Cryptocurrency robo-advisors, cryptocurrency exchange-traded funds (ETFs), non-fungible tokens (NFTs), and the metaverse—it has never been easier for the average consumer to own and trade or to learn about cryptocurrency.

Cryptocurrency’s market capitalization reached $3 trillion in November. As more cryptocurrency is mined globally, crypto and financial services companies create products and services that aspire to make investing in cryptocurrency more accessible and inviting—such as NFT games, robo-advisors aimed at beginners, and even a potential crypto trading floor included in proposed plans for a casino in New York.

Simply stated, US consumer adoption and crypto education continues to rise. Meanwhile, US politicians and regulators continue to debate how to fold digital assets into the country’s oversight. On December 6, the Biden administration remarked “advances in digital technology have dramatically improved the efficiency, convenience, and reach of alternatives to cash … at the same time, digital assets have been used in support of a variety of illicit activities.”

There is a balance to reach when it comes to encouraging technology and innovation to flourish while preventing potential bad actors. This became even more apparent as this quarter saw security breaches that led to millions in losses.

Despite potential security concerns, cryptocurrency is becoming increasingly engrained in the fabric of the consumer’s everyday life. Cryptocurrency will be also pivotal in the metaverse, a virtual reality space that has garnered plenty of attention recently and is a signal of products to come, if Facebook’s renaming to Meta is any indicator. Cryptocurrency is in the news, it is on social media, and as consumers familiarize themselves with the concept—it is in their portfolios.

In Guidehouse’s fourth edition of the Two Worlds Colliding Series, we delve into the ever-expanding crypto environment and discuss recent consumer, industry, and regulatory activity on the merging of cryptocurrency with financial services.

Regulators Discuss and Scrutinize Digital Assets

Regulators and politicians continue to work together—and sometimes debate—the treatment of crypto-companies.

- On December 8, top executives of major cryptocurrency companies testified during a Congressional hearing on “Digital Assets and the Future of Finance: Understanding the Challenges and Benefits of Financial Innovation in the United States,” marking the first Congressional hearing of its kind. Crypto executives expressed that “sound regulation is central to fueling crypto innovation and adoption,” and proposed regulatory oversight methods for the House Financial Services Committee to consider. These proposals generally clash with the current position taken by the US Securities and Exchange Commission (SEC). During the hearing, speakers discussed the desire to promote efficiency and market resiliency, protect consumers against fraud and market manipulation, facilitate fair competition, and provide clear standards for crypto companies to meet.

- On December 3, SEC Chairman Gary Gensler responded to questions from the Senate Banking Committee on cryptocurrencies. Despite requests for elaboration from the Senate Banking Committee, Gensler continues to assert that the SEC does not need to specify which crypto-assets are and are not securities and that defining a crypto-asset depends on particular facts and circumstances.

- The Digital Commodities Exchange Act was released for public comment by US Rep. Glenn Thompson (R-Pa.). The current draft would establish a new regulatory regime for crypto-exchanges within the Commodity Futures Trading Commission—contradicting the opinion of Gensler, who argues custodial crypto-exchanges fall under existing securities laws.

- The SEC announced charges against a Latvian citizen over a series of digital asset-related investment schemes. The SEC tallied hundreds of retail investors who were defrauded out of at least $7 million through two different digital asset securities offerings.

- The CEO of a bitcoin mining company was called upon by Sen. Elizabeth Warren (D-Mass.) to discuss the environmental impact of its bitcoin mining operations, highlighting an environmentalist priority for certain politicians. The bitcoin mining company plans to establish that it meets nation-leading environmental standards.

Cryptocurrency Security Issues Arise

This month saw notable cases of security breaches to cryptocurrency companies.

- On December 1, a decentralized finance (DeFi) protocol suffered a breach to its front-end website, which was allegedly used to steal an estimated $120 million from users.

- On December 4, a crypto-exchange announced that it suffered a breach to an Ethereum hot wallet and Binance Smart Chain hot wallet, leading to approximately $200 million stolen from the Ethereum blockchain and the crypto-exchange’s Binance Smart Chain reserves.

M&A and Strategic Partnerships Continue to Grow

Cryptocurrency mergers and acquisitions (M&A) continued a rapid pace this quarter. M&A, including at least one company involved in digital assets, totaled more than 550 deals in aggregate worth more than $25 billion.

- Voyager Digital, a crypto trading platform, partnered with a CoinLedger, a crypto-tax reporting platform to better track user prior digital wallet, exchange, and blockchain transactions. The trading platform hopes this functionality will enhance personal portfolio management of capital gains, losses, and income tax reporting.

- Fidelity Digital Assets has formed a partnership with a collateralization focused crypto-company, Nexo. This synergy is expected to provide institutional investors with greater custodial and collateralized exposure to the digital asset class.

- Crypto.com, a cryptocurrency platform, acquired two US-based cryptocurrency exchanges, North American Derivatives Exchange and the Small Exchange for $216 million. The acquisition is meant to provide options for consumers to trade cryptocurrency derivatives and futures.

- 2TM, which holds the largest Brazilian cryptocurrency exchange company, has announced plans to strategically acquire companies in Latin America, with a hope to improve bitcoin infrastructure throughout financial markets. The Brazilian cryptocurrency exchange has already made multiple acquisitions this year and has seen headcount growth of 250% in 2021.

Consumer Adoption in the US

US consumers continue to learn more about cryptocurrency and gain exposure to cryptocurrency products and services, with certain demographics leading the way.

- According to Pew Research Center, 31% of 18-29-year-old Americans have traded, invested in, or used a cryptocurrency (namely Bitcoin and Ether), a significant difference compared to other age groups. Gender also appears to play a role in cryptocurrency interest: Men are about twice as likely to have used a cryptocurrency as women have (22% vs. 10%).

- A recent survey by CivicScience, a consumer data and intelligence provider, indicated nearly one in four participants responded that either they or someone they know have invested in cryptocurrency. In the process, certain participants have foregone traditional investments, such as bonds and stocks, to accommodate cryptocurrency investing.

Cryptocurrency Adoption Spreads and is Analyzed Globally

Cryptocurrency’s international footprint is growing. The US has offered to “engage countries to help with the analysis and development of central bank currencies in a manner consistent with stability, consumer and investor protection, and countering illicit finance.”

- On November 22, the International Monetary Fund released a statement concluding that El Salvador should not use bitcoin as legal tender due to financial and consumer risks, such as bitcoin’s high price volatility and the potential for fiscal contingent liabilities.

- Latin American-based fintech Mercado Pago and New York-based Paxos partner to bring over 28 million Brazilians access to trading cryptocurrency in a feature that will roll out in January. The feature will support bitcoin, Ethereum, and the Pax Dollar stablecoin.

- In November, South Korea’s Financial Services Commission called for expedited action on initial coin offerings (ICOs). The ICOs were previously the target of a ban in 2017, and the request for action aims to potentially include ICOs in the country’s Capital Market Act.

- The governing council of the European Central Bank (ECB) expanded the ECB’s electronic payment oversight to cover crypto-transfers and other digital payment tokens as part of a revamped Euro-system electronic payments instrument, schemes, and arrangement framework.

- On November 11, the chairman of the State Duma of Russia ordered creation of an inter-committee working group on cryptocurrency in order to place greater controls on the local mining industry. The US, Kazakhstan, and Russia are the largest contributors of bitcoin’s hash rate—however, Russian miners currently occupy a legal gray area.

Products and Services Make Cryptocurrency Accessible

Companies are releasing products and services that aim to bridge the gaps between the average consumer investor, retail investors, and cryptocurrency.

- Stacked, an SEC-registered crypto robo-advisor obtained Series A funding of $35 million to provide diversification and passive investing opportunities to users.

- New York-based Ritholtz Wealth Management is joining forces with WisdomTree Investments, a wealth management firm, to offer a crypto ETF.

- Fintech start-up Ripple is introducing a new product called Liquidity Hub, which would provide users with increased exposure to digital assets. Access to these digital assets will be sourced from over-the-counter trading desks, exchanges, and market-makers.

- Blockchain intelligence solution provider TRM raised $60 million in Series B fundraising. TRM will help financial institutions comply with regulations and aid in preventing fraud and financial crime for financial institutions, the public sector, and crypto firms.

- Several companies are developing products associated with the metaverse. Digital real estate is being purchased in the metaverse at unprecedented levels and unprecedented prices. For example, Axie Infinity’s play-to-earn video game sold a digital plot of land for 550 ETH (over $2.2 million).

Consumer Complaints

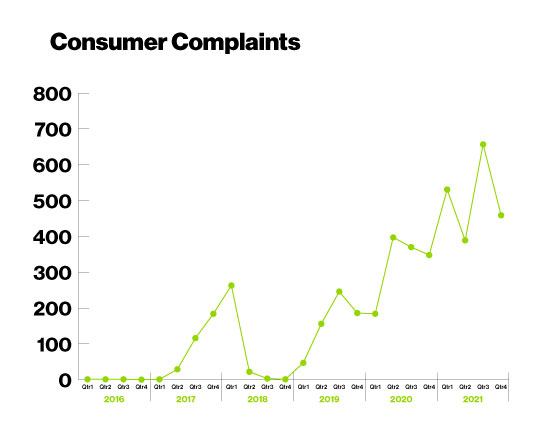

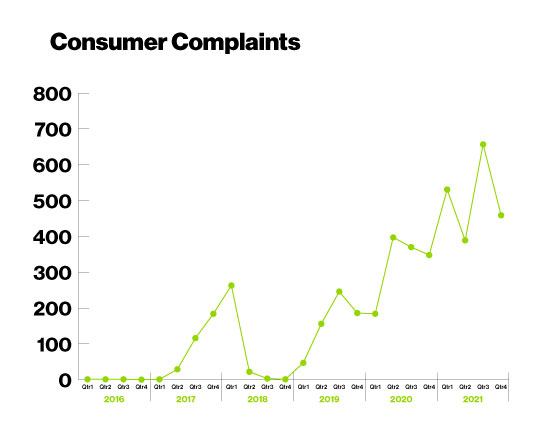

Consumer complaints submitted to the Consumer Financial Protection Bureau (CFPB) against popular cryptocurrency companies rose sharply in the beginning of 2021.

- Consumer complaints targeting popular cryptocurrency companies rose 57% in 2021 compared to 2020.

- During Q3 of 2021, there were 657 consumer complaints toward this group, compared to 370 consumer complaints during Q3 of 2020.

These complaints detail consumer stories about poor customer service experiences, lack of communication from crypto-companies, and difficulties in resolving account or technology issues.

“I’ve been using [crypto-account] instead of my bank for all of my personal savings… Last month, I was traveling and lost my phone, which meant I lost access to my [authentication application] … I followed their protocol… I have now been locked out of my funds for 5 weeks.”

“My [crypto-account] sustained a loss of approximately [$60,000] through a series of unauthorized transfers… [Company] made several demonstrably untrue statements regarding the unauthorized activity, concealing and omitting events that should have raised their suspicion.”

“I created [a crypto-account] and was using the services. I was unexpectedly banned from the service for no reason and they would not disclose why I was banned… I have tried to resolve this with the company and they refused to give me details or support.”

Below is a chart demonstrating the number of consumer complaints submitted to the CFPB targeting popular cryptocurrency companies over time.

What Leaders are Saying

In the meantime, everyone has an opinion and getting digital assets businesses and governments, law enforcement, and regulators to agree may prove to be a challenge.

"There is a 'decentralization illusion' in DeFi since the need for governance makes some level of centralization inevitable and structural aspects of the system lead to a concentration of power." Bank for International Settlements

“I think at the end of the day, if it’s really successful, [regulators] will kill [cryptocurrency adoption] and they will try to kill it. And I think they will kill it because they have ways of killing it.” Ray Dalio, American hedge fund manager

“We’ve purchased bitcoin for our own balance sheet, which we believe not only shows that we have skin in the game…but also could provide attractive financial benefits over the long term.” Amrita Ahuja, Block CFO

Search

Search