Search

Search

On February 7, 2024, the Financial Crimes Enforcement Network (FinCEN) issued a Notice of Proposed Rule Making (NPRM) to combat and deter money laundering in the U.S. residential real estate sector by increasing transparency. FinCEN specifically indicates that the reporting NPRM is meant to address “Illicit actors [that] exploit the U.S. residential real estate market to launder and hide the proceeds of serious crimes with anonymity,” through shell companies with all-cash purchases. After years and multiple targeted Geographic Targeting Orders, FinCEN is finally establishing a national reporting and record-keeping requirement for non-financed residential real estate transactions1. In this article, we discuss key points from the NPRM that real estate companies, attorneys, and financial institutions should be aware of.

FinCEN is proposing national reporting requirements, through the filing of Suspicious Activity Reports, which it refers to as a Real Estate Report2. The Real Estate Report, however, is not intended to report suspicious transactions, but rather a defined list of objective characteristics of a certain property transfer type. In this way, the Real Estate Report represents a more streamlined approach to SARs in that like a Currency Transaction Report (CTR), Form 8300, the Real Estate Report is:

Like traditional SARs, however, Real Estate Reports must be retained for a period of five (5) years and be filed no later than 30 days after the completion of the property transfer.

The NPRM covers only a selection of non-financed residential real estate transactions. The criteria for whether property falls within the parameters of the rule can be met in one of three ways: (1) It is real property that includes a structure designed principally for occupancy by one to four families; (2) It is land that is vacant or unimproved, and that is zoned, or for which a permit has been issued, for occupancy by one to four families; or (3) It is a share in a cooperative housing corporation.

Key points to consider:

FinCEN expects that the obligation to file Real Estate Reports would generally apply to settlement agents, title insurance agents, escrow agents, and attorneys. The NPRM, however, designates only one reporting person for any given reportable transfer, which can be decided in one of two ways, the Reporting Cascade or by written agreement. Through the cascade, a real estate professional would be a reporting person required to file a report and keep records for a given transfer if the person performs a function described in the cascade and no other person performs a function described higher in the cascade.

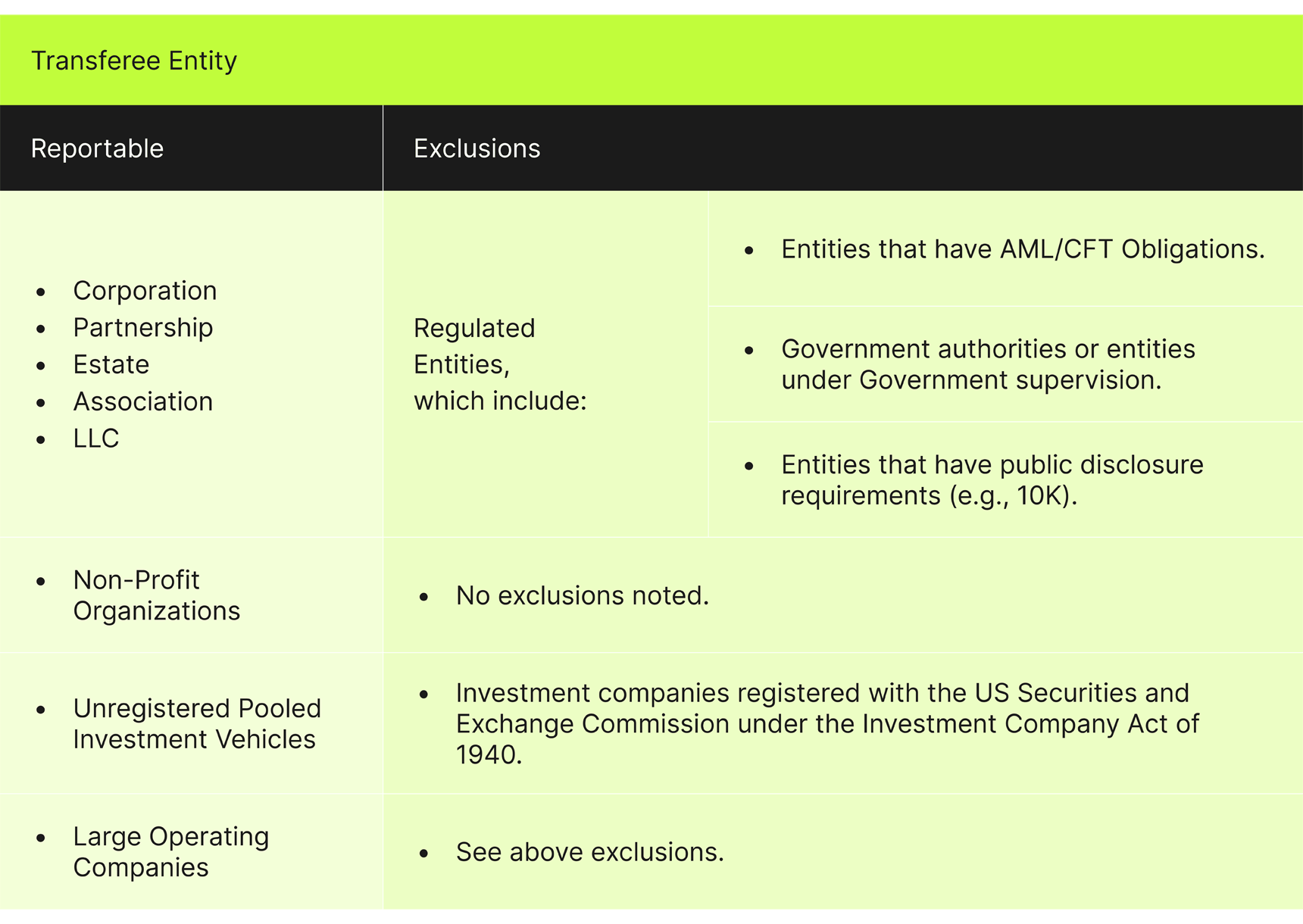

Reporting Entities must only report if a transferee is an Entity or Trust. Transfers made to natural persons are not reportable. Below outlines reportable transferees and exceptions:

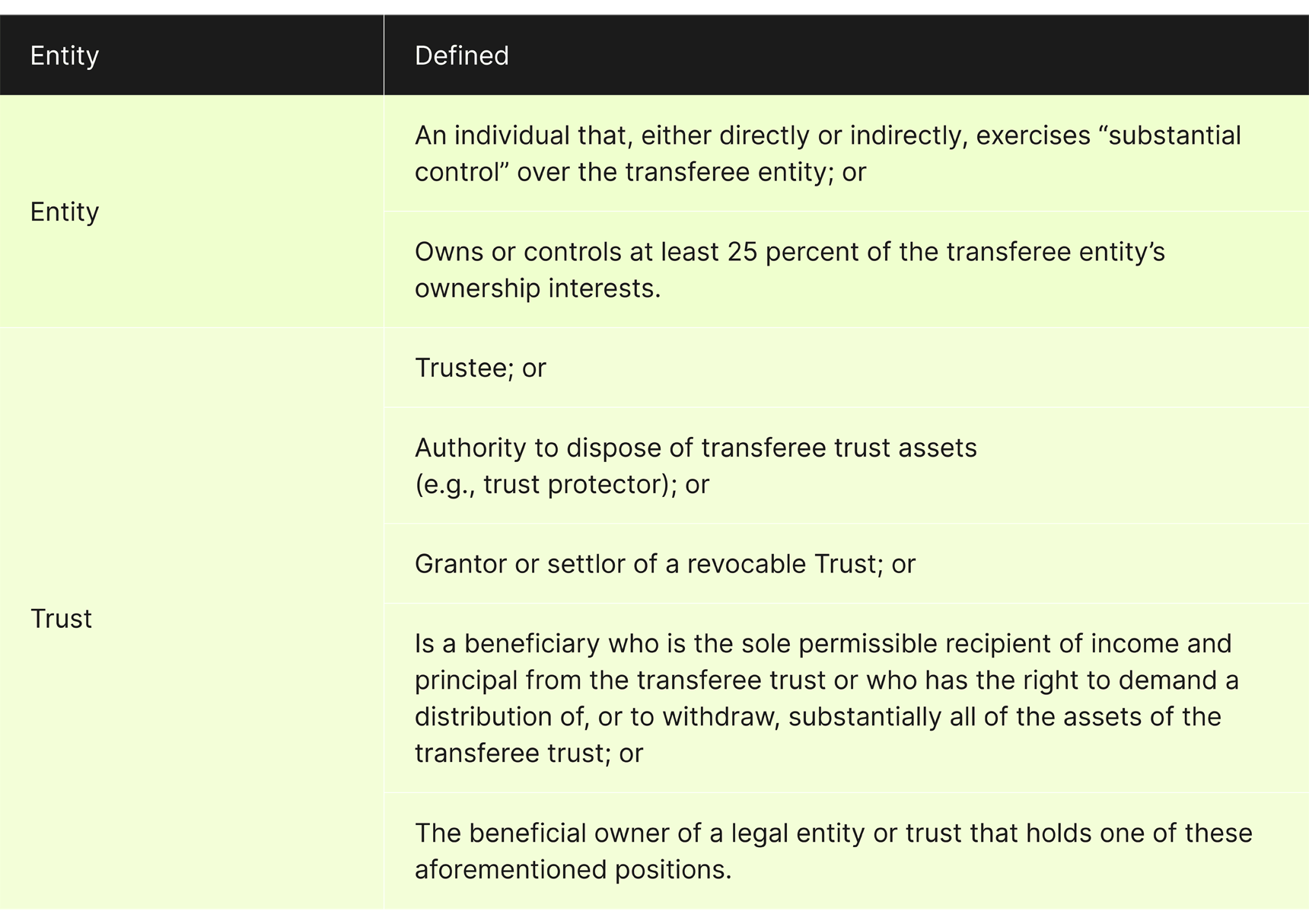

The NPRM requires the reporting of general information about the transaction, which includes information about individuals representing the transferee entity or transferee trust Information about the business filing the report (the reporting person); information about the residential real property being sold or transferred; information about the transferor (e.g., the seller); and information about any payments made. Notably, the rule also requires the reporting of beneficial ownership information for the legal entity (transferee entity) or trust (transferee trust) receiving the property. Where possible, FinCEN has aligned the proposed rule’s definitions of beneficial ownership with those contained in the Corporate Transparency Act and its implementing regulations.

No AML Program Requirement

The NPRM continues to exempt persons involved in real estate closings and settlements from the BSA’s requirement to establish AML/CFT programs6. Guidehouse, however, continually reminds its clients that it is a criminal offense to facilitate laundering the proceeds of crime, whether or not there is a regulatory requirement to have a compliance program. An adequate and effective compliance program is a factor that the Department of Justice uses to determine whether to bring charges, negotiate pleas, or other agreements.

Commercial Real Estate is Not Reportable…Yet

Despite a significant discussion in the previous ANPRM , non-financed commercial real estate transactions were not included in the NPRM. Guidehouse advises, however, that this NPRM has not closed the door on commercial real estate transactions and continues to seek public comment for this sector7.

Attorneys are Covered! What about Attorney-Client Privilege?

FinCEN acknowledges pushback from the legal industry that claims that attorney-client privilege prevents attorneys involved in real estate closings and settlements from reporting information, including beneficial ownership information. FinCEN indicates, however, that it only requires reporting by attorneys when they perform functions that generally may be performed by non-attorneys. The NPRM also indicates attorneys may enter into designation agreements with other real estate professionals described in the cascade, thereby passing the reporting obligation to another professional.

FinCEN is proposing an effective date of one year from the date the final rule is issued. Given that there is a high likelihood that the NPRM will be implemented in some form, real estate professionals need to be prepared. Guidehouse also reminds financial institutions that facilitate activity for Reporting Persons to review and update necessary controls to ensure that their customers are in compliance with relevant laws and regulations. This may include reviewing the financial institution’s onboarding and due diligence procedures, as well as reviewing investigative procedures and transaction- monitoring rules. To address these challenges, Guidehouse can help real estate firms and financial institutions assess their compliance programs to prepare for regulatory updates and to mitigate risks, including developing updates to operations, policies, procedures, controls, and technology.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.