Search

Search

Recent regulatory guidance and enforcement actions underscore a growing imperative for financial institutions operating in the U.S. to strengthen their Financial Crime Risk Management (FCRM) frameworks—particularly in response to threats posed by human trafficking and drug smuggling. These crimes are not only humanitarian crises but also key revenue streams for transnational criminal organizations, including powerful drug cartels.

The current administration has demonstrated intense focus on illegal immigration, human trafficking, and narcotics smuggling—prioritizing stricter border enforcement and increasing scrutiny of businesses that may be indirectly facilitating these activities. This shift in priorities has been echoed and supported by the current U.S. Congress, which recently passed significant budget increases for immigration law enforcement. This policy direction is expected to ripple throughout the financial sector, reshaping day-to-day compliance operations and elevating expectations for proactive risk mitigation.

Given the deep entanglement of human trafficking and drug smuggling with global criminal networks, financial institutions must evolve their detection and reporting mechanisms to stay ahead of regulatory expectations—and to play a meaningful role in disrupting these illicit economies.

In most cases, the same infrastructure, resources, financial products, and technological tools used for drug trafficking are also used to exploit and transport human beings. The U.S. Drug Enforcement Administration’s 2024 National Drug Threat Assessment highlights that cartels like the Sinaloa Cartel and Jalisco New Generation Cartel dominate drug trafficking into the U.S., using sophisticated networks that also support human trafficking operations.

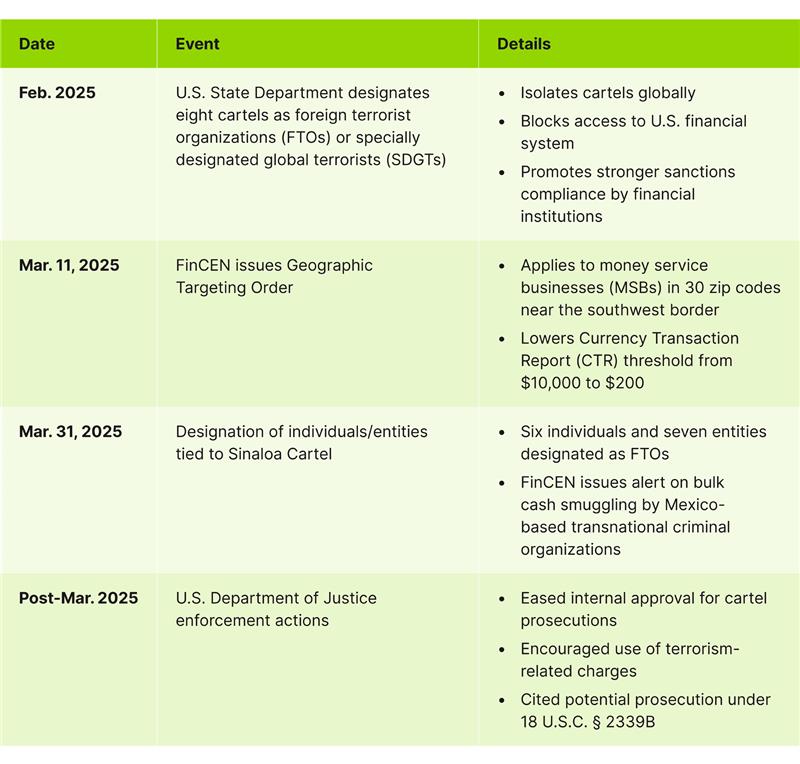

The designation of cartels as FTOs significantly increases legal risks for financial institutions with exposure to customer bases and geographies where cartel-related transactions are most prevalent. This administration’s heightened vigilance in combating cartel-related crime has made it increasingly likely that regulators will prioritize these issues for the foreseeable future, opening the possibility of increased prosecution of companies under stringent counterterrorism statues.

Similarly, FinCEN’s Geographic Targeting Order, which lowers the CTR threshold for MSBs across counties in California and Texas, requires financial institutions to update their transaction monitoring systems and CTR controls to remain compliant. The directive aligns with the administration’s broader focus on combating human trafficking and drug smuggling, emphasizing the need for institutions to prevent any form of support provided to individuals or entities connected to these crimes.

Failure to adhere to these regulatory guardrails may have dire consequences. As a recent example, a regional U.S. bank with operations along the southern border processed millions in cash deposits and international wires over several years. Many of those transactions bore the hallmarks of trafficking-related activity, such as frequent deposits just under CTR thresholds, use of funnel accounts, and wire transfers to entities in high-risk jurisdictions in Latin America. Despite these red flags, weak internal controls allowed the activity to continue unchecked. The bank’s failure to act played a role in enabling a broader network involved in drug and human smuggling, later exposed through federal investigation involving multiple agencies.

If your financial institution operates in the U.S., you should adopt a proactive, risk-based approach to remain compliant and effectively manage risk amid rapidly evolving regulatory priorities. This approach includes:

For instance, risk indicators that highlight unusual flow of funds, currency deposits, and cross-border transfers are more relevant to MSBs than other types of financial institutions. Risk indicators such as the frequent exchange of small-denomination bills for larger-denomination bills are more relevant to branch locations of banks and casinos. By taking a tailored, risk-based approach, you can better detect and disrupt activities linked to human trafficking, smuggling, and cartel operations. Staying informed on evolving guidance and aligning controls with your specific institutional risk not only strengthens compliance but also helps safeguard the overall financial system from being misused by criminal networks.

Consider assessing and enhancing your risk management programs using the following strategies:

Independent reviews of U.S. and non-U.S. regulatory requirements. Keep your BSA/AML/CFT, sanctions, fraud, and ABC programs aligned with both U.S. and international regulatory obligations and industry standards. Reviews should be performed in accordance with applicable laws, regulatory guidance, and established industry standards to identify gaps.

Financial crime risk assessments. Consider the potential impact that these threats pose to your institution, then tailor comprehensive, auditable risk assessment methodologies to your specific business model. You’ll also need to adequately resource your risk assessment executions so that they’re consistently issued to stakeholders on a timely, periodic basis.

KYC/CDD program assessment and implementation. Many human trafficking and drug smuggling controls are typically based within financial institutions’ KYC/CDD programs. You should evaluate your KYC/CDD programs to identify any gaps in policy, process, and systems. This assessment should include a review of customer risk rating methodologies, onboarding procedures, and ongoing monitoring practices to ensure that they’re aligned with emerging typologies and regulatory expectations. And you should evaluate whether your current systems can detect red flags associated with trafficking and smuggling.

Staff assessment and augmentation. Regularly assess your compliance staff levels and skills to ensure that they’re commensurate with your risk exposure and program demands. This assessment should include all interim CCOs, managers, and analysts. Where gaps exist at the leadership, investigative, or operational levels, you may need to apply additional resources on a temporary basis. Staffing needs and skill gaps can also be addressed by engaging professional managed services, which can provide scalable support across core financial crimes compliance functions such as KYC operations, transaction reviews and lookbacks, and SAR processing.

Financial crime technology implementation and enhancement. Effective FCRM programs rely on technology solutions that require careful planning, selection, customization, consistent monitoring, assessment, maintenance, and enhancement—particularly as new regulatory guidance and priorities are issued. That typically triggers the need for vendor selection processes, proposal reviews, new system implementation management, periodic tuning exercises, system QA testing, and issue remediation. These tasks are critical to ensure that FCRM technology and systems are current and aligned with established institution risk management objectives.

Institutional governance and control testing. Your employees can inadvertently play a direct role in facilitating criminal activity when your internal controls are weak or easily circumvented. Inadequate oversight of accounts, customer relationships, transaction monitoring, and employee behavior can also create opportunities for personnel to knowingly assist in laundering narcotics proceeds in exchange for bribes. Recent enforcement actions against institutions such as TD Bank have highlighted patterns of employee complicity in enabling drug trafficking networks by processing suspicious transactions and shielding illicit funds from detection. You can avoid this risk by assessing and testing your internal controls, proper assignment of responsibilities, regular employee vetting systems, and culture of accountability. These systems should be optimized to minimize that risk by facilitating early detection of red flags.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.