Search

Search

The real-time economy has accelerated expectations for immediacy, visibility, and integration in how money moves across clients, partners, and platforms. Payments—once viewed as back-office utilities—have become central to delivering timely financial experiences and unlocking new revenue streams.

As regional and national banks prepare for their next stage of growth, modernizing the end-to-end payment lifecycle will be essential, not only for operating at speed, but for competing on transparency, trust, and differentiated service. Building on the foundational achievement of enabling real-time rails, banks must now evolve toward scalable models that deliver long-term value.

Real-time ambitions meet real world demands

As the pace of the real-time economy accelerates, banks face growing urgency to modernize their end-to-end payment processes—not just to “keep up,” but to lead in how money movement supports business advantage. From consumers expecting instant availability and notifications, to fintech partners seeking seamless integration, the bar has moved well beyond traditional batch-based rails and legacy workarounds.

Consumers care about speed. Institutions care about certainty. Real-time payment rails serve the latter and enable the former.

In recent years, many banks have worked to establish foundational connectivity, standing up RTP and FedNow endpoints, revisiting ISO 20022 readiness, and piloting limited real-time use cases. Meanwhile, fintech partners entered these commercial relationships with high expectations around speed, flexibility, and ease of integration—expectations that were not always fully met. As a result, we anticipate banks focusing on reducing onboarding friction, standardizing exception handling, and deepening their readiness to scale across more diverse client use cases.

For many institutions, the challenge now lies in translating technical readiness into scalable operating models. Adopting RTP or FedNow is a critical first step, but the real impact comes from how you align internal processes to support real-time responsiveness at scale. That means rethinking workflows, exception handling, customer interactions, and data integration to create a seamless, efficient, and differentiated experience that drives growth and agility.

Why it matters now: Real-time expectations are embedded

Real-time capabilities are no longer seen as an edge—they’re now deeply ingrained in how customers expect financial services to function and how businesses design their operating models:

It’s critical to distinguish between instant availability and true real-time settlement—where transactions are posted, reconciled, and finalized without delay. While some banks offer faster availability through methods like same-day ACH or bank-offered push-to-card services, these may not offer true real-time settlement, posting, or operational finality. Real-time maturity goes beyond speed. It requires integrated orchestration, system-wide responsiveness, and end-to-end traceability. Moving from “instant-like” to fully real-time operations is a critical leap in the next phase of maturity.

Advancing real-time capabilities creates measurable benefits across your operations and client service, reducing post-transaction exceptions and manual follow-up, improving liquidity control and intraday cash visibility, and enabling greater precision in managing time-sensitive disbursements and merchant settlements. Real-time capabilities also strengthen your ability to manage risk, improve payment timing, and deliver more consistent value to clients.

From connectivity to capability: What real-time really needs

Many banks have completed the first step of enabling access to real-time payment networks. But true performance depends on more than connectivity, it requires internal alignment across people, systems, and decision logic.

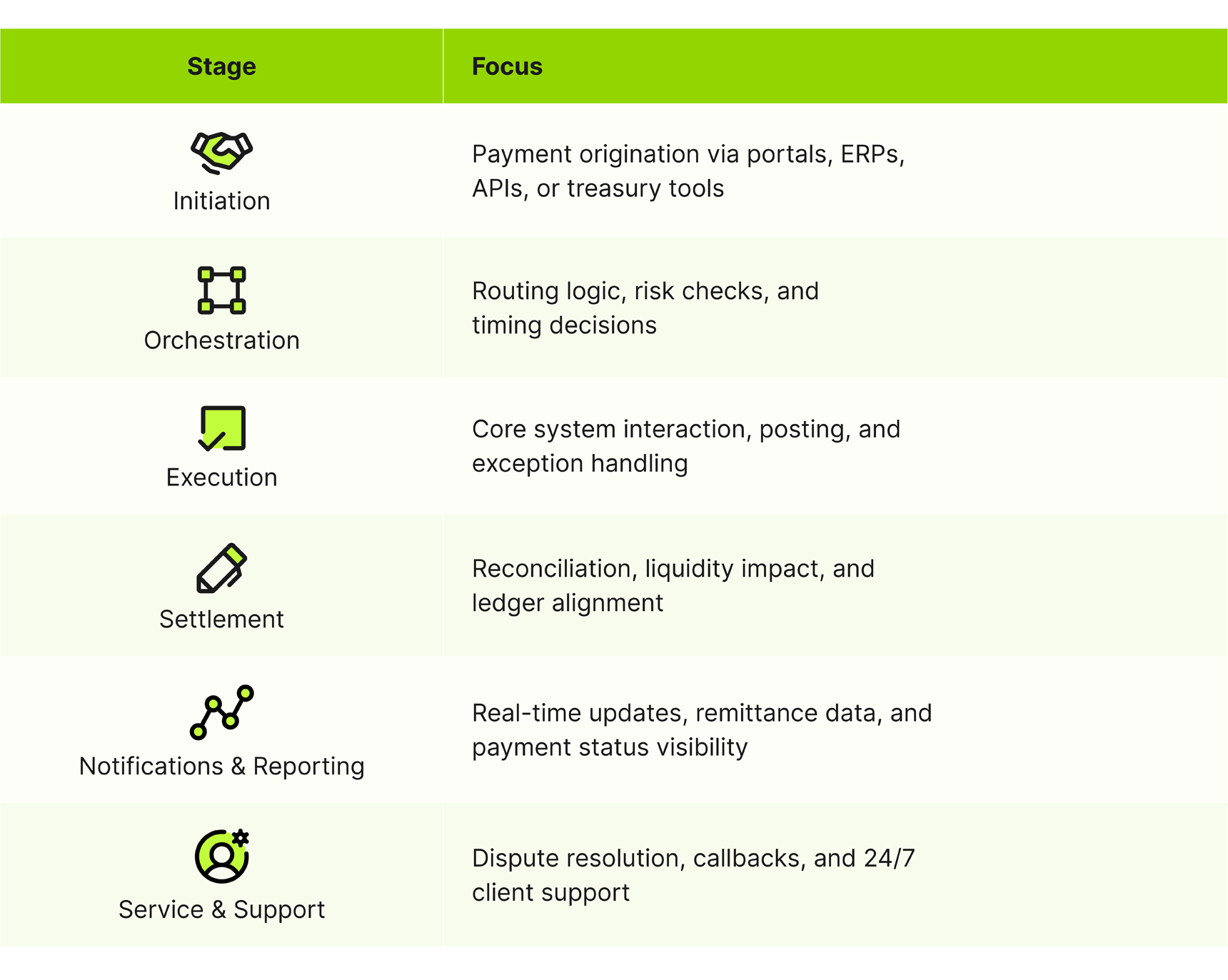

The following areas often shape whether real-time payments can operate smoothly and deliver the intended experience:

When these components aren’t aligned, real-time transactions can still encounter avoidable delays, blind spots, and added operating effort.

Behind every successful strategy lies a set of difficult choices. For many banks, navigating the broader payments ecosystem—across infrastructure providers, fintech enablers, and orchestration layers—adds complexity to achieving their long-term vision. Selecting the right combination of technologies that deliver short-term impact while enabling a longer-term North Star requires balancing near-term integration with future adaptability. This often means leveraging current systems where appropriate, while also planning for architectural flexibility: the ability to evolve or replace partners as innovation advances. Identifying the right mix of partners, and aligning them to evolving business models, requires a structured evaluation of the marketplace, grounded in both technical viability and strategic fit.

Enabled vs. embedded: a persistent gap

Even if you’re technically live on RTP or FedNow, the challenge is embedding those capabilities into the everyday delivery model. There’s a meaningful difference between having access to real-time rails and actually using them in a way that benefits clients and operations.

Bridging that gap requires more than infrastructure, it takes operational coordination and a clear plan for adoption at scale.

Friction points in real-time execution

Even with meaningful investment in RTP, FedNow, and ISO 20022, you still may face operational and system-level barriers that limit your ability to deliver consistent real-time experiences. These friction points typically emerge as you move from early enablement to more embedded use across client and internal workflows:

As you deepen real time-capabilities, certain strategies consistently stand out among leading banks.

As faster payment options introduce tighter processing windows, rethink how fraud detection fits into your payment flows. Embed controls directly into your payment orchestration layer, using real-time context to identify and block suspicious activity before the transaction is completed. By shifting fraud detection earlier in the process, you can reduce downstream remediation and protect clients without interrupting the user experience.

Implementing RTP or FedNow is an important step, but the real impact comes from how you scale and embed these capabilities across your operations. The most successful institutions view real-time payments not as a point solution, but as a platform capability that evolves in stages and expands its value over time.

The following progression reflects how many banks are building momentum by expanding real-time capabilities in a way that aligns with client needs, internal readiness, and long-term strategy:

You may have approached real-time payments through a compliance lens or in response to peer activity, but the real opportunity is using it as a lever for growth and client differentiation. That’s your North Star.

In today’s real-time economy, you have rare opening to stand out by offering certainty over speed, insights over data, and proactive service over reactive support.

Some banks have already translated real-time infrastructure into integrated workflows and differentiated offerings. Others are still scaling these capabilities to match their platform ambitions and client expectations.

Every friction point that remains in the payments lifecycle—manual status checks, delayed confirmations, file-based reconciliation—is not just a cost center. It’s a missed opportunity to win loyalty, deepen relationships, and grow share-of-wallet.

By modernizing integrated payments infrastructure—upgrading legacy systems, streamlining workflows, and embedding real-time capabilities—with a focus on client experience and operational relevance, your organization is positioned to lead with differentiated services that create tangible value.

This is the second article in a six-part series on elevating business processes for sustainable growth. The first article, Business process excellence: The future-proof bank, focused on the role of process excellence in unlocking agility and scalability. Upcoming articles will examine client onboarding and servicing, reinventing lending, embedding resilience into process redesign, and increasing adaptability.

Sign up to get these articles in your inbox when they publish.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.