On June 25, 2024, the Consumer Financial Protection Bureau (CFPB) issued an interim final rule to extend the Section 1071 Small Business Lending Rule compliance dates following the U.S. Supreme Court’s May 16 ruling that the CFPB’s funding mechanism does not violate the Appropriations Clause of the U.S. Constitution.

While the CFPB had finalized its

long-awaited Section 1071 Rule (the Rule) on March 30, 2023, several financial institutions and trade associations sued the CFPB to prohibit the rule’s implementation. On July 31, 2023, a Texas court granted a preliminary injunction preventing the CFPB from implementing or enforcing the Rule against the plaintiffs and their members. The district court later issued a nationwide injunction, prohibiting the CFPB from implementing or enforcing the Rule on any covered financial institution.

Despite the stay on the Rule, lenders continued to march forward, making progress toward their original compliance dates. With the extension of 290 days, lenders now have additional time to continue to develop and implement the processes, controls, system updates, policies, procedures, and training needed to be in compliance ahead of the new compliance dates.

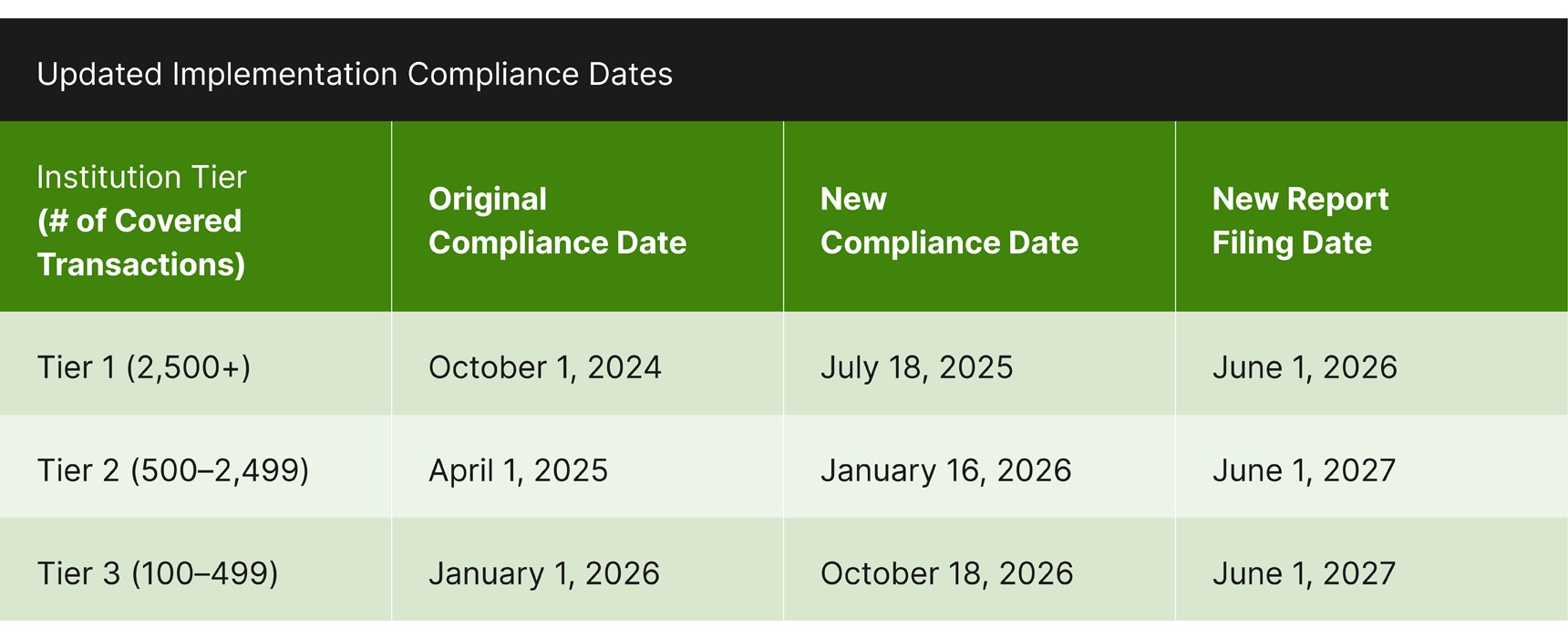

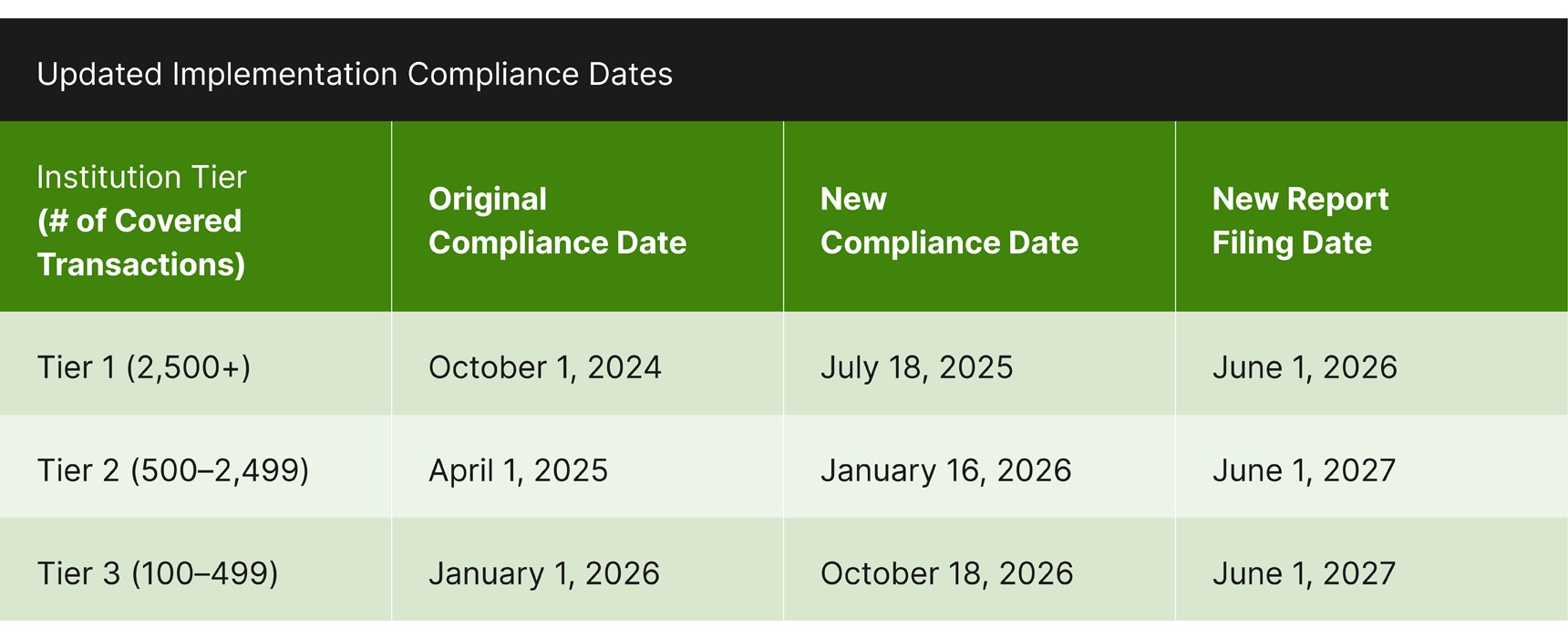

Updated Implementation Compliance Dates

Challenges with Implementing Rule 1071

Through Guidehouse’s seasoned work with lenders and our industry subject matter knowledge, we have been able to assist clients with some of the challenges lenders have been facing while preparing for the Rule, including:

Placement, formatting, and wording of demographic questions in the Application — Lenders want to make sure they are placing the new questions in the application such that they meet the CFPB’s requirements around discouragement risk but also do not result in a customer abandoning the application. Guidehouse recommends reviewing the current application flow and inputting the new questions where they fit most seamlessly. Additionally, lenders need to gather the demographic information prior to the decisioning of the application. For most applications Guidehouse has reviewed, the end of the application has worked best. Guidehouse has also seen lenders collecting the demographic information at the same time as the loan application, but on a separate form. Further, Guidehouse recommends utilizing the CFPB’s provided format and wording to enable compliance.

Timing of application updates and when to start to gather the data — The Rule permits lenders to start collecting on July 18, 2024, 12 months prior to the compliance date. Most lenders likely do not want to be the first to update their applications. Given the change in compliance dates and the progress many lenders have already been making in meeting the original date of October 1, 2024, a few lenders have indicated they will start collecting as early as Q4 this year, with most lenders opting to collect two to three months before the compliance date. Guidehouse recommends starting to collect early, to allow for more time to review the data, perform fair-lending analysis, and to establish all of the requirements from the Rule are being met. This time will also allow lenders to identify and correct issues and friction in the application or data gathering process.

Collection and transmission of data using third parties — Lenders are involving a variety of third parties as part of their Rule compliance activities. With the CFPB placing strict limits around the collection, storage, and transmission of demographic data and personally identifiable information (PII), lenders need to ensure that their usage of third parties does not run afoul of the regulation. Guidehouse recommends working with third-party vendors to ensure they are compliant with the CFPB’s requirements and only providing the data that is necessary to obtain the necessary outcome. Additionally, lenders should ensure that their vendor management process is up-to-date as it relates to third-party data usage.

"While the new compliance dates give financial institutions more time to prepare, the deadline is now less than a year away for some. It is important that financial institutions get started or keep pushing forward given some of the complexities related to system updates and reporting requirements among others."

— Kathryn Rock, Partner, Financial Services

How Guidehouse Can Help

Financial institutions should continue examining the impacts of the Rule to their organization to ensure compliance. Guidehouse can help alleviate these constraints by supporting financial institutions through all aspects of implementation and compliance with the Rule, including:

- Providing program management support.

- Establishing strong and accountable governance structures.

- Conducting gap assessments to determine what current processes, technology, and procedural changes are needed to comply with the Rule.

- Analyzing gaps in technology/systems, applications, data collection, and data management practices against the Rule requirements.

- Prioritizing and managing updates to technology/systems, applications, data collection, and data management practices.

- Drafting process flows and procedures, incorporating steps to provide decision audit trails.

- Conducting comprehensive training for applicable employees.

- Performing data quality reviews on collected data.

Conducting data control reviews.

Performing fair lending regression analyses on currently collected data.

Search

Search