Search

Search

The cryptocurrency industry is no stranger to the concept of “survival of the fittest.”

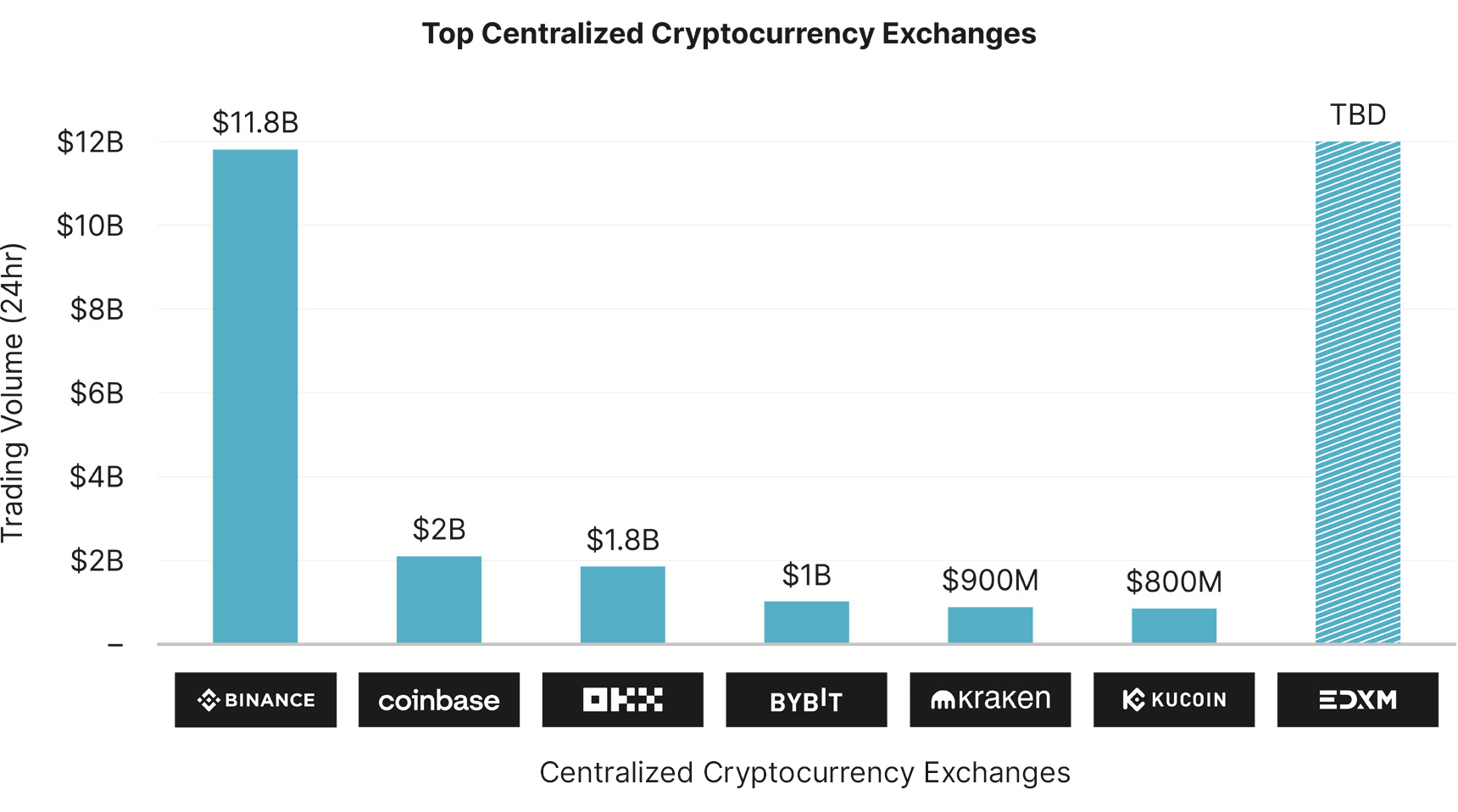

CoinMarketCap ranks and scores centralized cryptocurrency exchanges based on traffic, liquidity, trading volumes, and confidence in the legitimacy of trading volumes reported. Based on this criteria, the top two centralized exchanges were reported by CoinMarketCap to be Binance and Coinbase, followed by Kraken, KuCoin, OKX, and ByBit1.

On June 5 and 6, 2023, the U.S. Securities and Exchange Commission (SEC) charged two major cryptocurrency exchanges with operating as unregistered exchanges, broker-dealers, and clearing agencies, intentionally setting their focus on two of the largest centralized cryptocurrency players2.

The SEC charges, as well as the collapse of certain businesses such as FTX, have minimized market share from longstanding crypto-behemoths and created potential opportunities for new entrants to market.

Enter our traditional finance giants: On June 20, 2023, EDX Markets (EDX) was released in the U.S., a centralized cryptocurrency exchange backed by Fidelity Digital Assets, Charles Schwab, and Citadel Securities3. Then on June 29, 2023, BlackRock, the world’s largest asset manager, re-filed for approval from the SEC through Nasdaq to launch a Bitcoin Exchange-Traded Fund (ETF) called iShares Bitcoin Trust4. It seems as though the venerable players in the financial services sector noticed these opportunities and are looking to capitalize.

Going forward, we will be watching and waiting for answers to a few questions:

In the ninth edition of the Two Worlds Colliding series, we explore regulatory activity, crypto adoption both domestically and globally, security concerns, and the potential future of digital finance.

Recent attempts to enforce regulation within the cryptocurrency industry furthered the debate on whether cryptocurrency assets should be considered a security to be overseen by the SEC, or a commodity to be regulated by the U.S. Commodity Futures Trading Commission (CFTC). Since the SEC charged two large crypto exchanges in June 2023 for operating unregistered securities exchanges, many cryptocurrency platforms and investors are calling for additional clarification on what defines crypto as a security.

Hackers may be finding ways to generate sophisticated fraudulent behavior and hide their actions. After some security breaches this quarter, victims have not been able to identify the exploited security vulnerability. In other instances, hacks occurred shortly after third-party cybersecurity audits took place. For crypto and blockchain companies, recent events have put a spotlight on the utmost importance of effective cybersecurity.

Newly compiled data indicated two-thirds of cryptocurrency M&A involved a crypto-native firm purchasing another crypto firm14. Companies developing infrastructure associated with decentralized applications (Dapps) accounted for the largest portion of crypto M&A transactions (55%). Conversely, we saw a sharp decrease in private financing throughout the industry amidst heightened regulatory oversight.

Dealmaking reached an all-time high in Q1 2023 despite a sharp drop in venture capital funds flowing into the industry, resulting in 54 transactions15. Private crypto financing reached $3 billion in Q1, down from $12 billion in the same quarter of the previous year. Many of the deals occurring in 2023 involve Dapps, and the tools and infrastructure used to build them. A Dapp is an application built on a decentralized network involving a frontend-user interface and a smart contract16. “There’s more money, more activity around the actual applications and the tools and the infrastructure to build those applications,” said Dan Wang, an analyst at Architect Partners.

Notable activity included the below events:

Blockchain-based smart contracts are creating growth opportunities within the consumer finance industry with improvements in lending time, data accuracy, and investing transparency. Additionally, investment firms aim to fuse blockchain technology with generative AI to optimize back-end code and reduce the cost of executing blockchain transactions23. We witnessed exciting products and services enter the market over the past few months.

New initiatives look to lower the barriers of entry for crypto adoption. Emerging networks are encouraging financial institutions to adopt blockchain technologies.

Over the past quarter, autonomous areas have been the primary driver of government consideration cryptocurrency adoption. Large monetary authorities continue to focus their support on the underlying blockchain technology, specifically related to payment systems.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.