Search

Search

In March, the crypto industry watched as three of the most “crypto-friendly” banks in the U.S. — Silvergate, Silicon Valley Bank, and Signature — collapsed within a week. Although the failures were at least partially due to improper risk management practices, the deep relationship between these institutions and the crypto industry is likely to have significant implications for crypto banking, due to other banks fearing balance sheet volatility and needing to project stability to the public.

It seems counterintuitive. The crypto industry often prides itself on bolstering an independent financial system that caters to the individual and excises intermediaries. However, this vision for independence actually relies significantly on the ability to use current intermediaries (banking institutions).

In the aftermath of Silvergate, Silicon Valley Bank, and Signature collapsing, crypto companies have struggled to find new banking partners. In fact, one of the reasons there was a concentration of risk in these banks was the fact that many of the larger banks were not willing to provide banking services to customers they consider “higher risk,” like cryptocurrency exchanges and money services businesses. We’ve seen examples of this challenge in the past. A bank among the leaders in assets managed removed trading platform Swan Bitcoin from its corporate account in October, allegedly without warning. When banks refuse crypto clients, or remove them as clients, there is a threat that crypto companies will not be able to make payroll or maintain operations. Historically this reluctance has been borne out of a perceived banking risk associated with serving crypto clients.

“Overwhelmingly, banking is the challenge for crypto companies…A lot of people in crypto are denied access to banking services. It’s a real problem,” remarked William Quigley, the cofounder of Tether, a stablecoin issuer.1 The crypto industry concentrated reliance on Silvergate and Signature for its banking needs due to their willingness to accept crypto clients. Crypto companies now face an urgent challenge in finding alternative banking partners willing to establish a cooperative relationship.

In the ninth edition of the Two Worlds Colliding series, we explore regulatory activity, crypto adoption both domestically and globally, security concerns, and the potential future of digital finance.

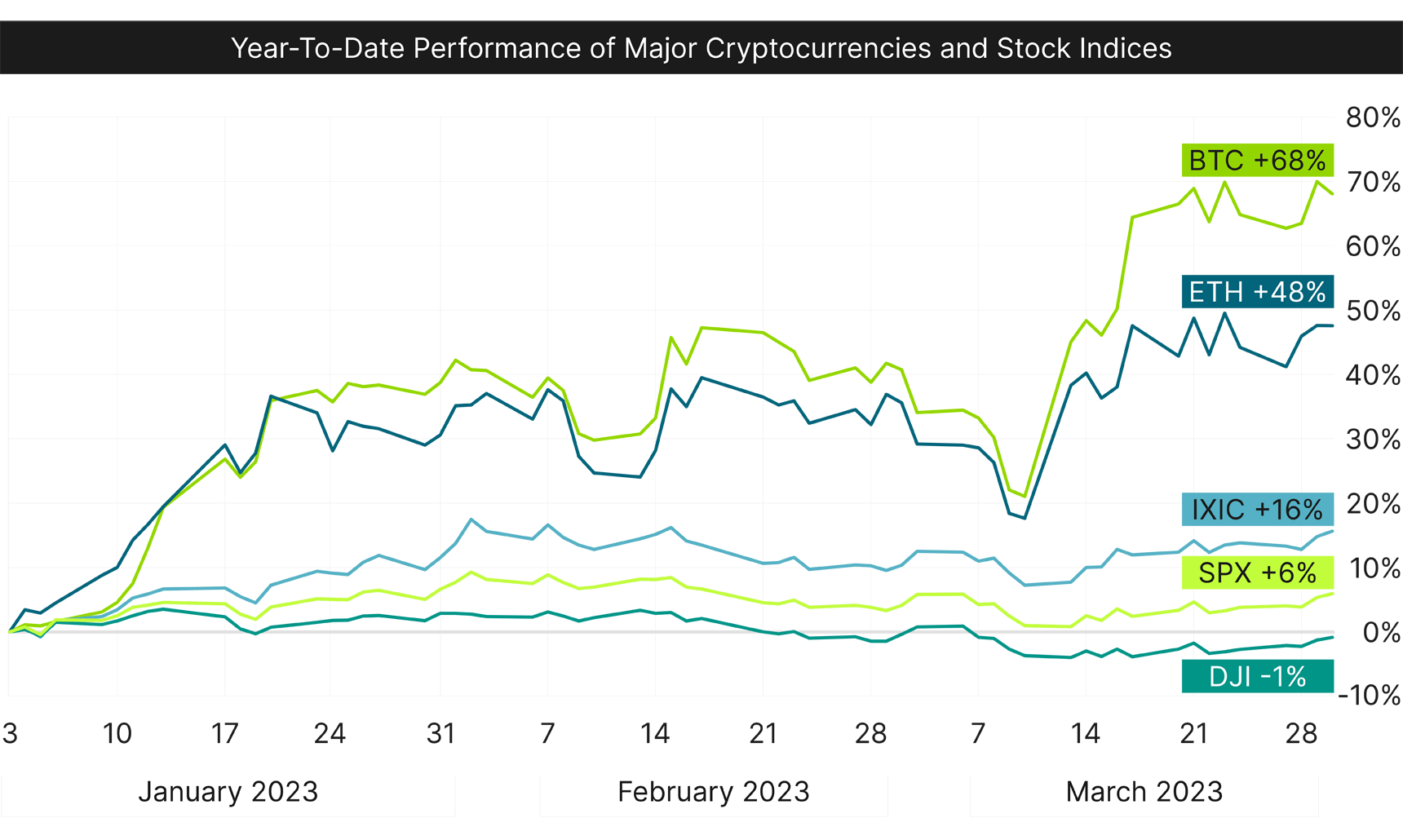

Bitcoin (BTC) and Ether (ETH) have largely outperformed the traditional stock market this year. BTC is up more than 70% since the beginning of the year, and ETH is up almost 50%. Meanwhile, Nasdaq (IXIC), the S&P 500 (SPX), and the Dow (DJI) have seen much lower returns, as shown in the graphic below.2

The relative strength of cryptocurrencies compared to the stock market can likely be attributed to multiple potential factors, but one that ultimately sticks out is the downfall of Silicon Valley Bank and Credit Suisse in early March.

The graphic below shows that BTC and ETH prices grew substantially following the news regarding Silicon Valley Bank and Credit Suisse, which could be interpreted as a sign that investors are buying into cryptocurrency as an alternative investment and store-of-value outside of the traditional banking system.

The relationship between the cryptocurrency industry and the U.S. regulators (particularly the U.S. Securities and Exchange Commission (SEC)) may be reaching new levels of tension. The industry’s calls have been consistent — the industry urges the SEC to issue rules applicable to crypto companies. The SEC, however, has responded by building implied rules through its enforcement actions, application rulings, and policy decisions that certain crypto companies have deemed insufficient or unclear. There is a lack of consensus on which party is “right” — whether crypto companies are choosing to ignore the SEC’s implied requirements, or whether the SEC is causing ambiguity for industry stakeholders.3

As of late February, the SEC has issued dozens of actions aimed at defining a crypto security and crypto exchanges. There may be tension between the industry and SEC Chair Gary Gensler after his remarks criticizing crypto companies, alleging that such companies are openly scorning the SEC and feigning ignorance of U.S. regulations. “The law’s pretty straightforward,” Gensler told CoinDesk.4

In March, the Commodity Futures Trading Commission alleged that a major cryptocurrency exchange has offered unregistered derivatives products and encouraged customer and employee practices that evade compliance best practices and requirements; the exchange is now being charged with violating futures transactions laws, failure to register as a futures commissions merchant, failure to properly supervise the business, poor know-your-customer and anti-money laundering processes, and more.5

In March, another major cryptocurrency exchange was issued a Wells Notice from the SEC, which warned that the SEC identified potential violations of securities law — this is the second warning the SEC has issued to a crypto entity this year, issuing another to a stablecoin issuer in February.6

The first quarter of 2023 was relatively quiet regarding large-scale security breaches. Although there were some large blockchain heists, the growing trends amongst hackers have been targeting high net worth individuals and non-fungible token (NFT) rug pull scams.

Fordefi’s Multi-Party Computation wallet has received SOC 2 Type II certification from Ernst & Young, demonstrating the strength of security, privacy, and processing integrity for this institutional DeFi wallet.17 Fordefi’s wallet is the first and only institutional DeFi wallet to be granted this certification, and comes at a time when the ability to safely transact and hold digital assets is a prime focus for financial institutions.

While widespread optimism remains for long-term adoption, short- and medium-term sentiment is currently mixed. This may be due to inconsistent regard as to how recent market volatility and tightening monetary policies will impact blockchain technology adoption broadly.

The adoption of blockchain technology continues to increase in the U.S. among companies and individuals. While cryptocurrencies have seen a dip in investment activities this quarter, the adoption of its underlying technology remains strong.

Lindsay Lohan was paid $10,000 to promote Tronix tokens offered by Justin Sun’s company Tron via a February 11, 2021, tweet:

“Exploring #DeFi and already liking $JST, $SUN on $TRX. Super fast and 0 fee. Good job @justinsuntron.”29

Gurbir S. Grewal, director of the SEC’s Division of Enforcement, remarked on Lohan’s failure to disclose that the tweet was a paid endorsement and warned Justin Sun’s misleading potential investors:

“This is the very conduct that the federal securities laws were designed to protect against regardless of the labels Sun and others used.”30

Rebecca Rettig tweeted after being named the first Chief Policy Officer of Polygon Labs in February:

“This role is for the entire web3 community. We will advocate for base layer protection, but also for every aspect of the builder ecosystem — DeFi, NFTs, web3 gaming, & innovative apps growing the web3 world. Decentralization is the whole point, & must be protected. We will also advocate for sensible, activities-based reg for crypto native entry points — front ends, wallets, bridges. You name it, we’re here for you.”31

The cryptocurrency industry is faced with a large obstacle in the wake of the bank closures earlier this year. On one hand, major cryptocurrencies (like BTC and ETH) have largely outperformed the U.S. stock market. The relative strength of cryptocurrencies could indicate that investors are increasingly turning to digital assets as a viable alternative to traditional investments, a trend that is likely to continue as the industry matures and becomes more mainstream.

However, the recent collapses of Silvergate, Silicon Valley Bank, and Signature highlight a critical challenge faced by the cryptocurrency industry — the lack of reliable banking partners. Crypto companies need banking partners to operate smoothly and continue to grow. However, the reluctance of traditional banks to serve crypto clients has left the industry vulnerable. Smaller companies may struggle to make payroll or sustain normal operations.

To address this challenge, regulators and banking institutions must work together to create a more welcoming environment for crypto companies. This means addressing perceived risks associated with banking crypto clients, providing more clarity around regulations, and creating a framework that encourages responsible innovation. By doing so, the crypto industry will be able to continue to grow and provide valuable services/alternative investments to a broad range of individuals and businesses around the world.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.