Search

Search

The U.S. power grid—and the utilities that operate it—are facing a paradigm shift unlike anything seen in the last century. The driver isn’t policy—it’s compute. AI is accelerating demand for large-load data centers at a pace that’s outstripping traditional utility planning cycles.

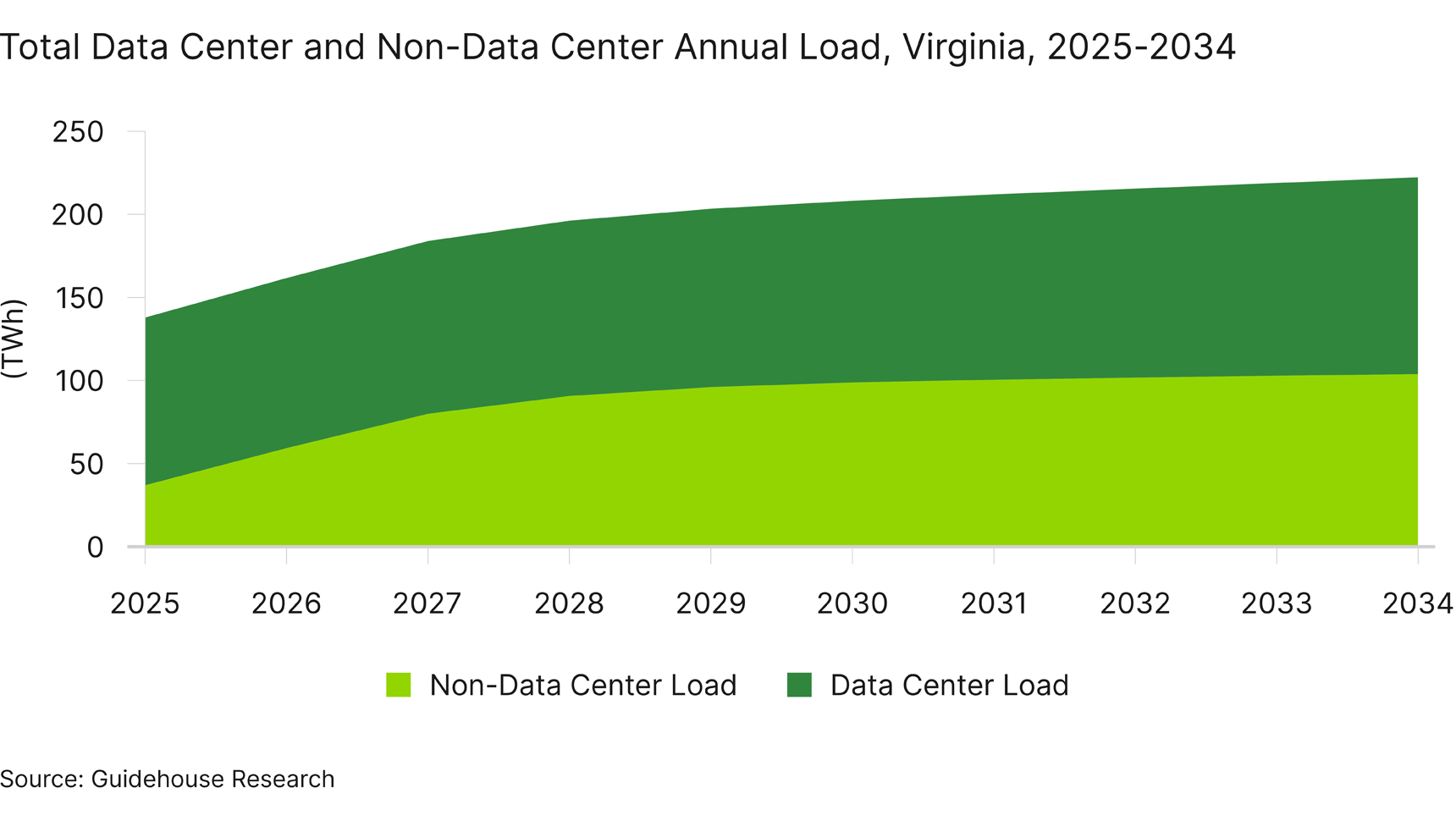

This isn’t a future problem. Burgeoning demand for AI data centers is already reshaping load profiles in Virginia, Texas, and other hot spots. Guidehouse Research predicts that Virginia’s data center load will approach half of the state’s overall power consumption by 2030—up from about a quarter today.

This shift is happening faster than most utilities are structurally prepared to handle. In Guidehouse’s tenth annual State and Future of the Power Industry pulse survey, more than 60% of utility leaders said they are ready for some load growth, but that system reliability needs are likely to temper upside.

Accelerated energy demand is coming, particularly over the next five years, but if utilities don’t lead through the data center surge, others will. The grid is no longer background infrastructure; it’s a strategic platform for the AI economy and one on which substantial new utility revenue can be built—if the right preparation and capital planning processes are implemented today.

Meeting the load demands of mushrooming data centers will cost billions of dollars and likely hundreds of billions. Duke Energy has already announced agreements worth $8 billion for new data center capacity investments; Entergy has committed more than $4 billion in Louisiana and Mississippi.

And in the first half of 2025 alone, there have been nearly 2,000 new interconnection requests made across the U.S. Based on the generation source mix and capacities requested, the cost of these new projects alone could easily reach $50 billion.

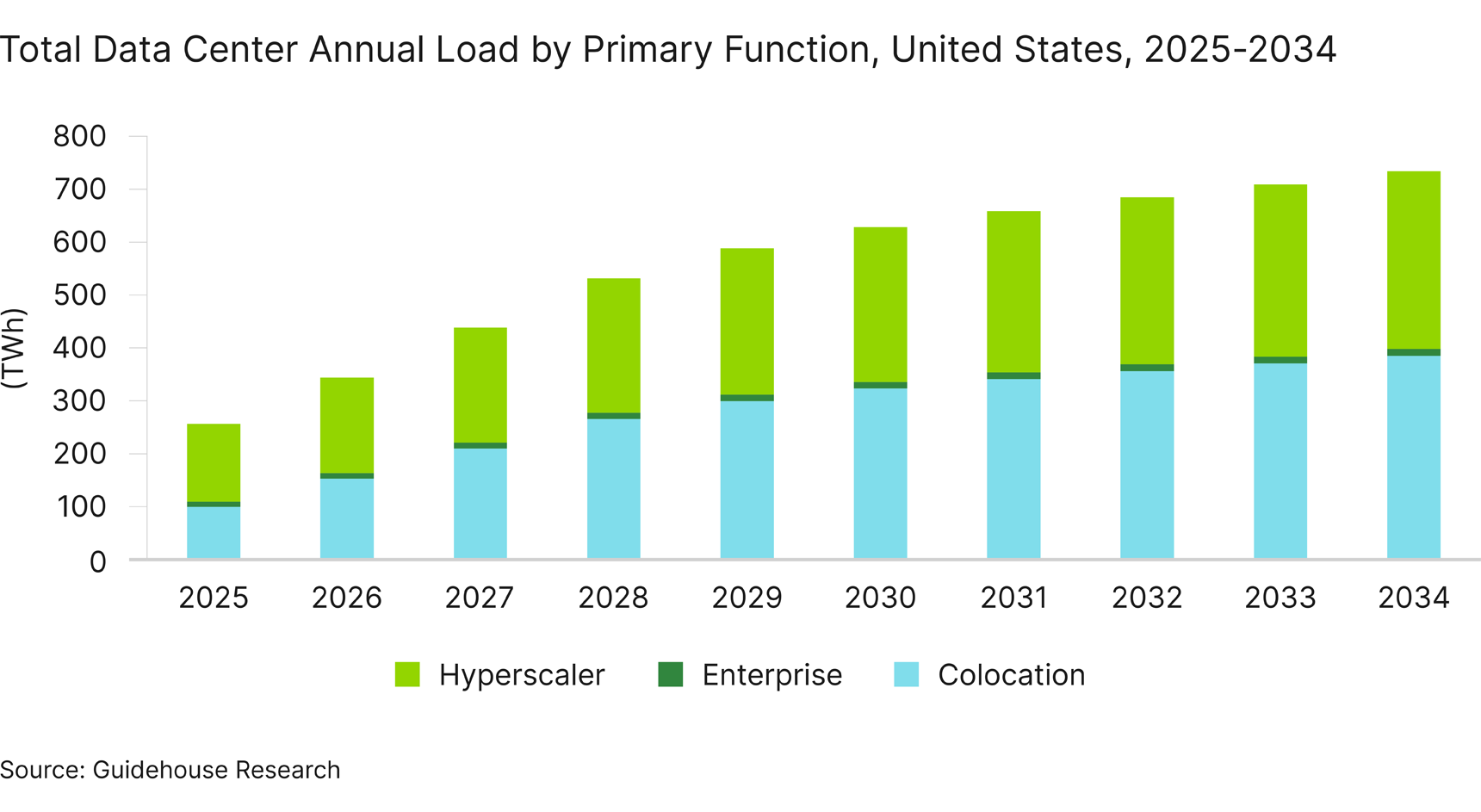

Considering that overall data center load is projected to nearly triple by 2035—to more than 700 TWh annually—utilities that don’t get ahead of the curve risk foregoing a significant revenue opportunity. Based on an average industrial rate of approximately ~$0.08/kWh, the potential utility revenue from new data center load in the U.S. could approach $250 billion (cumulative) over the next decade.

These numbers aren’t theoretical, and they get very large, very quickly, but forecasting the actual impact for a given utility at a certain point in time remains challenging. Load forecasting has always been part art, part science, and knowing exactly how and when these new facilities will impact the regional grid is complicated by the rapid evolution of more efficient chip and cooling technologies, as well as lengthening interconnection queues.

To get ahead of the wave, utilities should be investing in advanced scenario planning and AI-driven forecasting tools. Waiting for certainty is no longer a viable strategy.

In addition to new data center load growth, electrification trends and resiliency demands are creating a perfect capital investment storm. Many utilities will require a 50-100% increase in capital infrastructure investment over the next three years, and few are ready to deliver.

A transformational change of capital delivery models is needed to scale at the rate of market demand and maintain industry health. If they can’t adapt, utilities face numerous risks:

The traditional models for capital planning, rate-based returns, and long-cycle grid investment no longer match the velocity of change demanded by data center developers and hyperscalers.

Utilities were built for long-term capital recovery and the lead times for planning, regulatory approvals, permitting, and procurement (exacerbated by persistent supply chain constraints) make it incredibly difficult to meet the 18- to 24-month time to operation that data center developers are demanding.

This mismatch creates significant opportunity cost risk for utilities built for measured, incremental change. Hyperscalers and developers will quickly move on to the next site in their list—or contract for behind-the-meter (BTM) generation—if the local utility can’t meet its load requirements.

Utilities need new frameworks to manage risk and unlock opportunity. Novel tariff designs are emerging to adapt to the data center load challenge today, but best practices have yet to be standardized, and regulatory signoff has been a mixed bag. Emerging tariff models designed to support data centers as well as, in many cases, the green energy goals of hyperscalers include:

Utilities can begin piloting these models while simultaneously monitoring what works best for other utilities. But capital planning in anticipation of the data center surge can’t wait.

Rather than simply scaling legacy capital planning and buildout models, utilities will need to change their ways of working to be more flexible and responsive to shifting landscapes, and they’ll need to break down persistent silos to achieve continuous improvement.

Where new capital projects may have been previously performed in-house, utilities will increasingly need to work with engineering, procurement, and construction (EPC) firms—which may be in short supply. Establishing preferred partner status with major firms will become key.

Furthermore, technology and system integration—and robust data management—will be paramount to maintaining project oversight and achieving efficiencies. Pen and paper or Excel spreadsheets will no longer suffice; with billions of dollars on the line, project governance must go beyond “on time and on budget.”

At the same time, utilities must fulfill their obligation to serve the public good (such as their rate base). They must strike an increasingly difficult balance between making large, concentrated capital deployments and not passing excessive costs on to already sensitive ratepayers. Guidehouse recommends utility leaders take the following actions today as the AI boom ramps up:

The AI century is here. The grid is no longer just wires and substations; it’s the backbone of America’s digital future and a geopolitical imperative. Utilities have a choice: evolve into adaptive, compute-aligned infrastructure partners—or risk being sidelined by faster-moving players.

With a pro-AI, pro-data center, and pro-nuclear administration, the conditions are favorable. But leadership requires action and proactive, agile capital planning is a key place to start.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.