Search

Search

As the global energy sector reckons with increasingly severe impacts of climate change, infrastructure providers will find their assets facing diverse threats that are expected to rapidly increase in intensity over the next 25 years. For example, 6% of European conventional energy generation assets are projected to be exposed to extreme heat every year by 2030. By 2100, this value will likely rise to over 20%.

However, these increases won’t be uniform in frequency or intensity. Greater visibility of the specific risks faced by each asset will be necessary to inform cost-effective climate resilience investment planning.

To evaluate European energy infrastructure vulnerability to climate hazards at a granular level, Guidehouse conducted a study in conjunction with data partner Jupiter Intelligence1—a climate risk analytics firm founded by a cross-disciplinary team of technologists, scientists, and data analytics specialists. Using data from the Open Power System Data Platform and Jupiter’s ClimateScore model, experts assessed 748 conventional power plant assets across Europe for their exposure to acute heat, precipitation, and high winds in the Intergovernmental Panel on Climate Change’s SSP2-4.5 moderate climate change scenario.

As a representative example of the European power system, this study highlights the variance in impact that climate-related threats are expected to have on energy infrastructure. While our research focused on Europe, the findings can be applied more globally.

Finding #1: Projections reveal a significant increase in average exposure across acute heat, a moderate increase in average exposure to extreme precipitation, and a decrease in average exposure to extreme wind speeds.

In this study, extreme heat is defined as a day where the temperature exceeds 35°C . This threshold is used as an illustrative proxy and can be fine-tuned to better correspond to design standards. Across the sampled assets, the number of days breaching this threshold in a moderate warming scenario are projected to triple, from three days a year in 2025 to nine in 2100. With a temperature rise of 2.7°C by 21002, we would expect a near-doubling of acute heat risk over the next 25 years.

Our modeling also demonstrated that precipitation event intensity is projected to steadily increase over the next 25 years and rapidly escalate after 2050 to reach an almost 25% increase by 2100. This implies that precipitation-related threats such as flooding will likely increase over time and sharply accelerate in the middle of the century based on expected cumulative damage reaching key inflection points.

The intensity of acute winds is not forecast to materially change when averaged across the continent; however, these projections are subject to lower levels of confidence compared to expectations surrounding hazards such as extreme heat and precipitation. Mean wind speeds are expected to decrease across the board, leading to potential implications for renewable wind operators (and particularly those in offshore locations).

Finding #2: Stark differences are found at the country level, with certain countries seeing 30 times more extreme heat than others by the end of the century.

When considering the average number of days where the temperature is projected to exceed 35°C for conventional power plants across European countries, we found that assets in countries like Italy and Spain can expect significantly more exposure than the continental average. Power plants in France are predicted to consistently follow the European average, whereas assets in Germany, the Netherlands, and in the United Kingdom are expected to fall well below the continental average.

Drilling down into asset-level assessments, however, yields powerful new sources of insight. Using the same visualization for select nuclear power plants in France, we discover significant differences within the country’s cohort of assets.

Grey boxes represent the continental average

For example, the Tricastin nuclear power plant, located about 60 kilometers north of Avignon, is expected to face more than 30 days of temperatures exceeding 35°C by 2075 compared to the national French average of 10 days. This type of variation demonstrates the significant differences in exposure within a domestic cohort of assets, and the importance of stakeholders taking a truly tailored approach to climate resilience.

Finding #3: Segmenting asset-level exposure into three main categories can support stakeholders when developing a tailored investment plan.

When domestic portfolios are categorized based on both current exposure and future evolution, we can identify, down to the asset level, where differing strategic approaches will yield value. For this study, we have developed the following classifications:

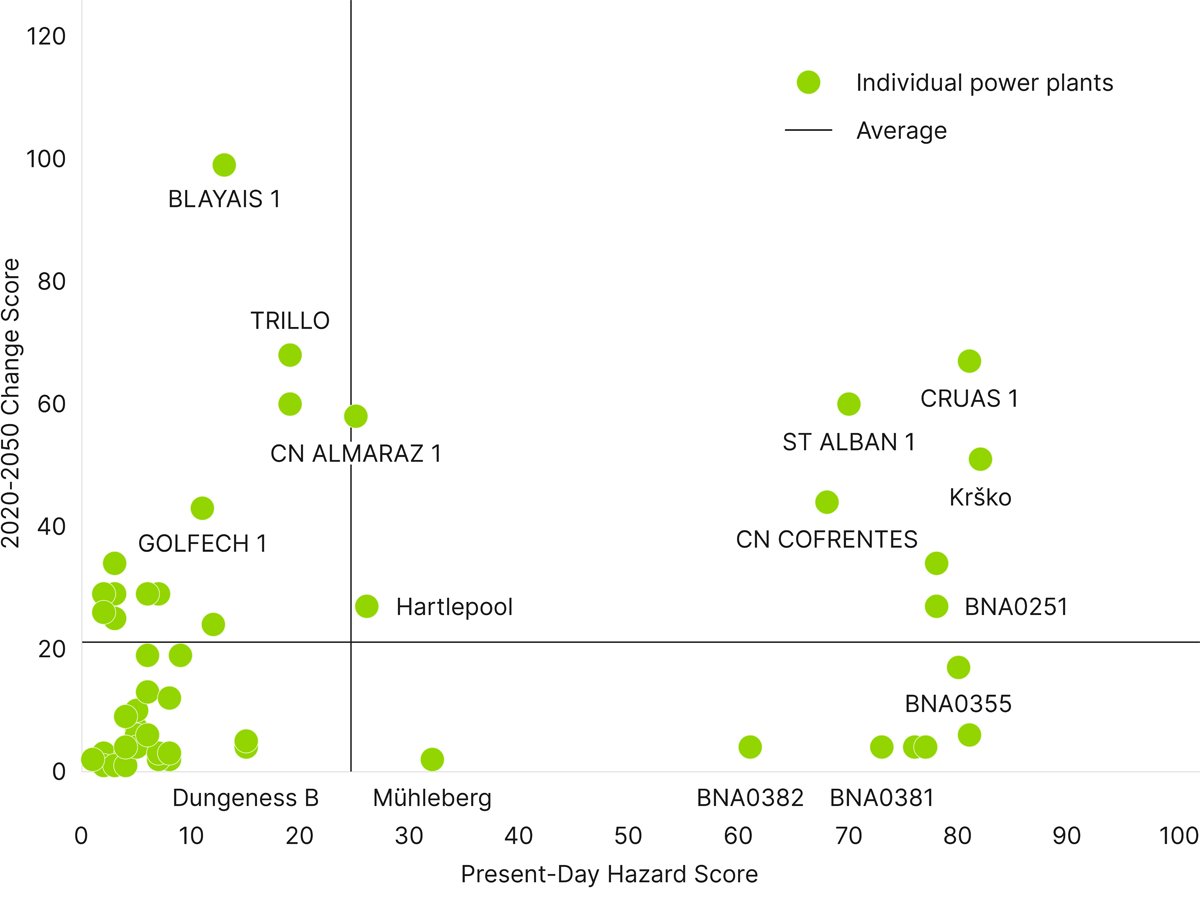

We assigned major nuclear power plants in Europe an “All Perils Score”—a composite score that takes into consideration multiple perils such as flooding, wind, wildfires, and heat to help understand the total risk each asset may face—then plotted their expected levels of future change.

“Black sheep” (high current exposure, high levels of future change), found in the top-right section of the quadrant, are mostly composed of assets in France and Spain. In practice, these assets already face significant impact from flooding, high winds, or heat, so they may be well-prepared. Those planning investment for new assets in these areas will need to be fully aware of the “gold-plated” resiliency costs required.

“White elephants” (relative current exposure, low levels of future change) are grouped in the bottom-right section. This category mostly consists of German power plants that face relatively high levels of present-day flood risk. Blanket installation of additional resiliency measures could lead to significant overspend in these areas, so assets that aren’t expected to experience high levels of future change should be flagged to not receive unnecessary funding where the return on investment would likely be minimal.

“Red canaries” (lower current exposure, high levels of future change), occupying the top-left corner, are mostly composed of assets in France and Spain. Additional granularity in assessing and managing these assets would likely prove beneficial. For assets that aren’t currently influenced by climate change but are forecasted to be heavily impacted in the future, affected regions, communities, and infrastructure providers will need to make significant shifts in related investment, mindset, and response capabilities.

Infrastructure providers are under increasing pressure to take physical climate change risks into consideration as regulators implement more stringent disclosure requirements. One example is in the UK, where Ofgem (the UK’s energy regulator) requires that infrastructure providers qualitatively identify climate risks on an asset-by-asset basis, delivering proposals for adapting to climate change under the Adaptation Reporting Power process. However, given the scale of infrastructure that will be built to meet the UK’s ambitious 2030 Clean Power targets, the regulator is considering including requirements for networks to quantify these risks and include them within their asset planning process.

To address current regulatory requirements and meet consumer expectations, a high-level, primarily qualitative risk assessment is often sufficient to gather an initial understanding of an enterprise’s exposure. However, for infrastructure providers with a multi-decadal relationship to the area they serve, a more comprehensive, data-driven approach is needed to help prioritize, rationalize, and schedule their investments.

The findings from this study highlight the change that assets across Europe will face, and the emergence of extreme events in locations that have no precedent to learn from. With the right guidance, infrastructure providers can identify these “canary in the coal mine” warnings through comprehensive risk assessments to better understand and target their response to increasingly frequent climate hazards.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.