Search

Search

Momentum is rapidly building in the United Arab Emirates (UAE) hydrogen sector. In November, Emirates Steel announced plans to open the Middle East’s first green steel pilot plant in 2024.1 In December, the Abu Dhabi National Oil Company (ADNOC) announced its acquisition of Fertiglobe, the world’s largest exporter of fertilizers, as part of its plans to become a major clean hydrogen player.2 Also in December, Abu Dhabi Ports and Masdar announced plans to jointly explore the development of a green hydrogen hub to serve both domestic and export markets.3

These announcements followed in the footsteps of the release of the UAE’s updated National Hydrogen Strategy.4 The strategy aims to position the UAE as a top global producer of low-carbon hydrogen as early as 2031. The strategy establishes demand and production targets and identifies key enablers and actions for the creation of domestic and export markets including policy, regulation, governance, and funding support.

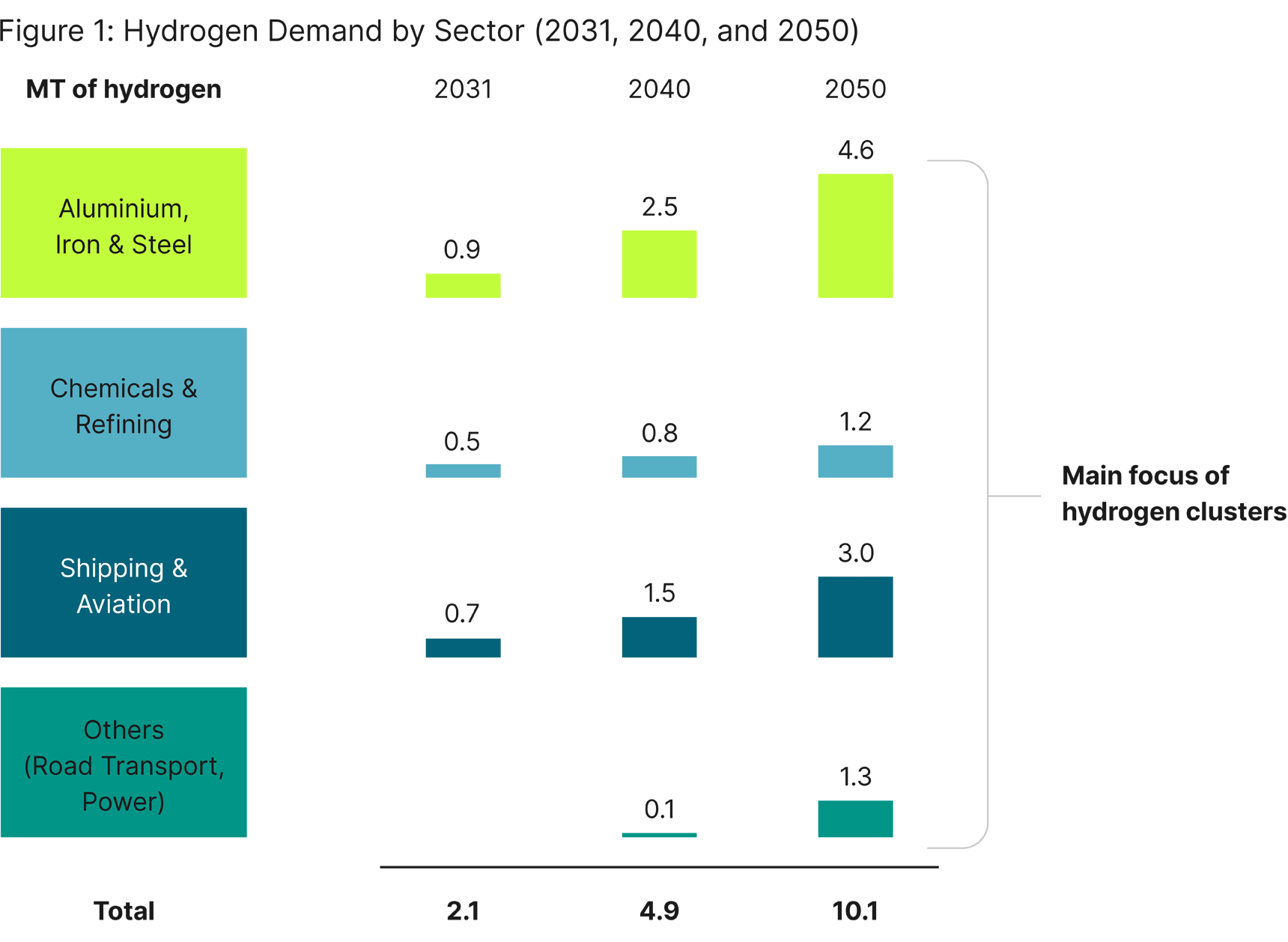

While the UAE recognizes the importance of exports, it sees the creation of a domestic market as the foundation of building a strong near-term hydrogen economy. This domestic focus will support the decarbonization of energy-intensive industries and hard-to-abate sectors where hydrogen can have a significant impact in reducing emissions. In the UAE, these high-priority sectors include aluminum, iron and steel, chemicals, refining, fertilizers, shipping, and aviation sectors. These sectors are expected to account for the bulk of future domestic demand. The strategy forecasts demand to reach 2.1 megatons (MT) by 2031, of which roughly 50% would be from aluminum, iron and steel, and 30% from aviation and shipping. From 2031 to 2050, demand is expected to increase nearly five-fold to 10.1 MT. However, the increase would come with a significant change in the contribution of key sectors: roughly 50% would be from aviation and shipping, whereas only 30% from aluminum, iron and steel.

Much of this demand is expected to develop in demand clusters (or “oases” as referred to in the strategy). The strategy sees these clusters as a no-regret opportunity to accelerate the creation of a domestic hydrogen market. The UAE plans to support the development of these clusters through public-private sector collaboration, policy, financing, and technical support.

The strategy targets the development of two hydrogen clusters by 2031, and five by 2050. However, the UAE is not clear on the exact locations of these priority clusters, their sizes, or potential offtakers. Nonetheless, the strategy does offer some clues: It identifies the industrial regions of Ruwais and Khalifa Economic Zone Abu Dhabi (KEZAD) as suitable clusters given their hydrogen storage potential.

While the UAE’s priority clusters are yet to be identified, assessing the geographical distribution of energy-intensive industries and transport hubs across the UAE can offer an accurate view of potential cluster locations. This, complemented by an understanding of the pipeline of hydrogen projects across the UAE and the investment agendas of major hydrogen players – such as ADNOC, Masdar and TAQA – offers even more information on potential clusters.

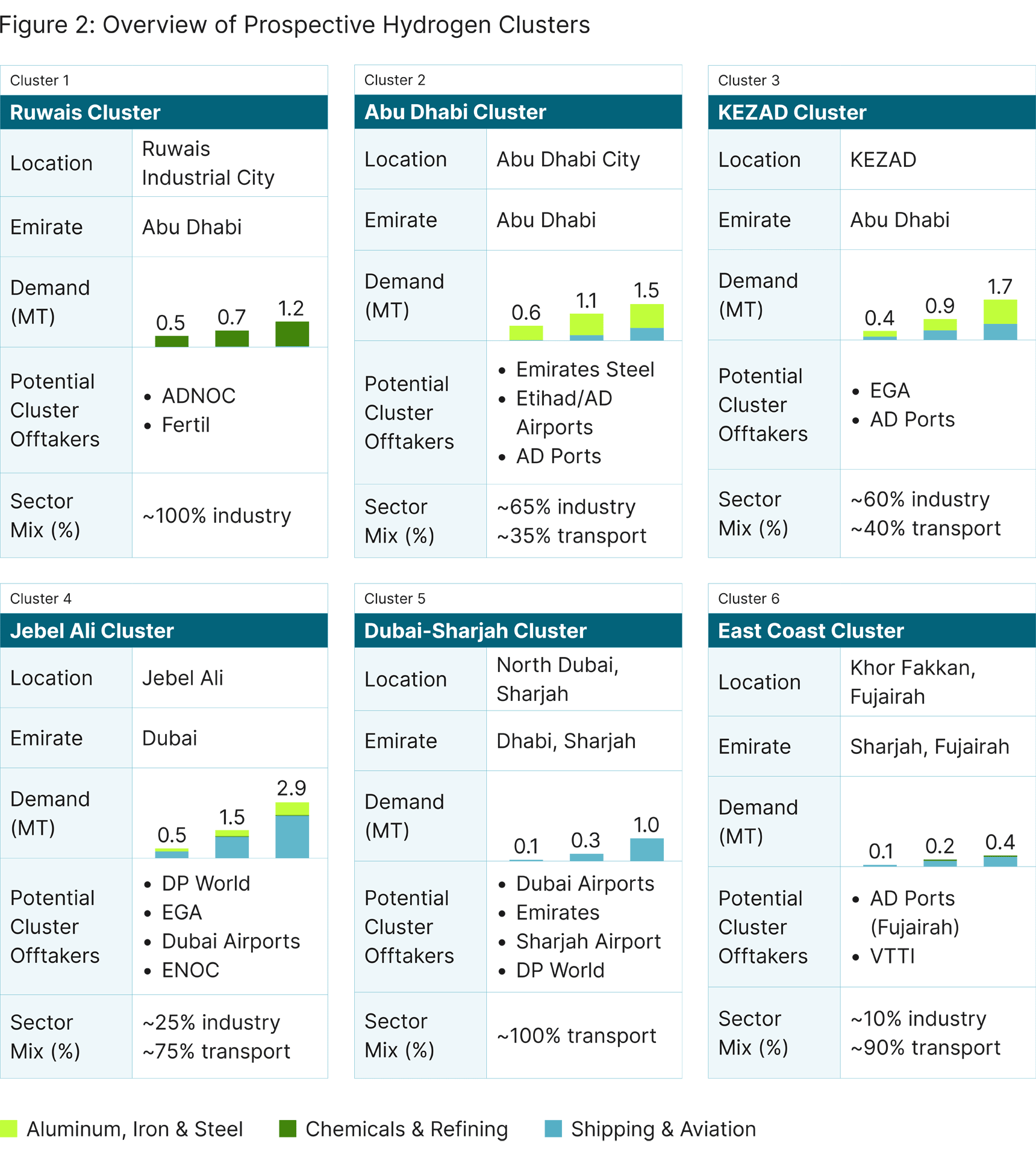

Based on this assessment, six clusters emerge as prospective priority clusters. Each cluster is characterized by the concentration of energy-intensive industries – including operations of high-profile industry giants like ADNOC, Emirates Steel and Emirates Global Aluminum (EGA) – as well as mission-critical transport hubs – with operations by transport & logistics giants like DP World, Dubai Airports and Abu Dhabi Ports. Combined, these clusters account for 8.8 MT of demand, equivalent to 90% of demand forecasted by 2050.

The Ruwais cluster would be almost exclusively an industrial cluster, primarily composed of demand from ADNOC’s Ruwais refinery – the UAE’s largest oil refinery – and Fertil’s petrochemical complex. The Ruwais cluster would also capture demand from other major industrial facilities in the Ruwais Industrial City complex, and potentially an expanded Mugharraq Port.

The Abu Dhabi cluster would be composed of demand from Emirates Steel’s Mussafah operations, Abu Dhabi’s AUH Airport (Etihad Airways’ main hub), and the Zayed and Mussafah Ports. Demand would be largely concentrated along the Mussafah-AUH corridor in the outskirts of Abu Dhabi and would also encompass demand from neighboring industrial areas, as well as the nearby Al Dhafra Military Air Base.

The KEZAD cluster would be primarily composed of EGA’s Al Taweelah facility, the largest aluminum production facility in the Middle East, and the Khalifa Port, the UAE’s second largest port. The KEZAD cluster could also potentially capture hydrogen demand for power generation at the Taweelah Power and Desalination Complex.

The Jebel Ali cluster would likely form the UAE’s largest cluster. It would be primarily composed of DP World’s Jebel Ali Port (the Middle East’s largest port), EGA’s Jebel Ali facility, Dubai’s DWC Airport, and ENOC’s oil refinery (Emirates National Oil Company).

The Dubai-Sharjah cluster would be the UAE’s only cluster almost exclusively made up of transport hubs. The cluster would be primarily composed of Dubai’s DXB Airport (Emirates’ main hub) and Sharjah’s SHJ Airport. The cluster would also capture demand from three mid-size ports: Dubai’s Port Rashid and Sharja’s Port Khalid and Port Hamriyah.

The East Coast cluster, or the Khor Fakkan-Fujairah cluster, would likely be the UAE’s smallest cluster, however strategically located in the eastern seaboard with direct access to the Gulf of Oman. The East Coast cluster would be primarily composed of the Khor Fakkan Port, and Fujairah’s refinery complex, airport, and maritime port.

Orchestrating the creation and development of these highly complex industry and transport agglomerations will be no easy feat. Experience from Europe shows that cluster projects face a range of challenges including offtaker coordination, inconsistent decarbonization timelines, commercial risks, early hydrogen production costs, and availability of transmission and storage infrastructure, among many others.

The most immediate challenge faced by the UAE will be the identification and selection of its near-term priority clusters. Certainly not a trivial exercise; requiring the assessment of future potential demand, the feasibility and economics of supply routes, and extensive offtaker alignment.

While the journey will be long, each of these six demand clusters offers a unique opportunity to the UAE with significant potential to be transformed into regional hydrogen powerhouses with major economic growth and job-creation potential.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.