Search

Search

The US Securities and Exchange Commission’s (SEC) proposed climate risk rules continue to dominate the financial markets’ attention on climate disclosure. But as markets await federal action, a pair of new statewide climate disclosure laws from California have been signed. They mimic the SEC proposed rules closely, and in some places exceed them. These laws will impact many firms across the globe.

On October 7, 2023, the governor of California signed into law two landmark climate disclosure bills that impose mandatory climate-related reporting requirements for large public and private companies that do business or operate in the state. The two laws, SB 253, the Climate Corporate Data Accountability Act (CCDAA), and SB 261, the Climate-Related Financial Risk Act (CRFRA), are a watershed moment in the US for corporate climate disclosure—the strongest, broadest, and most concrete requirements on the topic to date.

The new laws are part of a growing regulatory consensus around the globe on corporate climate disclosure. Governments and regulators are increasingly calling on companies to be more transparent in reporting climate-related impacts and risks in a structured and repeated format.

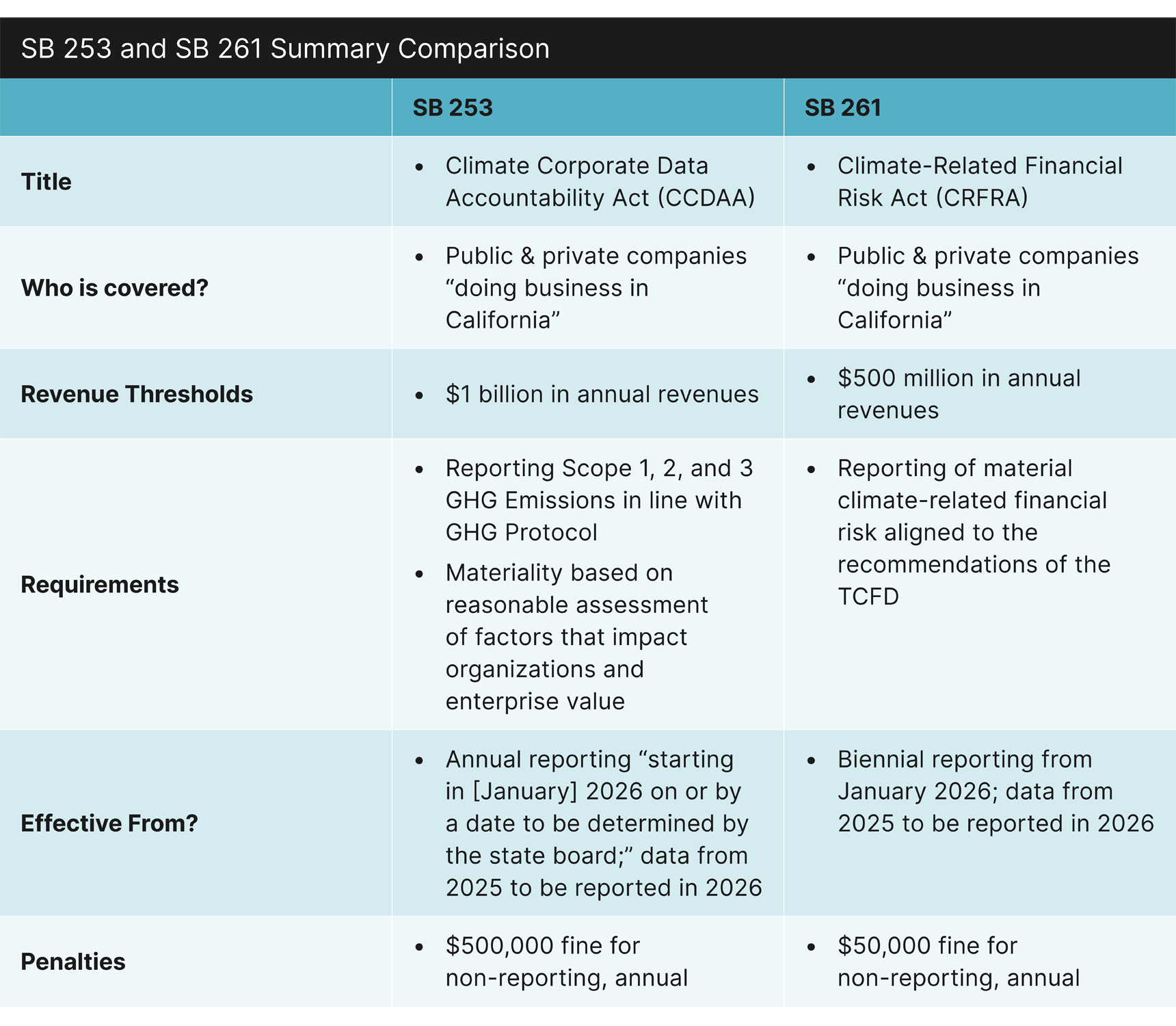

SB 253 and SB 261 Summary Comparison

The laws point to established protocols and frameworks to measure GHG emissions and to assess material climate-related risks.

SB 253: GHG Protocol

The proposed rule’s GHG emissions disclosure requirements are modeled on the GHG Protocol—the leading methodology for corporate GHG emissions measurement. The GHG Protocol has been the methodology by which virtually all rules and regulations expect GHG emissions to be calculated, including the proposed SEC rules. SB 253 acknowledges the necessity of use of emission factors, or ratios that typically relate GHG emissions to a proxy measure of activity at an emissions source, where direct data is unavailable. The Partnership for Carbon Accounting Financials’ Global Standard is also a resource for financial institutions that enables them to assess and disclose GHG emissions associated with their financial activities.

SB 261: Task Force on Climate-Related Financial Disclosures

The guidance on how to comply with SB 261 is quite broad. While the bill does not currently require a specific methodology, it references the TCFD framework. We expect CARB to clarify that the TCFD framework is the primary approach for compliance.

TCFD is framework created by the Financial Stability Board that has rapidly become the most commonly applied international standard for a firm’s reporting climate-related risk and opportunities. For example, it is the primary framework for the climate risk portions of the proposed SEC rules. This has driven rapid adoption of the TCFD by firms. According to the 2023 TCFD Status Report, nearly 90% of public reports reviewed show alignment with at least one of the TCFD recommendations, a sharp increase from prior years.

The TCFD framework asks reporting organizations to describe their approach to identifying, assessing, monitoring, and managing climate-related financial risks for different climate scenarios. TCFD is not prescriptive in how organizations should approach each recommended action; it provides structure for standardized climate-related disclosures.

It is worth noting that accurate GHG emissions measurements via the GHG Protocol (as required in SB 253) are one of the recommendations of the TCFD framework. Compliance with SB 253 will feed into and support SB 261 compliance.

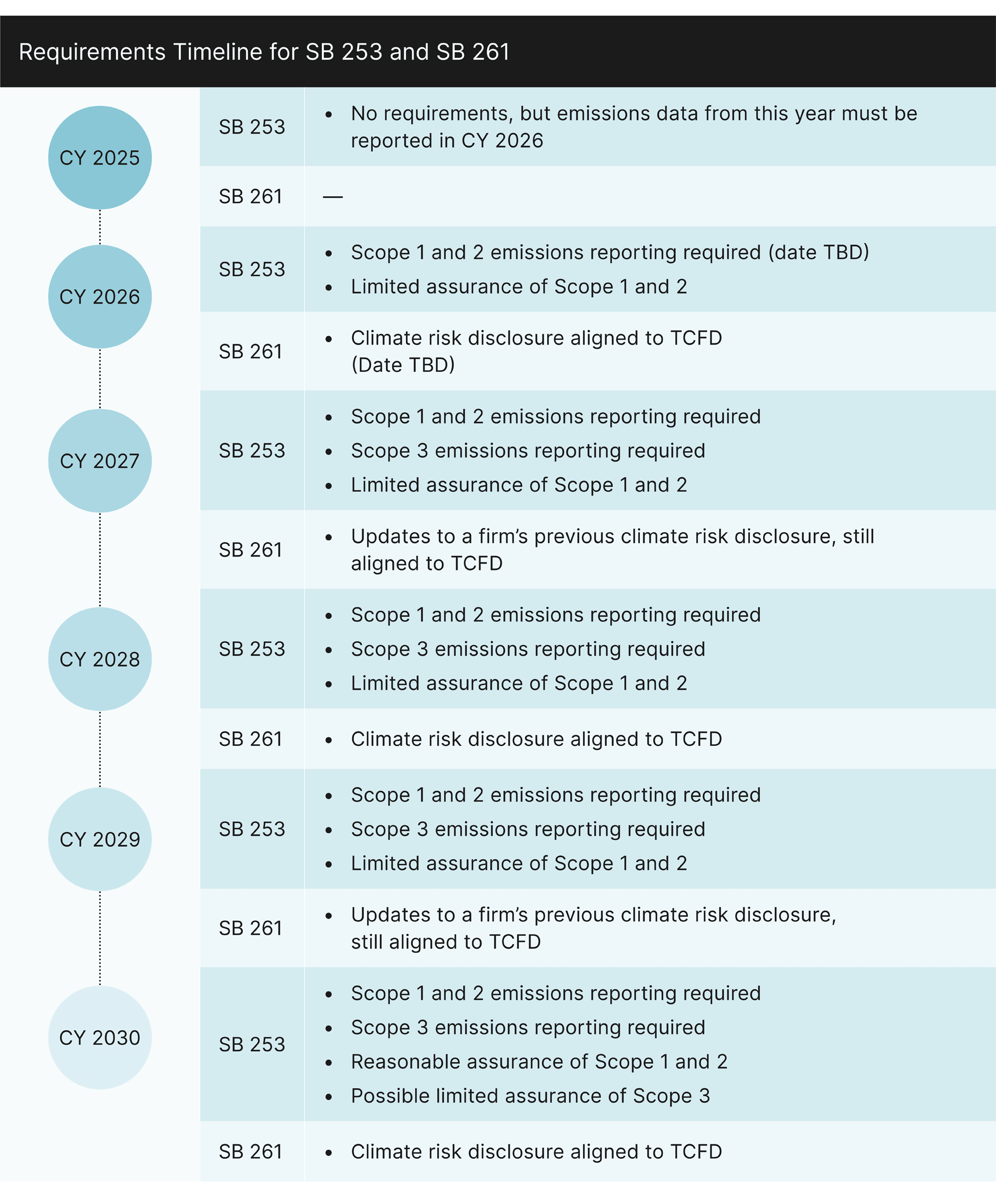

In regard to SB 253, for a Covered Entity, annual Scope 1 and Scope 2 GHG emissions reporting begins in 2026 for the prior fiscal year. Disclosure of annual Scope 3 GHG emissions is added in 2027.

Limited assurance of Scope 1 and Scope 2 GHG emissions would be required beginning in 2026. Reasonable assurance of Scope 1 & 2 GHG emissions data is required beginning in 2030. Scope 3 GHG emissions may require assurance at a limited assurance level beginning in 2030; CARB will make that determination in the future.

The specific dates of required filing of Scope 1, Scope 2, and Scope 3 emissions data will be determined by CARB. As the law is currently written, Scope 3 emissions are not required to be disclosed until 2027. While it is anticipated the data will be based on 2026 measurements for Scope 3, a yet to be determined aggressive approach may be taken by CARB to include 2025 emissions. In 2027, and for all subsequent reports, Scope 3 emissions must be reported within 180 days after the Covered Entity publicly discloses Scope 1 and Scope 2 for the prior fiscal year.

However, on or before January 1, 2030, CARB is required to revisit and potentially update the date of these annual deadlines, with the goal that the deadline for disclosure of Scope 3 GHG emissions would fall “as close in time as practicable” to the deadline for disclosure of Scopes 1 and 2 GHG emissions.

For SB 261, a Covered Entity would be required to make this report available publicly on its own website, published on or before January 1, 2026.

Requirements Timeline for SB 253 and SB 261

The SB 253 and SB 261, taken together, require many of the same core disclosures as the proposed SEC rules—GHG emissions and climate risks. But there are important differences that firms will need to understand. The California bills impact both public and private firms, whereas SEC rules would only impact public firms (i.e., SEC registrants). The SB 253 is also more aggressive in its Scope 3 requirements. The law requires all firms to disclose Scope 3 emissions, whereas the proposed SEC rules had negotiated exemptions, e.g., only disclose Scope 3 if it is “material” and/or the firm has a target.

Firms should make use of this time to put in place the foundational governance structures, policies, procedures, technology, and data to make themselves disclosure-ready by 2026.

Assess: Any firm’s first steps should include analyzing the CA Bills. This includes identifying the impact and requirements for their firm specifically. It also includes a current state and gap assessment of the firm’s level of preparedness to meet the requirements, e.g., the relative maturity of Scopes 1, 2, and 3 GHG measurement and climate risk assessment and disclosure. While many firms may perform some level of voluntary climate-related reporting today (as part of Carbon Disclosure Project and TCFD reporting, for example), the CA Bills will require a higher level of rigor around the data and outputs, since they will need to become part of future regulatory disclosures.

Monitor: While the CA Bills have passed into state law, many of the specific requirements and definitions in the bills are still to be determined, with subsequent guidance to be provided by CARB. This may include the official dates of reporting, as well as more detailed rules around who is covered and what needs to be disclosed. Firms should continue to track these clarifications and updates for changes that may impact them.

Plan and Prepare: Firms should make an action plan from today to identify a clear path for the firm’s disclosure actions. This will create a clear path for the firm to close key gaps, engage and mobilize key stakeholders, and execute the work needed to be ready for the disclosure deadline. This planning will also likely involve improved data systems and require engaging new stakeholders. That higher level of rigor around data, processes, and outputs will require coordination across numerous business units, many of which are often not engaged in sustainability topics, e.g., many firms’ regulatory disclosure stakeholders may not have worked closely with sustainability and climate teams. Executives may not have formally engaged on climate risk topics. Additionally, portions of the business-like procurement, whose data is crucial to Scope 3 emissions calculations, may be unfamiliar with the types of data needed.

Practice: The 2026 deadlines allow proactive firms to practice executing the data, analysis, and disclosure required in the years prior—identifying challenges, improving quality and speed, and building the connections to effectively meet these new requirements. 2024 is a crucial time to build data systems, conduct measurements, and execute risk assessments before the covered reporting years. Processes will need to be optimized, implemented, and tested again. In short, firms should begin the work to develop, pilot, and test any of the datasets, governance structures, and business processes that will be the significant inputs needed to comply with the CA Bills once they come into effect.

Transform: Wise firms will take this opportunity to transform their organizational approaches to climate, Environmental, Social, and Governance (ESG) investors, and data. Engaging the people, processes, and technology of the whole firm will do more than comply with this law; it can unlock new savings and innovation opportunities. It can also help organizations become more resilient long-term.

Our global team of sustainability experts help clients stay ahead of evolving regulations and achieve compliance by implementing strategic initiatives across all aspects of operations. We are well-positioned to help firms of all sizes undertake complex data gathering and reporting efforts to meet changing requirements and work proactively toward mandatory disclosures. Guidehouse can confidently advise clients on the following items:

Readiness Assessment and Roadmap: We help you create your readiness roadmap by establishing a framework to understand applicable regulations, timelines, and the current state of your existing policies. More importantly, we evaluate the maturity of those policies, how those policies are integrated across the company, and the processes and controls that are in place to support them. We then measure against the data point and requirements of the disclosures to provide detailed and actionable recommendations for prioritized enhancements across the sustainability program.

Understanding and Reducing Your Emissions: Our decarbonization team will help you create robust GHG Protocol-aligned Scopes 1, 2, & 3 footprints to use as a baseline for abatement measures, target-setting, and to meet the requirements of SB 253. We provide insights for your teams to continuously evolve the footprints and to incorporate better data as it becomes available.

Climate Risk and Mitigation: Guidehouse brings a holistic understanding of TCFD and climate-related risk, opportunities, and impact assessments. Our team leverages sector knowledge and integrates climate, enterprise risk management, and ESG into the assessments to ensure a multidisciplinary approach. Understanding the risks and impacts of your value chain is key and through both our footprinting and our TCFD-aligned climate risk assessment, we help you understand the risks, impacts, and potential disruptions across your suppliers and your investments.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.