Search

Search

Healthcare providers’ approach to value-based care must be reset to make the intended — and much-needed — impact. For too long, the prevailing trends in the move toward value have almost exclusively indexed on:

There is no denying that reducing the proportion of gross domestic product that we spend on healthcare in this country — currently 20% — must be an outcome of healthcare transformation. But this cannot be the only endpoint of value-based contracts.

When there’s more focus on cost reduction than on value as defined by the consumer, it can be easy to lose sight of what people need and expect from healthcare, like convenience, quality, and accessibility. There are more choices now than ever before for healthcare consumers, and they’re often willing to pay more to get it.

The economics of a savings-centered value model don’t work for providers at a time when costs outpace revenue lines. When participation in value-based care models pushes providers deep into the red, they are no longer meeting what should be their goal: helping people more effectively manage their health.

There is a better way.

The move toward consumer-centric value positions providers to be not just affordable, but essential in the eyes of both consumers and payers. It gives providers greater market differentiation while enabling them to serve as trusted resources in addressing holistic care needs. To get there, providers must:

If you were to ask most healthcare providers to describe their value-based care strategy, they would respond by highlighting the payers and populations for which they have undertaken risk.

While value-based payment offers sustainable growth opportunities across government lines of business, and could contribute to growth in commercially insured patients — albeit at a much lower level — many providers struggle to reap the financial benefits of risk-based contracts. This is due to flaws in contract structure and mechanics, variation in clinical performance opportunities across lines of business, as well as lack of core provider competencies and tools to successfully manage patient lives under contract, track progress, and maintain a viable business model.

These challenges are exacerbated by a failure of reimbursement rates and models to adapt quickly enough to accommodate increases in multi-channel care, new competition, and shifts in demand.

Disruptors in the market are keenly aware of the potential and opportunity to grow by delivering a better experience and improved outcomes without a change in payment model. Some, like Walmart, still operate under a fee-for-service payment model; the company achieved a Net Promoter Score of 80 based on healthcare price transparency and convenience.1 Others offer a subscription model for care, like One Medical’s primary care subscription model, which provides access to in-person and digital health visits and screening technologies for $199 a year.2

For vertically integrated organizations, risk is a viable and sustainable business model. This is one reason why Kaiser Permanente is willing to invest $5 billion into Risant Health over the next half decade as a convener of a new multi-system value-based care organization, starting with the acquisition of Geisinger Health. For most healthcare providers, however, risk should be viewed as a contracting tool that can be selectively deployed if it aids in achieving one or more of the following objectives:

Consider the case of a northeastern academic medical center (AMC) for which two-thirds of patients are on Medicare and/or Medicaid. This AMC is at full capacity and unable to open the access required by its customers to effectively manage their care. Entering risk-based contracts for Medicaid and Medicare Advantage patients enables the medical center to harvest the rewards from shifting low-acuity, avoidable hospital utilization to alternative and appropriate settings of care while it attracts and backfills with commercially insured consumers. This touches on the first three objectives outlined above while doing what is right for patients — a win/win.

Changing your operating model to be value-centric — and therefore customer-centric — ultimately yields loyal consumers by helping individuals avoid becoming patients.

As a network, many healthcare providers lack a real value proposition for consumers. Instead, they offer value as a point of service, such as delivering the best outcomes for heart surgery or providing the best experience for maternal care.

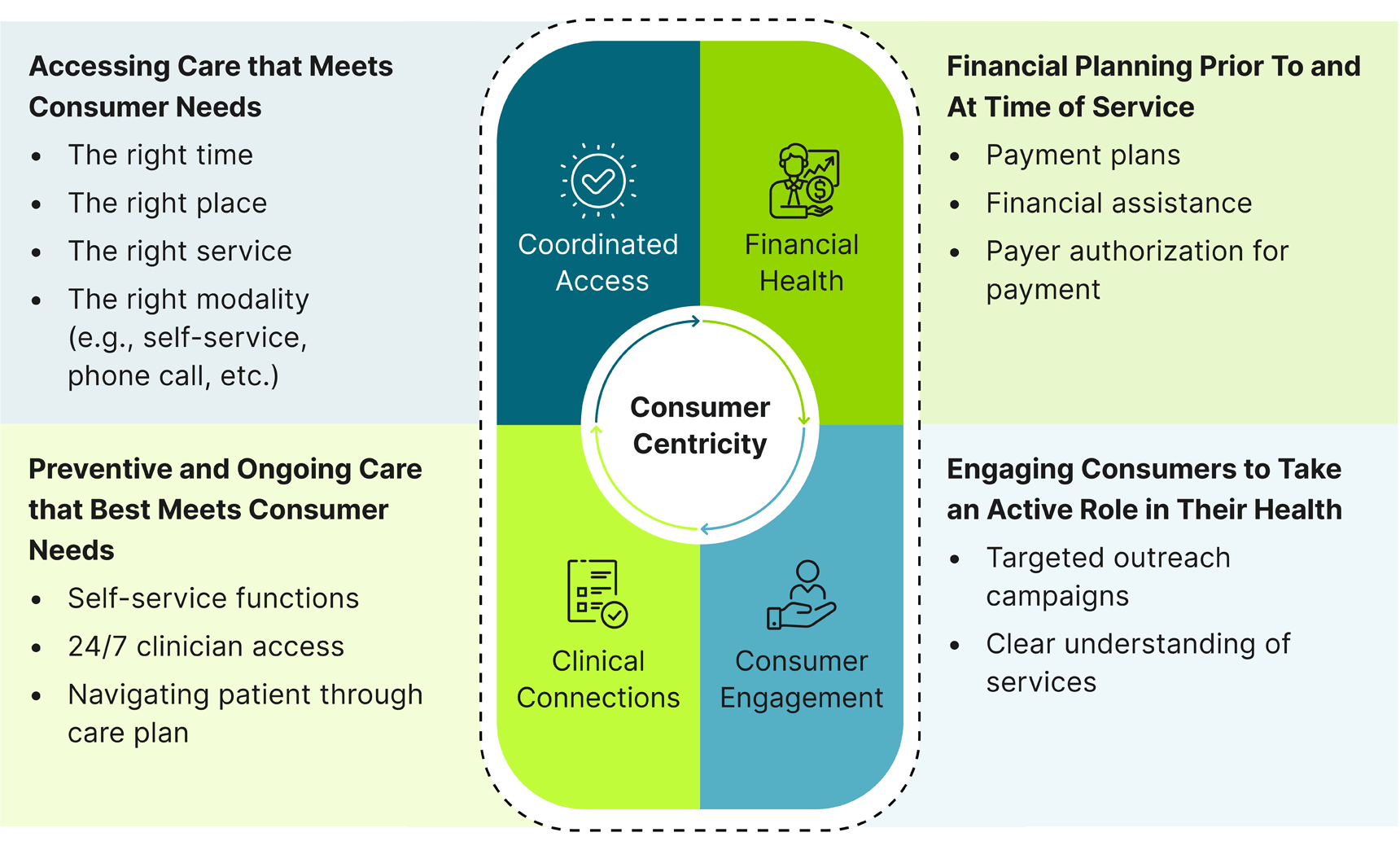

Today, value — and the financial benefits that come with it — must be redefined to be customer-centric, consumer-defined, and customized to an individual’s unique needs. Guidehouse embeds this thinking across four “wedges” that encompass the entirety of a consumer’s journey.

Creating personalized connections with people not only yields loyal customers who come back for all their healthcare needs, it also results in a more efficient and lower-cost operating model. Imagine a registration process that is completely automated, allowing individuals to easily schedule an appointment, complete registration, and prepare for their appointment, all from the comfort of home and through their smartphone. This is value-based care the way it should be and was originally intended: delivering a differentiated customer experience and outcomes through a highly effective operating model to earn more people’s business and a greater share of their business at the superior price point.

Achieving this level of transformation will require health system C-suite leaders to exercise muscles that may be foreign to them. Here are four actions to consider:

Measure your performance differently. Investing time and energy into what you will measure and how you will measure it, with a focus on value from the perspective of the consumer, enables you to more clearly define the path toward transformation. It also allows you to thoughtfully consider what success will look like for all key stakeholders. Two metrics to be sure to capture: The number of people you serve, and the revenue captured per customer.

Avoid the trap of "build it and they will come." This year, one out of five C-suite leaders surveyed by Guidehouse expects their organization to ramp up purposeful AI, automation, and digital care strategies to boost consumer engagement and efficiency.3 It is essential that the entire healthcare team understands that such investments are not merely a promotional vehicle for driving consumers to locations and services for care. They must ensure that these investments generate value by effectively using real-time data to enhance care and daily operations, reducing non-value-added activities for caregivers, and improving engagement with consumers.

Reorient key stakeholders to the game that really matters. First engage healthcare teams and then healthcare purchasers of all types — from consumers to health plans to employers — in this vision. Make sure your boots on the ground — your clinicians and staff — as well as the communities you serve, take an active role in defining this vision. Clinicians also will be key to determining: "How will we roll this out — and with what resources?"

Build virtual networks to offer access to care anywhere, any time. To develop the stickiness that providers desire and avoid overbuilding brick and mortar solutions that may become outdated, virtual care delivery models are a key market differentiation strategy. This can lead to increased network acquisition and retention, as well as greater capture of appropriate downstream care for centers of excellence that now serve larger geographic regions. Virtual care strategies can also solve for the main dissatisfier in healthcare: access. Instead of waiting weeks or months to see a specialist or primary care provider, patients will appreciate the convenience of same-day/-week telehealth appointments.

Developing an approach to care that brings true value to the consumer isn’t a matter of choosing one payment model over another. Realistically, there will always be room for both value-based payment and fee-for-service. What matters is designing an intentional approach to value — one that positions people at the center. By hitting reset on value-based program design, healthcare providers can more effectively demonstrate their total value proposition for consumers and ensure relevance in a world of disruptive innovation.

1Bailey, Victoria . “How Walmart Became a Major Player in the Healthcare Industry.” Revcycleintelligence.com, 14 Mar. 2023, revcycleintelligence.com/features/how-walmart-became-a-major-player-in-the-healthcare-industry.

2“Analysis | Can a Subscription Model Fix Primary Care in the U.S.?” Washington Post, www.washingtonpost.com/business/2021/06/03/primary-care-one-medical/.

4“Hospital C-Suite Leaders Project 2023 Outpatient Volumes to Increase by 10% or More.” Guidehouse, 2 Mar. 2023, guidehouse.com/news/healthcare/2023/gh-hfma-exec-survey.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.