value to end consumers.

Category 3: Medium WTP

This level is characterized by the prevalence of competitive alternatives for decarbonization. Here, alternative decarbonization solutions set the benchmark price for green H2 products, determining the WTP. Although the potential volumes of green H2 for decarbonization are substantial, the current drive to move along this pathway is low. This is exemplified by sectors such as petrochemicals, where base chemical production in Europe relies on naphtha (crude oil) cracking-based processes. Currently, bio-naphtha is the most competitive decarbonization solution, as opposed to H2 use via a methanol route.

Category 4: Low WTP

At this level, regulatory drivers exist but lack stringent penalties (for example, the EU’s Renewable Energy Directive III, which mandates a 42% RFNBO quota for H2 in industry) or entail less ambitious targets. In these scenarios, the effectiveness of green H2 hinges on broader regulatory frameworks and evolving market dynamics. Without compelling incentives, such scenarios result in the lowest WTP value for green H2, effectively the cost level of conventional production.

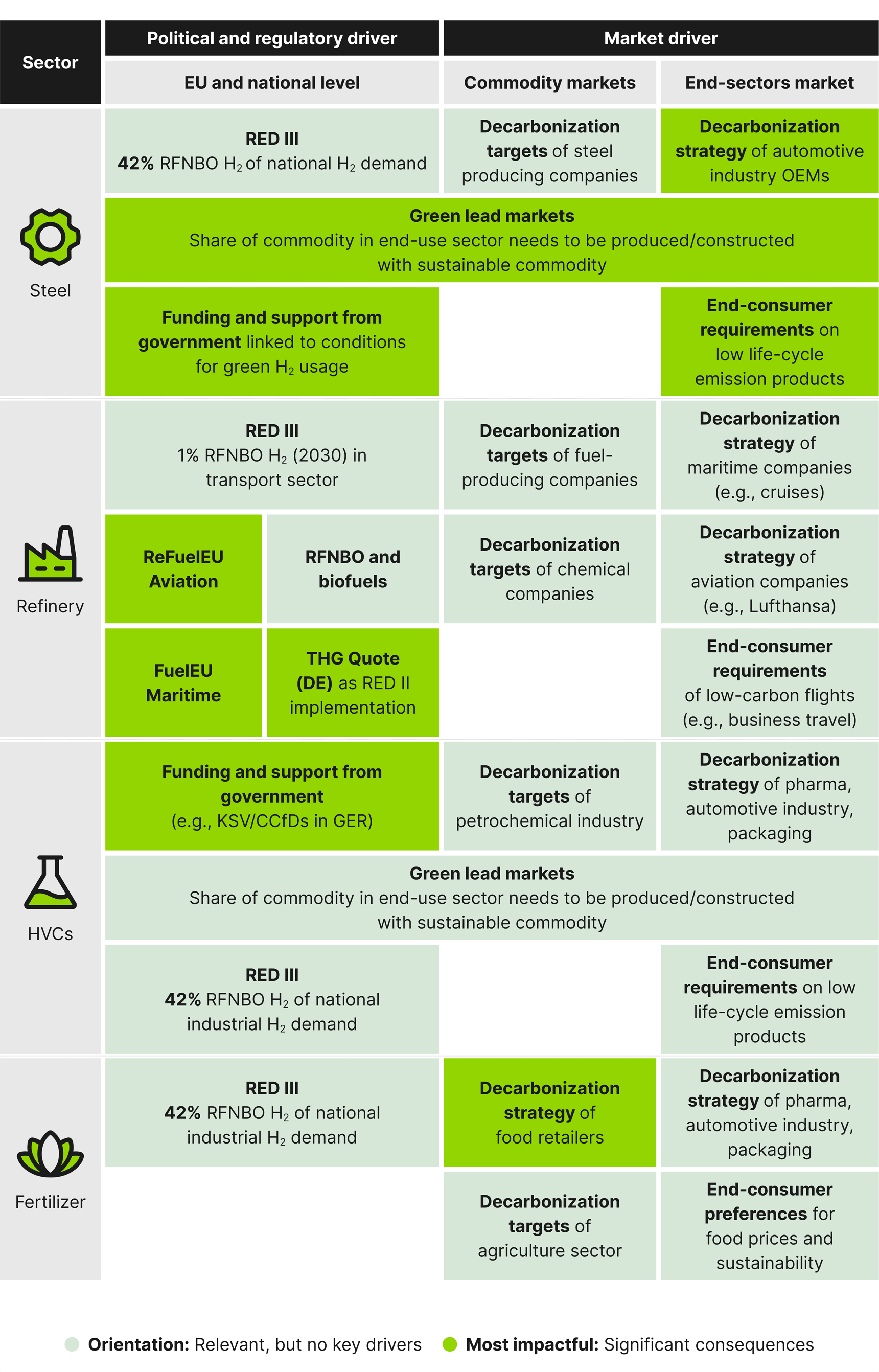

Based on the category of identified drivers, we have mapped them across relevant sectors (see Figure 1, below), highlighting where key drivers were identified.

Understanding the intricate interplay of regulatory frameworks, market forces, and technological advancements is paramount for stakeholders throughout the H2 value chain. Our analysis shows that the WTP for green H2 remains diverse across sectors. Additionally, it seems that, in some, it is low compared to the anticipated levelized cost of hydrogen in the early market ramp-up, while for others it will be very high by 2030.

Market stakeholders must meticulously assess the drivers for a certain WTP, considering their implications in case of non-fulfilment, and link each driver to specific H2 volumes rather than applying them uniformly across entire sectors. For governmental stakeholders, the priority lies in identifying and implementing efficient, integrated funding strategies. It is also crucial to recognize that not all sectors require equal funding. While certain sectors benefit from clear regulatory guidelines facilitating higher WTP value and volumes, others will need more extensive market-driven assessments to determine expected volumes and WTP. By embracing these insights, stakeholders can navigate the complexities of the green H2 economy, fostering innovation and ensuring a resilient energy future.

1. Relevant sectors for green H2 usage are steel, refineries, high-value chemicals (HVCs), and the fertilizer industry.

2. Methodology: Factors shaping WTP values for green H2 fall into two overarching categories: regulatory drivers and market-based drivers. In light of that, we set four levels of WTP, based on mechanisms that influence values, such as alternative decarbonization solutions, or regulatory pressure to take green H2.

3. Wirtschaftsvereinigung Stahl, “Green Steel Definition—A Labelling System for Green Lead Markets.”

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.