Search

Search

In response to the conflict between Russia and Ukraine, the U.S. has implemented extensive sanctions programs to undermine Russian military capabilities by targeting critical entities, industries, individuals, and financial institutions. Russia, however, often leverages middlemen, shell companies, and facilitators to evade these new sanctions regimes, thereby gaining access to the U.S. financial system, as well as procuring critical military hardware.

To counter these tactics, on December 22, 2023, President Biden signed Executive Order (EO) 141141, which amended EO 140242 and expands the Office of Foreign Assets Control’s (OFAC) authority to impose sanctions on foreign financial institutions (FFI) engaging in transactions involving Russia’s military-industrial base. EO 14114 exposes FFIs to new secondary sanctions risks and imposes restrictions on the import of certain Russian goods. The penalty for non-compliance is severe, including total exclusion of the FFI from the U.S. dollar-based global financial system. Therefore, it is critical for FFIs to be cognizant of any new potential sanctions risk exposure generated by EO 14114. This article is intended to call attention to the changes imposed by EO 14114 and their impact on FFIs.

EO 14114 expands OFAC’s ability to target activity occurring outside the U.S. by imposing secondary sanctions on FFIs who engage in or facilitate transactional activity related to Russia’s military industrial base. Prior to the issuance of EO 14114, U.S. sanctions on Russia were primarily list-based and sectoral in nature.

Sectoral Sanctions

Sectoral sanctions impose restrictions on certain industries within a country’s economy, thereby prohibiting U.S. persons from engaging in sector-specific transactions. For example, EO 140663 bans the import of Russian oil, liquified natural gas, and coal into the U.S., as well any new U.S. investments in Russia’s energy sector, thereby depriving Russia of billions of dollars of potential revenue.

List-Based Sanctions

List-based sanctions (also referred to as smart sanctions) prohibit or restrict transactional activity between U.S. persons and specific individuals or entities listed on a specifically designated nationals and blocked persons (SDN) list or on a sectoral sanctions identifications (SSI) list. The SDN list imposes full blocking sanctions—meaning all their property and interests in property located in the U.S. will be blocked/frozen—whereas those on SSI list are subject to sanctions that prohibit and/or limit their ability to transact within specified sectors of the Russian economy.

For example, if an entity on the SSI list has a majority ownership interest in a shale project, then U.S. persons would be prohibited from providing any goods, services, or technology in support of such a project. By contrast, individuals like Russian President Vladimir Putin are on the SDN list, and U.S. persons are prohibited from transacting with him. Other examples of other specifically sanctioned parties may include hackers, oligarchs, terrorists, drug traffickers, and transnational criminal organizations.

Secondary Sanctions

Secondary sanctions are intended to target specified transactional activity conducted by non-U.S. persons/entities. EO 14114 does just that by providing OFAC with the new authority to impose sanctions on FFIs that support Russia’s military-industrial base. For example, if there is a high volume of transactional activity between an FFI and Russian SDNs, OFAC would have the authority to impose secondary sanctions on that FFI. The U.S. Treasury Secretary Janet Yellen has made it clear that OFAC “will not hesitate to use the new tools provided by this authority to take decisive, and surgical, action against financial institutions that facilitate the supply of Russia’s war machine.4”

Any FFI that OFAC determines has engaged in the prohibited transactional activity described in EO 14114 will be subject to restrictions on, or the complete loss of, their correspondent accounts and payable-through accounts located in the U.S. More severely, the FFI may be subject to full blocking sanctions, which would effectively prevent the FFI from maintaining its presence in the U.S. financial system.

Accompanying Guidance for FFIs on OFAC Secondary Sanctions

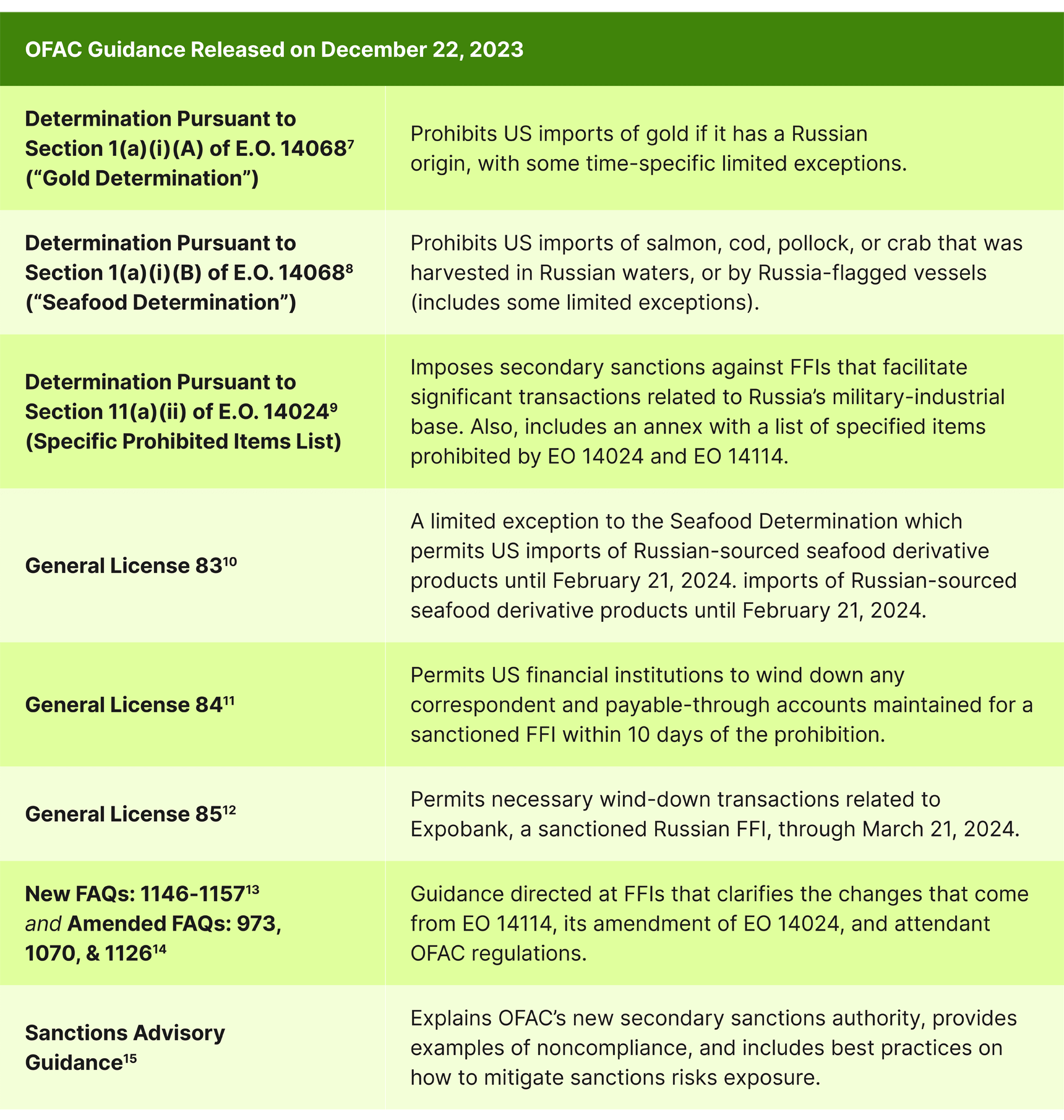

On the same day EO 14114 was signed, OFAC simultaneously released three determinations; three general licenses (GLs); 12 new and three amended frequently asked questions (FAQs); and a Sanctions Advisory Guidance (expanded upon in the corresponding chart below). This additional guidance complements EO 14114 and provides extensive information, expectations, exceptions, mitigating measures, and examples on how to comply with the new secondary sanctions imposed on Russia. Of particular importance is the OFAC Sanctions Advisory notice titled Guidance for Foreign Financial Institutions on OFAC Sanctions Authorities Targeting Support to Russia’s Military-Industrial Base5, which provides an executive summary of OFAC’s new sanctioning authority, examples of non-compliance, and ways to mitigate sanctions risks (further outlined in Section III, below).

U.S. sanctions are imposed based on a strict liability legal standard, which means a FFI will be held liable for violating U.S. sanctions regardless of whether they knew or had reason to know they were engaging in such a violation. This is especially troublesome for FFIs who are unknowingly exposed to deceptive sanctions evasions tactics by Russia and its associates in an effort to circumvent the secondary sanctions. Accordingly, FFIs must take reasonable and necessary steps to mitigate any new secondary sanctions risk exposure within their compliance programs. Below includes examples of non-compliant activity and ways for FFIs to mitigate the sanctions risks presented by EO 14114.

Activity that Could Expose FFIs to Secondary Sanctions

To comply with the requirements of EO 14114, FFIs must take proactive steps to ensure they are not engaging in prohibited activity. Since sanctions are imposed based on a strict liability standard, FFIs must exercise extra caution and perform heightened due diligence when engaging in potentially prohibited transactions. For example, maintaining accounts for, or transferring funds or providing other financial services (e.g., payment processing, trade finance, insurance) to any person/entity that supports Russia’s military-industrial base, including those that operate in the specified sectors6, will subject an FFI to secondary U.S. sanctions. Likewise, facilitating the sale, supply, or transfer of specified items to Russian importers or companies shipping the items to Russia, or otherwise helping entities/individuals evade Russian sanctions, will expose FFIs to sanctions risks and potential penalties. Thus, a FFI must proactively conduct due diligence on its new and existing customers, engage in detailed customer supply chain monitoring, and act preemptively to identify and block customers and/or counterparties that may support Russia’s military-industrial base.

Mitigating Sanctions Risks

FFIs must implement mitigating controls that identify and isolate Russian sanctions risk exposure to comply with EO 14114. These controls should be implemented in addition to pre-existing baseline customer due diligence that may already be in place and, moreover, they must be commensurate to the FFI’s sanctions risk exposure. Such mitigating factors may include, but are not limited to:

OFAC’s new secondary sanctions authority will certainly be utilized to hold FFIs accountable for activity that supports the Russian military-industrial base. FFIs are expected to make every effort not to facilitate Russian sanctions evasion or circumvention. Regardless of whether a sanctions violation occurs knowingly or unknowingly, its ramifications can be significant—up to and including full blocking sanctions and being prohibited from maintaining any U.S. financial account. Accordingly, FFIs must ensure their sanctions screening controls are up-to-date and that any high risk transactions or customers are properly screened pursuant to EO 14114.

Guidehouse’s Financial Crime, Fraud, and Investigative Services Practice is composed of former regulators, federal prosecutors, compliance professionals, forensic accountants, and law enforcement officers responsible for preventing, detecting, and investigating sanctions, anti-bribery and corruption, anti-money laundering, and fraud matters. Our expert team works with FFIs of all sizes to develop, enhance, and maintain effective and efficient sanctions risk management and compliance frameworks that help clients mitigate sanctions risks and exposure. We tailor our solutions to clients’ needs and circumstances, for example by performing sanctions risk assessments, assessing the efficacy and sufficiency of sanctions screening programs and governance processes, drafting, or updating sanctions policies, procedures, and infrastructure, and administering personnel sanctions training sessions.

Guidehouse also leverages its extensive sanctions expertise gleaned from directly supporting OFAC, for whom we have made recommendations about whether to issue specific licenses for blocked transfers of funds, and for whom we have investigated prospective licensees subject to sanctions programs impacting the Russian Federation, the Republic of Belarus, and Ukraine, as well as those subject to Iranian, transnational organized crime, and terrorism sanctions programs. At Guidehouse, we do not subscribe to a one-size-fits-all approach, instead combining the above commercial and public sector sanctions experience with strong data analytics and technology experience to assist clients responding to federal/state enforcement actions, new regulatory guidance, governmental requests, investigations, audits, and other inquiries.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.