Search

Search

The financial strain of the pandemic and its aftermath is prompting states to broaden and hasten unclaimed property examinations and enforcement, tightening exemptions and shortening dormancy periods to mitigate budget shortfalls. While this increased focus on regulatory compliance is not new to insurers, rapid advances in machine intelligence to detect non-compliance are intensifying the need for sophisticated, data-driven methodologies to fulfill unclaimed property obligations. This growing need for precise and prompt data, however, is paradoxically met with more restricted and complicated access to the essential data sources that power these methodologies.

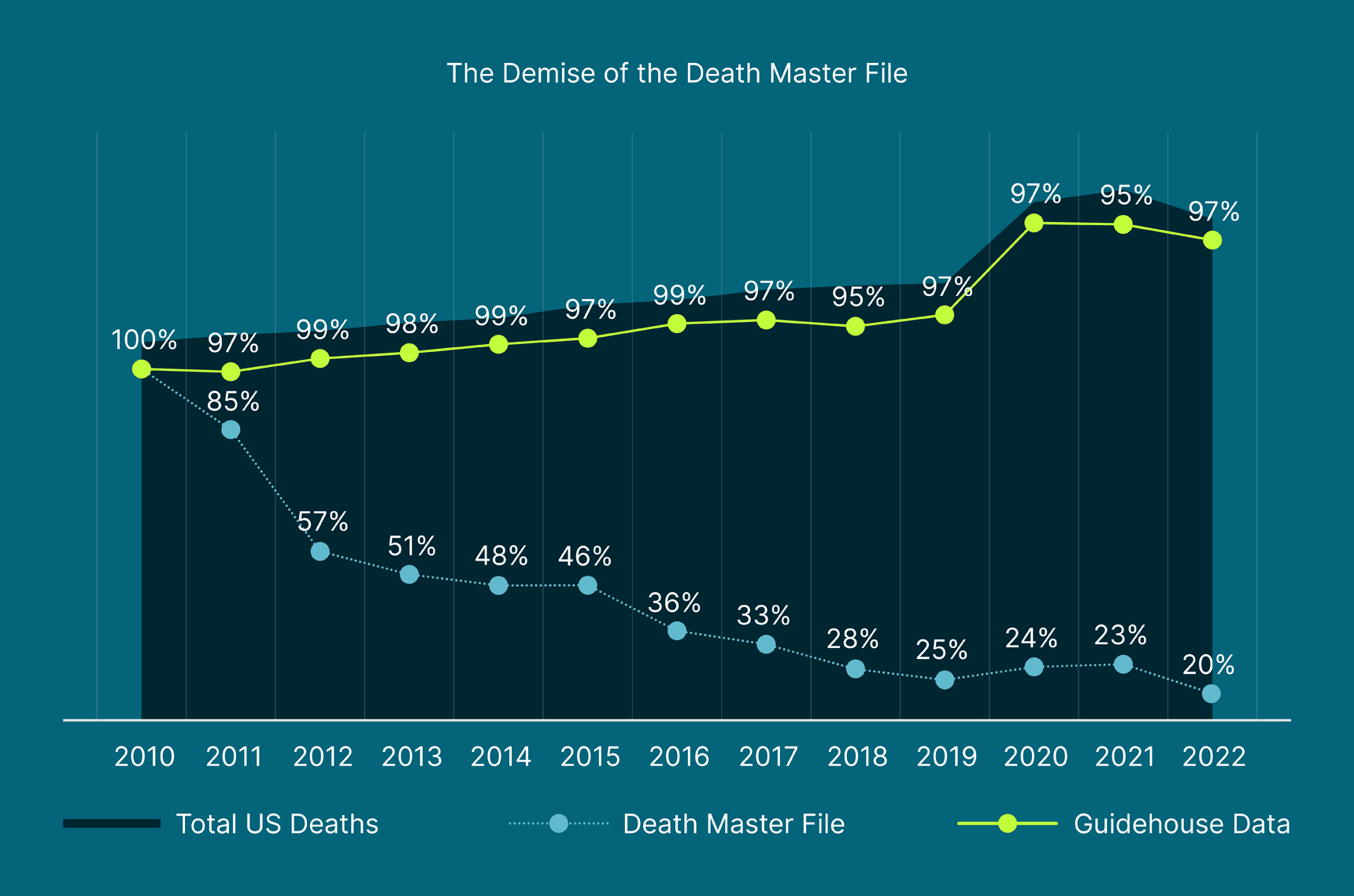

Before November 2011, the Social Security Administration’s Death Master File (DMF) was a comprehensive, accessible, and affordable repository of nationwide deaths available to approved entities, offering insurers an efficient and economical means to monitor the vital status of their policyholders using reliable data from the federal government. However, changes to Section 205(r) of the Social Security Act, effective on November 1, 2011, prohibited the disclosure of state death records except under specific conditions, resulting in the removal of 4.2 million records from the DMF and subsequent annual exclusion of more than 1 million records.

In the years that followed, the Limited Access Death Master File (LADMF) emerged with a fraction of nationwide deaths, now capturing fewer than 20% of deaths in the United States. Access to this repository is limited to certified organizations that implement rigorous internal controls and obtain independent attestation from an Accredited Conformity Assessment Body. The certification process, which is both time-consuming and expensive, and the lack of a comprehensive alternative to the DMF, greatly complicates processes to collect data and evaluate claims. These added layers of complexity to an already onerous process are challenging for insurers to address on their own.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.