Search

Search

Data drives decision making in the financial services industry and leaders at pension funds, banks, insurance companies, and government agencies use mortality data to inform processes, payments, and other business operations. Yet, many remain unaware of the substantial financial and operational risks of using outdated or inaccurate information about deceased individuals.

Recent analyses of the Limited Access Death Master File (LADMF) reveal data quality issues that should concern any organization depending solely on this resource.

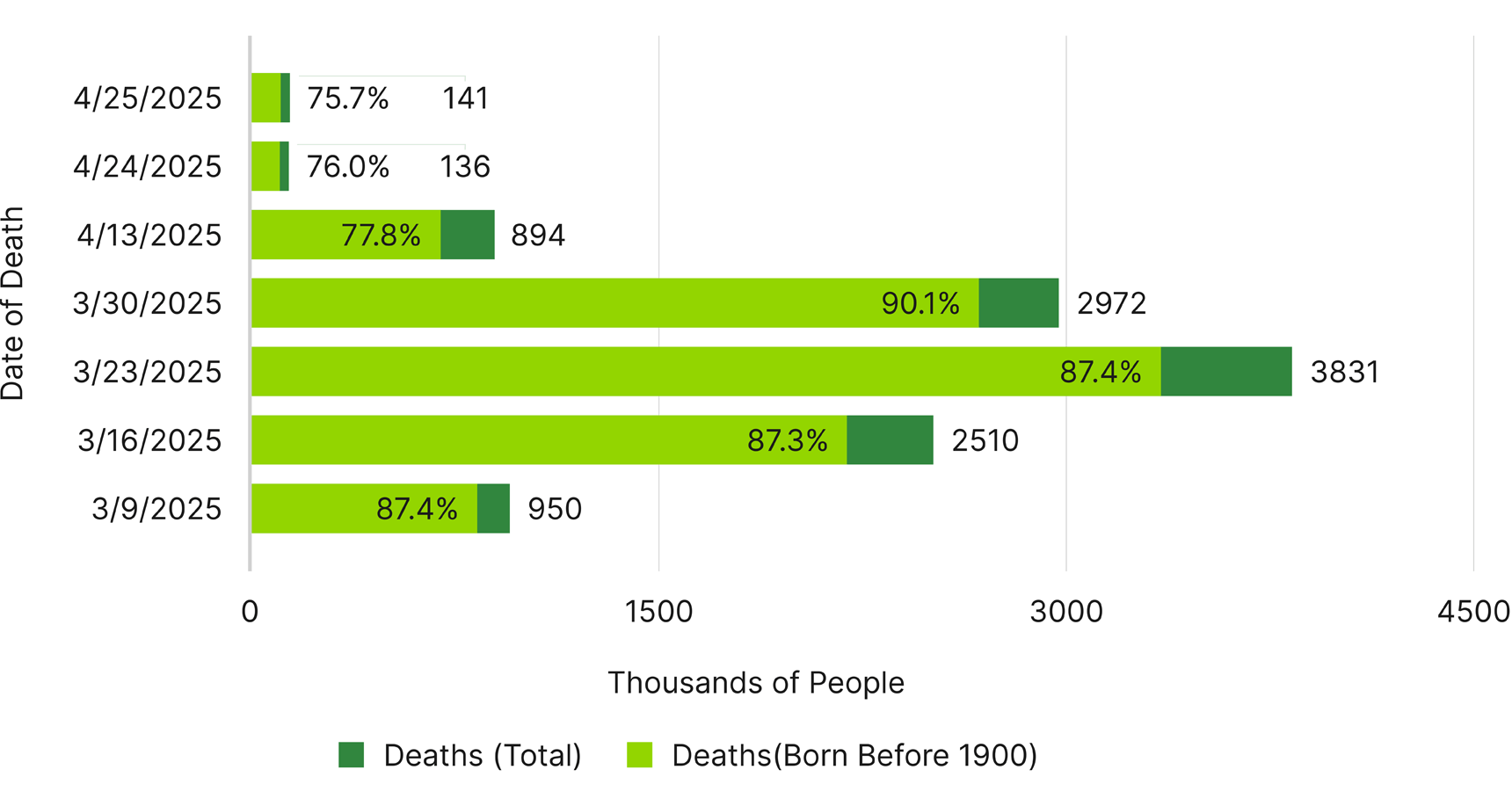

In March 2025 alone, the LADMF reported several unprecedented spikes in mortality data (Table 1):

In April 2025, the sharp uptick in reported deaths continued with 875,152 deaths reported on April 13th, 136,548 deaths reported on April 24th, and 141,290 deaths reported on April 25th.

Table 1: LADMF: Total deaths vs. deaths (born before 1900). 1

These numbers don't represent actual mortality events, but rather administrative backlogs and data cleanup efforts. For context, the LADMF averaged just 11,000 new records per week before March—meaning these spikes represent a hundreds-fold increase over baseline volumes.

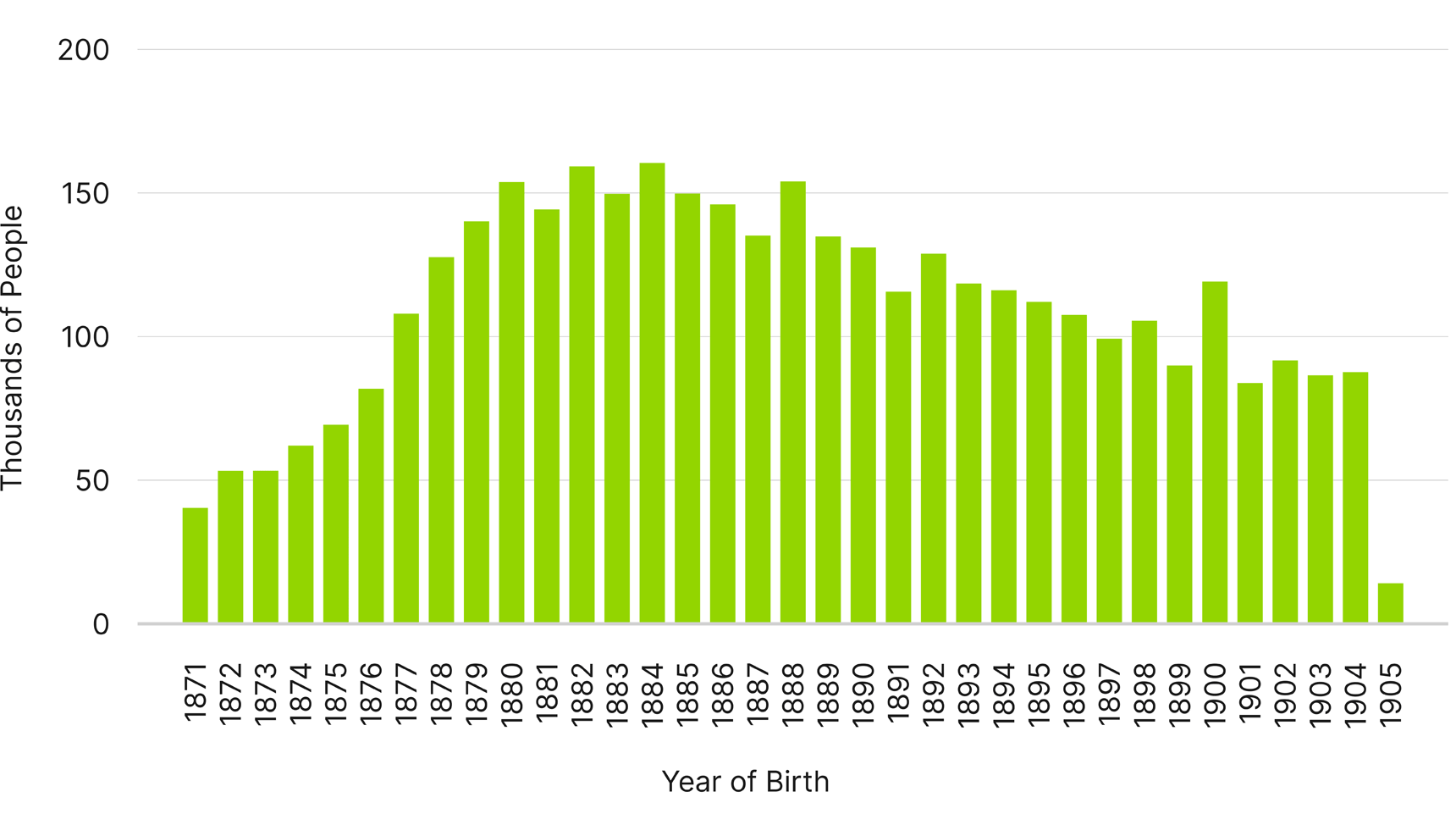

The March data set also reveals some anomalies in age profiles of reported deaths (Table 2):

For reference, individuals born before 1900 typically represent less than 0.01% of weekly records prior to March 2025.

Table 2: LADMF: March 23rd deaths, reported on March 28th. 2

The SSA notes that its overall death data is “highly accurate” with error rates under 0.33%, but analysts warn that even a tiny error rate on millions of records can mask substantial operational and financial risks.

The consequences of relying on flawed mortality data extend far beyond statistical anomalies:

1. Improper payments

The U.S. government loses an estimated $1 billion annually through improper payments to deceased individuals. For private organizations, the financial exposure can be just as large:

2. Operational inefficiencies

Outdated mortality information creates significant internal inefficiencies:

3. Reputational damage

Something that can be difficult to quantify—but can be equally as impactful—is the reputational damage caused by using inaccurate mortality data:

The recent LADMF data anomalies demonstrate why relying on a single source of mortality information is inherently risky. The March and April 2025 backlog release introduced several critical issues:

For organizations that rely solely on LADMF data for compliance programs or payment decisions, these issues can create blind spots that compromise even the most robust processes. Industry experts advocate that organizations not rely exclusively on the LADMF. Instead, they recommend multi-source, real-time mortality verification as a strategic priority. Supplemental checks—for example, using commercial death indexes or state records – can catch anomalies that a single-file update might miss.

Guidehouse experts work with forward-thinking organizations to address these challenges by leveraging tens of thousands of state, federal, and private data sources to cross-validate mortality in near real-time. The combination of increased coverage and speed of reporting translates to greater accuracy and measurable savings by stopping improper payments and mitigating fraud. Additionally, matching algorithms capable of accommodating data variations, such as nicknames, phonetic variations, misspellings, and transposed characters reduces manual review and increases match confidence. In the end, organizations gain transparency and an ability to make informed decisions based on verified mortality data.

For organizations still relying exclusively on single-source mortality verification, the recent LADMF anomalies serve as a stark reminder of the hidden costs of outdated approaches. The path forward requires:

As organizations face growing pressure to manage costs, comply more quickly with regulations, and deliver exceptional customer experiences, accurate mortality verification has become increasingly crucial. The financial and operational impacts of outdated systems are too significant to overlook.

By using comprehensive, multi-source mortality verification solutions such as VitalAudit®, organizations can turn a compliance burden into a strategic advantage. This approach reduces costs, improves operational efficiency, enhances compliance, and ultimately provides better experiences for customers and their beneficiaries.

Choosing between a single, flawed data source and a robust, multi-source verification solution is becoming increasingly clear. In an era where data quality drives business outcomes, accurate mortality information is not just a compliance checkbox—it's a competitive necessity.

1. National Technology Information Service, https://dmf.ntis.gov/

2. ibid.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.