Search

Search

Court order workflows spanning subpoenas, levies, garnishments, and writs of execution are notoriously inefficient. The legal obligation is complex as financial institutions must respond with speed across a varied array of documents spanning the federal and state court system. The variation is further compounded by the disparity around receipt across channels (branch, fax, email, etc.) and file format. Considering these complexities and as volumes rise, these inefficiencies increasingly burden financial institutions. Fragmented systems, inconsistent instructions, and manual exception handling slow resolution and elevate operational risk.

Guidehouse has built a proprietary AI-powered capability to address these challenges that span document classification and extraction through workflow initiation and next best action suggestions.

Benefits include:

Top financial institutions process hundreds of thousands of court orders annually. In 2025, the top 10 banks alone are projected to handle over 5 million. Yet nearly 60% of these are false positives with no customers / accounts found in an organization—triggering exception replies and manual triage.

This isn’t just a workflow issue. It’s a strategic challenge impacting cost, compliance, and customer experience. Purpose-built AI agents are built to enable high-performance classification and extraction, empowering legal operations to shift from reactive processing to secure, proactive intelligence.

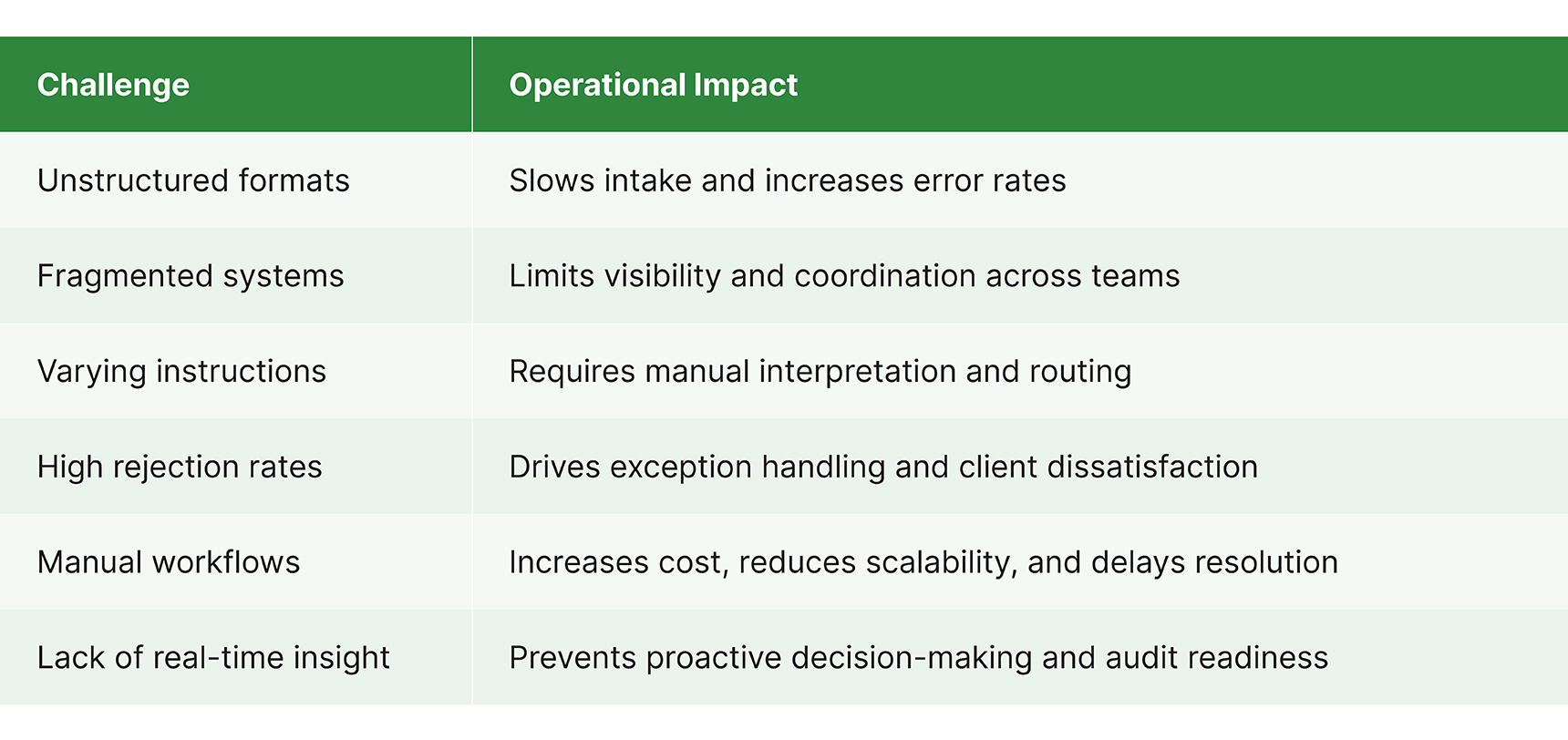

Court order processing challenges span departments legal, compliance, customer service, and IT—creating bottlenecks that traditional automation tools struggle to resolve. Manual triage and exception handling remain the norm, driving up costs and delaying resolution. Organizations are experiencing the below challenges:

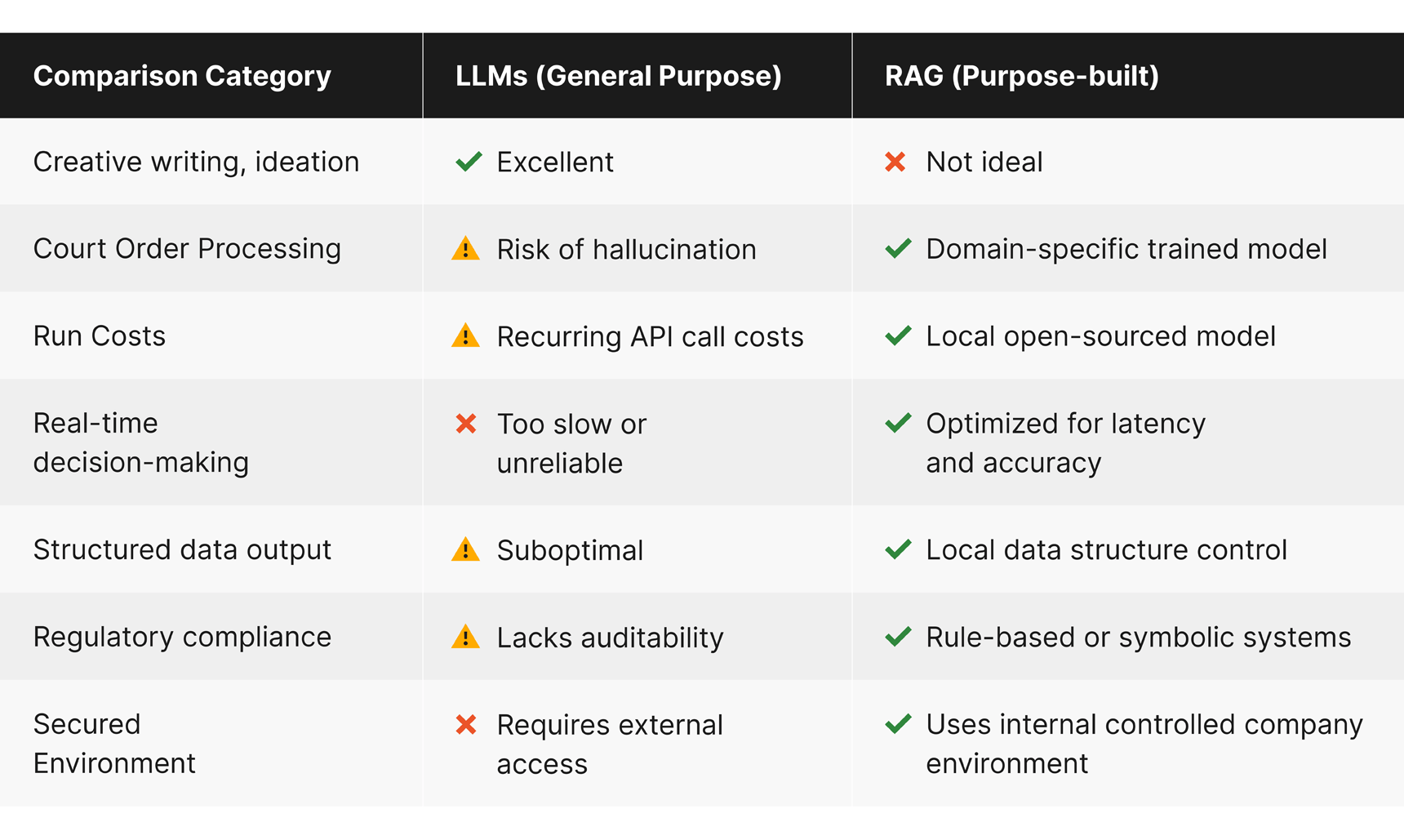

The first wave of generative AI, led by large language models (LLMs), showcased impressive capabilities in creative and general-purpose tasks. But in high-stakes, document-heavy workflows like court order processing, LLMs often fall short with hallucinated outputs, latency issues, and external data dependencies that raise privacy and reliability concerns.

Retrieval-augmented generation (RAG) offers a smarter path. Purpose-built AI agents using RAG architectures are trained on domain-specific data, deployed locally, and integrated seamlessly with institutional systems. These agents support audit-ready workflows and symbolic logic—aligning with regulatory standards and enterprise governance.

Benefits include:

Deploying purpose-built AI agents goes beyond efficiency—it enables scalable intelligence. These agents:

This evolution transforms legal operations from reactive workflows to proactive insight—reducing exceptions, improving compliance, and accelerating resolution. For financial institutions, this means fewer delays, lower costs, and greater confidence in every step of the workflow.

For leaders in legal operations, compliance, and automation, adopting purpose-built AI agents is a strategic move. These agents:

As AI agents become embedded in enterprise workflows, the opportunity to reimagine court order processing is real. But success requires more than technology. It demands:

This isn’t just about deploying a tool. It’s about building a smarter system—one that learns, evolves, and delivers lasting value.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.