Search

Search

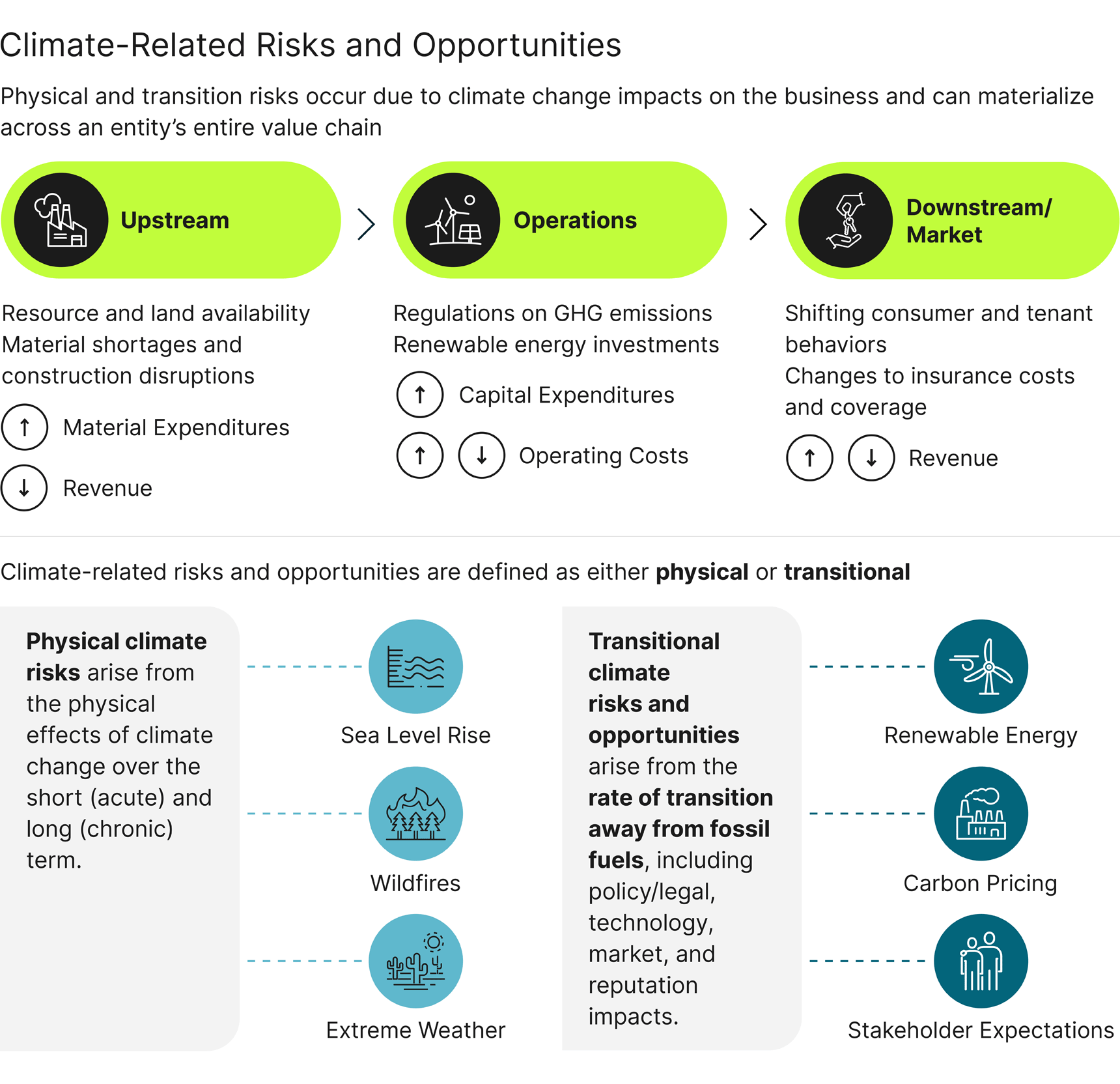

Climate change is redefining the landscape of the 21st century at every level of government and in every industry. Climate-related risks, including both physical risks and transition risks, pose unique challenges for financial institutions and asset portfolios.

To help manage climate-related financial risks, financial regulators must consider options to:

All organizations, including financial institutions, are navigating the complexities posed by an increasingly volatile climate, increasingly stricter regulations, growing stakeholder and investor awareness around climate-related risks, and the need for organizational and infrastructure resilience.

Climate-related risks, including both physical risks (e.g., hurricanes, flooding, and wildfires) and transition risks (e.g., changes to tax policies, building codes, and climate-driven migration), pose unique challenges for financial institutions and asset portfolios. Physical climate risks can impair financial assets, leading to increased defaults and stranded assets, and transition climate risks can impose greater costs on borrowers and lead to higher lending and servicing costs. In addition, climate-related risks pose heightened impacts on the underserved or underbanked population and low-to-moderate income communities.

Managing climate-related risks is an evolving field and new to many financial institutions. Any technical assistance efforts that financial regulators can provide to financial institutions to help better understand and manage potential risks from climate change would be beneficial not only to the industry, but also to the success of the national decarbonization agenda. There must be a concerted effort to support broader climate literacy in addition to more traditional “carrots-and-sticks,” compliance-based approaches. As such, financial regulators should consider options to support financial institutions with their climate-related efforts, including, but not limited to:

As financial institutions increase their understanding of climate-related financial risks, financial regulators should consider whether potential regulatory changes are necessary to accelerate action within the financial services industry with managing climate-related financial risks. The most important regulatory change would be the establishment of clear, coherent, and consistent disclosure standards for how financial institutions assess, quantify, and disclose climate-related risks. Today, there are many competing voluntary disclosure frameworks (e.g., Task Force on Climate-Related Financial Disclosures (TCFD)) and various industry-based frameworks (e.g., Partnership for Carbon Accounting Financials). Additionally, the governor of California recently signed two state laws related to Emissions Reporting and Climate Risk Reporting that will be mandatory for all companies doing business in California starting in 2026, and the U.S. Securities and Exchange Commission (SEC) is expected to release its climate disclosure rule in 2024. These recently passed, or expected, laws and regulations have upped the ante on mandatory disclosure for financial institutions.

Financial regulators should also consider whether climate-related financial risks should be incorporated into supervisory and examination programs. Prior to doing so, it is critical to ensure that supervisory and examination staff have the technical capabilities and understand how climate and transition risk are modeled and quantified—financial regulators can only supervise performance that they understand. Therefore, it is critical for financial regulators to improve their own climate literacy and pursue strategies to procure and implement the climate models and underlying data, and hire the industry expertise needed to successfully deploy these models as part of supervisory and examination activities.

From the 2008 financial crisis to the COVID-19 pandemic, Guidehouse has proudly served as a long-term trusted advisor to federal agencies, including many of the financial regulators, in helping tackle some of the biggest challenges facing our nation.

We are a market leader in assessing climate-related financial risks for federal agencies, regulators, and financial institutions, and have extensive experience advising clients on potential risks and impacts posed by transition risk events and the various data and technology platforms to assess physical climate risks. Furthermore, we are an industry leader in the various disclosure frameworks, such as TCFD, International Sustainability Standards Board, and regulatory proposals (e.g., the U.S. Securities and Exchange Commission’s proposed climate disclosure rule).

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.