Search

Search

As the widespread use of quantum computing edges closer, the financial services industry stands at a crossroads. This technological revolution, while promising groundbreaking advancements, also poses a formidable challenge to the foundations of modern cybersecurity. With their unprecedented processing power, quantum computers will inevitably render current cryptographic systems obsolete, potentially exposing a host of underestimated data security risks.

For financial services companies in particular, this transition represents a significant material risk. For these trusted custodians of vast amounts of personal data, protecting sensitive information is paramount. Therefore, the immediate need to begin a migration toward environments deemed “quantum-safe” should be a high priority for financial services companies.

Post-quantum cryptography isn't just a technical capability upgrade, but a strategic imperative for the longevity and resilience of financial services firms in an evolving digital landscape. It represents the next identified frontier in data security, designed to withstand the cryptographic assaults powered by quantum computing.

This stark reality necessitates immediate action from financial services companies to safeguard their clients’ data and maintain their trust when “Q-Day” (the day quantum computers become powerful enough to break the encryption algorithms that currently secure our digital communications) arrives.

Quantum computing represents a paradigm shift in computational power and problem-solving capabilities. Unlike classical computers, which use bits to process information in binary form (0s OR 1s), quantum computers leverage the principles of quantum mechanics to process data in qubits (0s AND 1s). Qubits can exist simultaneously in multiple states—a phenomenon known as superposition—and can be entangled. This allows quantum computers to perform many calculations simultaneously, thereby solving complex problems exponentially faster than classical computers. Quantum computing will likely also be the “super-brain” powering the next generation of AI once both are at scale.

Some technologists and scientists currently estimate that quantum computers will break widely used encryption algorithms, including RSA (Rivest–Shamir–Adleman) and ECC (elliptic-curve cryptography), by the end of this decade. These are the foundational methods of encryption securing large amounts of digital communications and data today. IBM has reported that it is on track to deliver a fault-tolerant, error-corrected quantum computing system by 2029.1 With that in mind, the urgency of transitioning to quantum-safe cryptography can't be overstated.

Post-quantum cryptography refers to cryptographic algorithms designed to be secure against the capabilities of quantum computers. These algorithms employ mathematical problems that are believed to resist quantum-driven attacks. Examples include lattice-based, hash-based, and code-based cryptography. Post-quantum cryptography aims to develop and implement encryption methods that will withstand the advanced processing power of quantum computers, ensuring the continued protection of even the most sensitive information considered quantum-safe.

Financial services companies of all sizes handle vast amounts of personal, financial, and health-related data, making them prime attack targets. By proactively adopting post-quantum cryptography safeguards, companies can protect their data assets, comply with emerging regulations, and maintain their reputation as trusted custodians of sensitive client information.

Today, quantum computing is in a stage of rapid development, with significant advancements made by leading technology companies and research institutions. Key players such as IBM, Google, and Microsoft, along with startups such as Rigetti Computing and D-Wave Systems, have developed functioning quantum computers. While these quantum computers have demonstrated remarkable potential, their performance relative to traditional computers remains limited by several factors, including qubit coherence time, error rates, and scalability.

Current quantum systems are bulky and require extremely low operating temperatures, posing significant technical and environmental challenges. It may take several years to overcome these limitations and achieve large-scale, fault-tolerant quantum computing capable of breaking contemporary cryptographic algorithms. Or, given the material progress made in the last two years in qubit power, the threat to current encryption methods may be sooner than many organizations currently believe.

Recently, Microsoft unveiled its Majorana 1 quantum chip – a topological processor that leverages a novel state of matter to significantly improve qubit stability and scalability. Unlike traditional superconducting qubits that suffer from short coherence times and high error rates, Majorana 1’s “topological” qubits are inherently more stable, with built-in error resistance at the hardware level. This breakthrough underscores the pressing need to advance post-quantum cryptography (PQC) frameworks, as more scalable quantum systems could compromise conventional encryption methods sooner than anticipated. For financial institutions, such developments intensify the urgency of quantum security preparations, with experts warning that the timeline for quantum threats is accelerating, and organizations must begin implementing quantum-safe measures now.

.png)

Some IT organizations believe quantum-safe cryptography’s data security vulnerability is similar to the Y2K risk profile, which prompted companies to scramble in the last few years of the prior century to solve a problem that may or may not have existed. These professionals believe a risk from quantum computing may be on the horizon, but they still have time.

Others more familiar with the details of quantum-safe cryptography are closely following National Institute of Standards and Technology (NIST) guidance, which is driving the regulations and requirements that many of the largest firms will likely have to operationalize in the next 24 months. At present, there is no precise date as to when a quantum computer, sufficiently scaled and in the hands of a bad actor, will start cracking the current encryption algorithms. However, organizations should nonetheless consider several crucial points:

Vulnerability is a problem now—Deploying our current public key cryptography infrastructure took almost two decades. Depending on the changes needed, implementing the next one could also take many years. Without a definite date when this threat will be realized, IT organizations should be preparing now. The importance of this preparation can't be stressed enough. Some data has a long shelf life and may already be compromised. The practice of “harvest now, decrypt later”—whereby cyber criminals or rogue nation-states hack and gather massive amounts of encrypted data and store it, waiting patiently until quantum computers are available for decryption—is likely already a factor. Much critical enterprise data, including schematics, formulae, algorithms, and trade secrets, has a long shelf life. In addition, the base PII (personally identifiable information) included in client/customer data, such as Social Security numbers and health information, should be protected for that client’s lifetime at minimum.

Federal agencies are now actively getting ready—In December 2022, President Joe Biden signed into law the Quantum Computing Cybersecurity Preparedness Act, which forces all federal agencies to develop plans to transition their systems to post-quantum encryption standards capable of surviving the arrival of Q-Day.

It’s not just about security—As awareness of Q-Day trickles down to the public at large, touting post-quantum cryptography standards could become a differentiator in the marketplace.

The potential threat of a quantum computer attack on a financial services company can't be overemphasized. The consequences of the resulting loss of customer data would also be catastrophic. Customer trust, the cornerstone of any financial institution, would be severely compromised or shattered. The reputational damage would be immense, leading to loss of business, legal repercussions, and a significant decline in market value. In an industry where reputation is everything, the fallout from a quantum computer attack could be irreparable. Here are some specific areas that need urgent attention:

Client data security—Financial services companies store vast amounts of personal data, including Social Security numbers, addresses, and financial information. If adversaries intercept and store this data today, massive privacy breaches will ensue once quantum computers gain decryption capacities.

End Point Devices (IoT)—Many IoT devices currently use potentially vulnerable encryption keys to secure data transmissions. Without appropriate quantum safe security measures in place, payment terminals, ATMs, and other IoT devices used to transact huge volumes of business every second could be at risk for material data breaches, or worse.

Claims processing and policy management—Claims-processing systems and policy management platforms depend on secure encryption to maintain data integrity and confidentiality. Quantum computers could easily penetrate system encryption and allow unauthorized access to claims-processing systems, resulting in fraudulent processing, payment redirection, or worse.

Third-party vendor security—Financial services companies often work with third-party vendors for various services, including data storage, analytics, and IT support. If these vendors don't adopt quantum-safe encryption, the supply chain becomes vulnerable to quantum computer-driven attacks. A breach at a third-party vendor could expose sensitive data, even if the primary company’s systems are secure.

Long-term data confidentiality—Financial services companies must protect data that will remain valuable for decades, such as loan application data, long-term policyholder records, and claims histories. Quantum computer-driven decryptions threaten the confidentiality of this historical data, potentially exposing it to future decryption attacks. If stolen and eventually decrypted, any of this data could lead to significant privacy violations and legal repercussions.

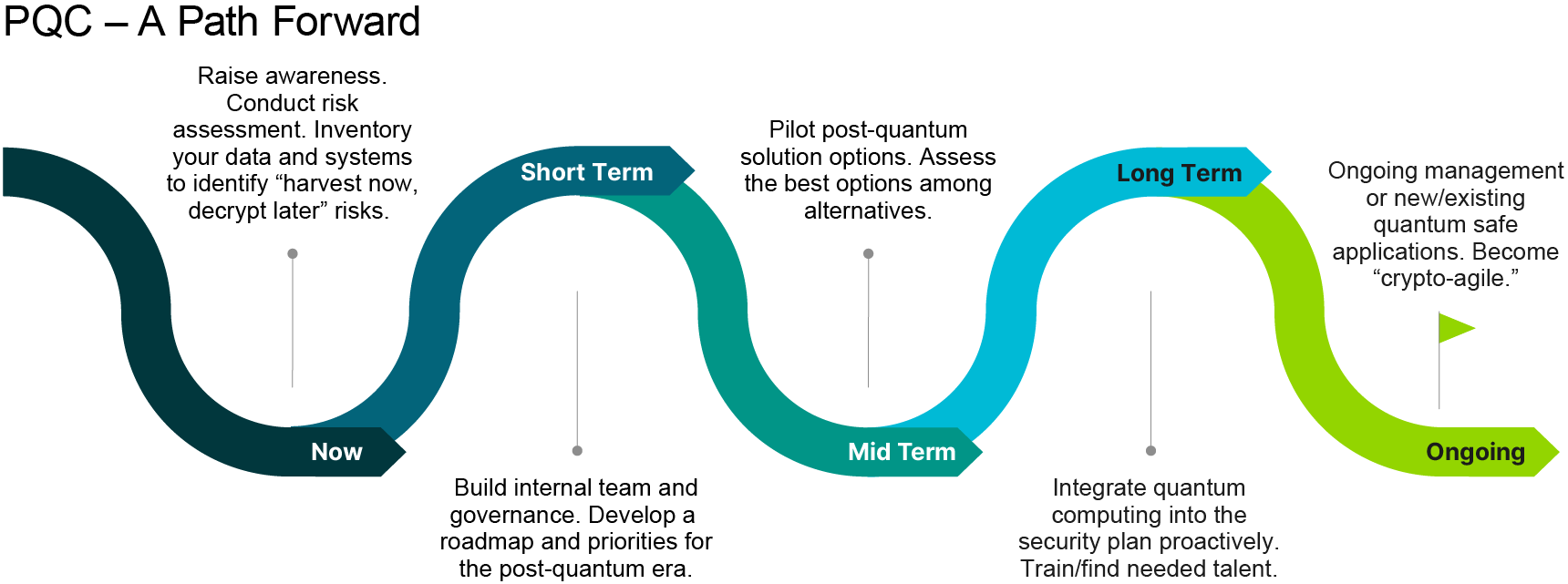

To ensure data security and maintain industry leadership, companies must take decisive action today to address the looming threat of misapplied quantum computing power against current cryptographic systems. Transitioning to quantum-safe cryptography requires a comprehensive, phased approach that addresses immediate vulnerabilities while laying the groundwork for long-term security and resilience. Companies can proactively protect their data and ensure continued compliance and trust in an increasingly uncertain technological landscape by implementing a strategic plan addressing short-term awareness and assessment, medium-term transition and implementation, and long-term resilience and readiness.

In the short term, financial services companies must focus on raising awareness, conducting risk assessments, and beginning the transition to quantum-safe cryptography.

In the medium term, the focus should shift toward integrating quantum-safe cryptographic algorithms into existing systems.

During this phase, investing in ongoing training for IT and cybersecurity staff is crucial to effectively handling the new cryptographic technologies. This will ensure that the organization remains nimble and can quickly adapt to future quantum computing developments.

In the long term, companies should embed quantum-safe practices into their core operations and continuously monitor the evolving quantum landscape.

By taking these proactive steps, companies can reinforce data security, strengthen customer trust, and position themselves as leaders in the secure digital landscape of the future.

The advent of quantum computing heralds unprecedented opportunities and significant challenges, particularly for financial services companies. By understanding the immediate and future threats posed by quantum computers to current encryption methods, companies can take proactive measures to transition to quantum-safe cryptography. The importance of preparing for a post-quantum world extends beyond theoretical risks. The timeline for quantum supremacy is uncertain, but the potential for overnight vulnerability means that companies must act now.

Procrastination in adopting quantum-safe measures could lead to unprecedented breaches, regulatory penalties, and a loss of customer confidence that could take years to rebuild. By proactively recognizing and embracing quantum-safe cryptography, financial services companies can protect their data assets, comply with emerging regulations, and position themselves as leaders in technological innovation and security.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.