Search

Search

The European Union (EU) foresees a massive demand for low-carbon hydrogen (H2) to achieve its Fit-for-551 and REPowerEU goals. However, there is a discrepancy between the potential domestic supply and demand for low-carbon H2, especially in central Europe. Therefore, fast implementation towards 2030 of H2-import corridors2 is critical in the EU.3

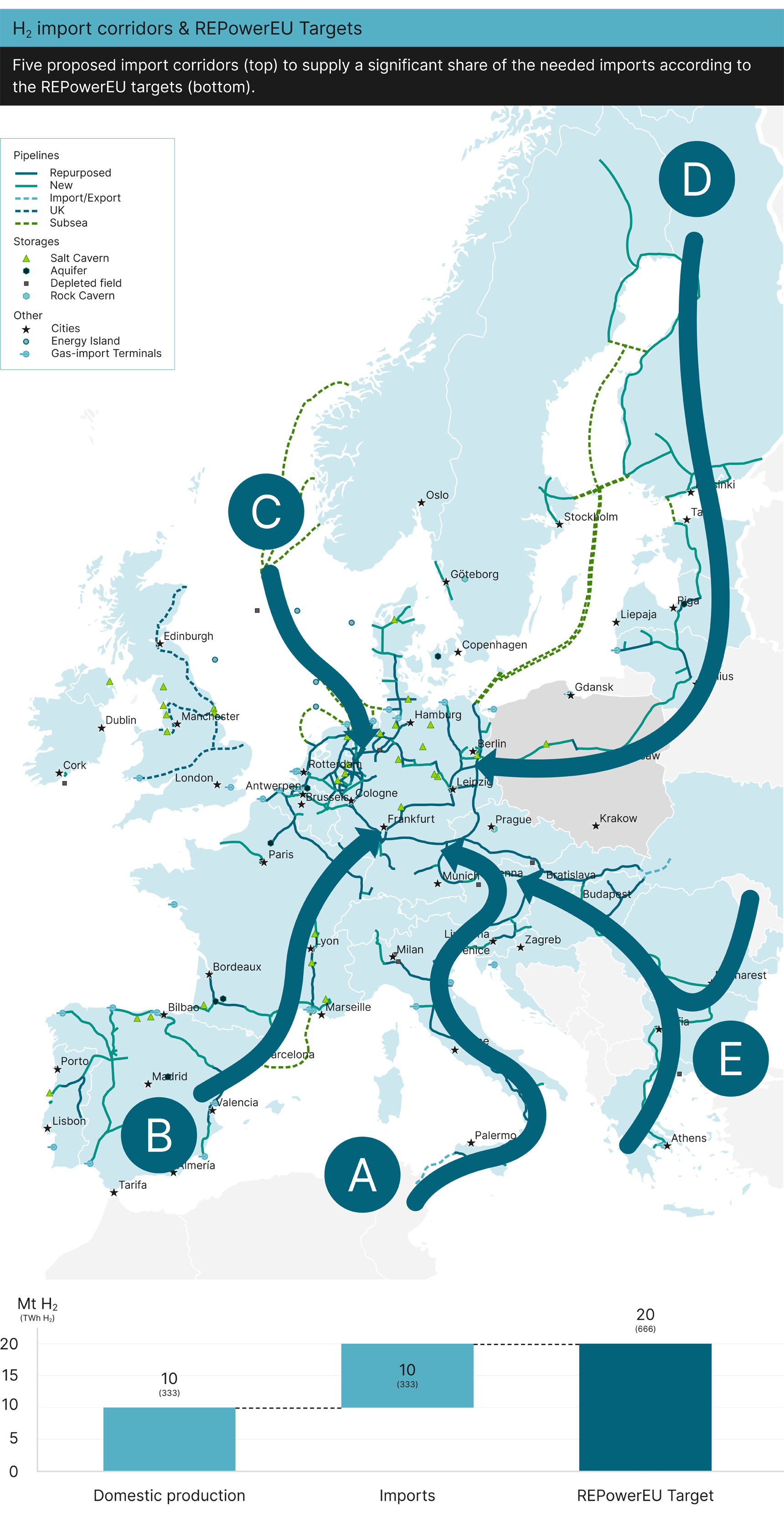

Guidehouse has defined five key pipeline-based import corridors for 2030 to central Europe within the European Hydrogen Backbone work (see graph below) and already elaborated on the urgency for policymakers to take action to meet the REPowerEU ambitions.4 To achieve these goals, faster uptake of transport infrastructure, including integrated European H2 infrastructure planning, support mechanisms, and simplified permitting procedures, are required.

Additionally, the corridor development relies on multiple stakeholders representing the production, transport, and offtake of H2. However, there are substantial uncertainties in the development of an H2 market, hence hesitation from a supplier perspective regarding the substantial investment risks. The potential hydrogen demand players, on the other hand, need economic and secure supply options before they can commit to take off H2. This results in a so-called chicken-and-egg problem, which cannot be solved by a single player.

Currently, there is growing momentum for H2 with significant announcements of import capacities, including 500 kt/a demand issued from TotalEnergies5 or a 10 GW pipeline from Norway to Germany by 2030.6 To leverage this momentum, we have identified five factors to ensure a successful implementation of the necessary import corridors.

Success Factor 1: Involvement of Complete Value Chain

The ramp-up of the value chain requires all stakeholders to develop their assets simultaneously, which demands strategic coordination across all parties. Relevant stakeholders along the value chain include H2 producers, transport system operators, and major offtakers like the steel and chemical industry, power producers, and refineries. They must be aligned on timing and volume expectations and communicate the aggregate transport and storage infrastructure needs to the transport system operator and H2 producer. Stakeholder collaboration along the H2 value chain not only supports the alignment of key milestones like investment decisions, which are crucial when building up an entirely new value chain, but also provides all parties with a deepened understanding of their challenges and enables them to work together on solutions. Integrated timeline planning is a pivotal tool to facilitate this alignment. Additionally, a joint positioning across the value chain has the weight and credibility to communicate the urgency and need for regulatory adaptions and political support to policymakers. One example is the cooperation between low-carbon H2 producers and the power sector as offtaker on an import corridor from Norway to Germany – which is one reason why this sector is likely to be one of the earliest implemented.

Success Factor 2: An Updated View of Import Corridor Options

There are many relevant hydrogen corridors and import routes, including H2 derivatives. Given the dynamic policy, regulatory, and market developments, it is important to keep an updated view of supply corridor alternatives. Several import options are required to enable a resilient supply. While pipeline corridors enable lower transport costs, shipping solutions might be available earlier and have more flexible supply options. Therefore, it is necessary to assess and define a frequently updated roadmap of corridor and H2 carrier options.

Success Factor 3: Requirement of Central Orchestrator

The presence of a central orchestrating entity is vital for developing H2 import corridors. Stakeholders with a high economic interest in the uptake and coordination of the H2 value chain are best suited to take the orchestrating role. These will likely be H2 suppliers who need to understand the risks and progress along the value chain, as well as have close collaboration with infrastructure developers and offtakers to get the security needed to invest. Additionally, the close collaboration of stakeholders across the value chain requires handling compliance issues and expertise in many different fields, so appointing an external partner to support the project management for an H2 consortium can be valuable.

Success Factor 4: Supportive and Clear Policy and Regulation Across the Value Chain

Policymakers and regulators need to define clear regulations and support mechanisms in time. Investment decisions for the construction of a transmission infrastructure need to be made by early 2025.The national implementation of the EU Renewable Fuels of Non-Biological Origin quotas for industry and transport, resulting from the RED III, ReFuel EU, and FuelEU Maritime initiatives, will provide more clarity to H2 offtakers, but also to the supplier side on production volumes. Furthermore, policymakers must implement support mechanisms soon to allow companies to invest in H2 production before 2026 and for competitive H2 costs in offtake sectors. A joint group of stakeholders across the value chain is best positioned to assess and communicate these needs to policymakers.

Success Factor 5: Start Now – to Be Ready by 2030

Assessments of timelines for different import corridors showed that it is crucial to start these initiatives in 2024. Otherwise, it will be very challenging to implement an H2 import value chain by 2030. Besides the limited timeframe for technical assessments, permitting, and construction of H2 import corridors, it is also important to soon get into discussions around H2 offtake agreements and how initial contracts – very likely bilateral agreements – will look. It is critical for the transmission system to receive clear messages that this infrastructure will be needed, but especially for potential H2 producers to start planning, procuring, and making investment decisions.

Guidehouse Expertise and PMO Experience to Support the Implementation of H2 Import Corridors

All this will lead to three outcomes. First, the supply side will be integrated earlier toward (conditional) offtake agreements that allow them to pursue the detailed engineering phase and make the final investment decision. Second, infrastructure operators will get certainty on the needs of their assets (and communicate this to the relevant regulators). Last, offtakers will be able to secure an early hydrogen supply that will be limited around 2030.

Guidehouse’s proactive program management capabilities are well suited and proven to successfully support a group of stakeholders on H2 import corridor development. This is backed up by the in-house expertise Guidehouse has on all topics related to hydrogen, its derivatives, and the infrastructure and demand sectors – from a technical as well as regulatory perspective.

1. European Council. 2022. “Fit for 55.” http://www.consilium.europa.eu. 2022. https://www.consilium.europa.eu/en/policies/green-deal/fit-for-55-the-eu-plan-for-a-green-transition/.

2. “Five Hydrogen Supply Corridors for Europe in 2030.” 2022. https://ehb.eu/files/downloads/EHB-Supply-corridors-presentation-ExecSum.pdf.

3. ENTSOG. "Learnbook on Hydrogen Supply Corridors." 2023. https://www.entsog.eu/sites/default/files/2023-04/web_entsog_230311_CHA_Learnbook_230418.pdf

4. Peterse Jaap. "Accelerating Hydrogen Imports to Meet REPowerEU Ambitions Requires Urgent Action. Guidehouse. 2022. https://guidehouse.com/insights/energy/2022/accelerating-hydrogen-imports-to-meet-repowereu-ambitions-requires-urgent-action

5. Burgess, James. 2023. “TotalEnergies Issues Tenders for 500,000 Mt/Year of Green Hydrogen in Europe.” Spglobal.com. S&P Global Commodity Insights. September 14, 2023. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/electric-power/091423-totalenergies-issues-tenders-for-500000-mtyear-of-green-hydrogen-in-europe.

6. RWE. n.d. “Hydrogen Pipeline with Equinor | Project of RWE.” Www.rwe.com. https://www.rwe.com/en/research-and-development/project-plans/hydrogen-pipeline-in-the-north-sea/.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.