Search

Search

This is the first article in a series about how energy providers can thrive in an AI-powered future.

With the adoption of artificial intelligence (AI) speeding up across industries, utilities face a stark choice: Evolve into intelligent, adaptive platforms or risk becoming passive infrastructure in a market increasingly shaped by hyperscalers, software-native challengers, and policy volatility. AI is not just another digital tool to be piloted across individual functions, but a new, holistic operating system for the entire utility—one that will redefine how energy is produced, delivered, governed, and experienced.

Transforming the Energy Cloud

More than a decade ago, Guidehouse introduced the Energy Cloud: a vision of a dynamic, digital energy network that is evolving from a linear, one-way, centralized system to incorporate a multidirectional “network of networks.” That vision continues to take shape. Smart meters, distributed energy resource management systems (DERMS), and advanced distribution management systems (ADMS) are now standard. The U.S. Energy Information Administration reports that nearly one-quarter of U.S. electricity came from renewable sources in 2024, and Guidehouse Research estimates that more than half of new generation capacity came from distributed energy resources (DER) and renewables as of 2024. Virtual power plant (VPP) deployments have proliferated, highlighting critical cost and speed advantages over conventional forms of dispatchable generation.

The next generational leap in computing advances is underway, and its impact on the energy industry is already profound. Guidehouse analysis estimates that utilities around the world have invested tens of billions of dollars in earlier-generation analytics, not including nascent generative-AI-based solutions or the massive generation, transmission and distribution infrastructure needed to power AI data centers.

As an always-on operating system, AI represents the next major leap in the Energy Cloud story. No longer a peripheral tool, AI is emerging as a foundational layer that integrates intelligence directly into grid operations, customer engagement, and ecosystem coordination. It has the potential to automate decision-making, optimize grid operations, and transform customer engagement in adaptive, ever more granular ways.

AI enables utilities to more effectively orchestrate across a distributed and constantly evolving energy ecosystem. It can unlock existing generation and supply chain efficiencies, particularly if new large load data centers are tapped as a grid resource. The Duke University Nicholas Institute for Energy, Environment & Sustainability estimates that 100 GW of capacity could be unlocked across the U.S. if AI data centers participate in flexibility programs like demand response.

AI also threatens to disintermediate utilities from their most valuable customers. The disruptive Energy Cloud trends we observed shaping the industry over the past decade are becoming commonplace as AI permeates every layer of the utility enterprise stack.

The Trump Administration has prioritized American dominance in the AI arena with its America’s AI Action Plan, released in July 2025. The directive outlines three strategic pillars for the country:

The plan calls AI “an industrial revolution, an information revolution, and a renaissance—all at once.” For utilities, the mandate is clear: Operationalize AI to support this burgeoning industry, maintain relevance and system governance, and drive measurable stakeholder value. The stakes are existential.

To meet this fast-approaching future, utilities must start thinking beyond agentic workflows to develop fully orchestrated operating systems connecting the enterprise seamlessly to a sentient grid and distributed stakeholder ecosystem—breaking down silos, managing complex workflows, and enabling utilities to thrive in a more dynamic, porous, and competitive energy landscape. The hype may outpace near-term results, but the long-term implications will likely exceed current expectations.

As personal computers began to enter homes and offices, the U.S. electric grid had already matured into a highly coordinated, reliable national infrastructure network. For utilities in the early 1980s, desktop computing was a peripheral innovation—useful, but not mission-critical. Their mandate remained unchanged: Deliver affordable, reliable power at scale.

Fast forward 50 years, and the convergence of internet connectivity, mobile computing, and cloud infrastructure has transformed the grid into a digital platform—enabling predictive maintenance, self-healing, automation, DER integration, and increasingly sophisticated customer engagement. Over this period, according to Guidehouse Research, utility employee productivity has improved by at least 20%, driven in large part by digital enablement. With the accelerating integration of AI, as utilities move beyond pilots to navigate increasingly complex energy networks, a shift from infrastructure-centric operations to intelligence-driven orchestration will reframe business models and reshape organizational design.

The demand challenge—and opportunity

Scaling energy supply and infrastructure is widely acknowledged to be a significant bottleneck for progressing to artificial general intelligence (AGI). Not only are trillions in high-profile investments on the line, but a global race for AI dominance now puts the U.S. economy and geopolitical security in play. Utilities have a critical role to play in this race. Hyperscalers have invested more than $1 trillion in data center infrastructure to date, according to public filings, not only to support AI buildouts, but also to sustain growth in search, crypto, and other areas.

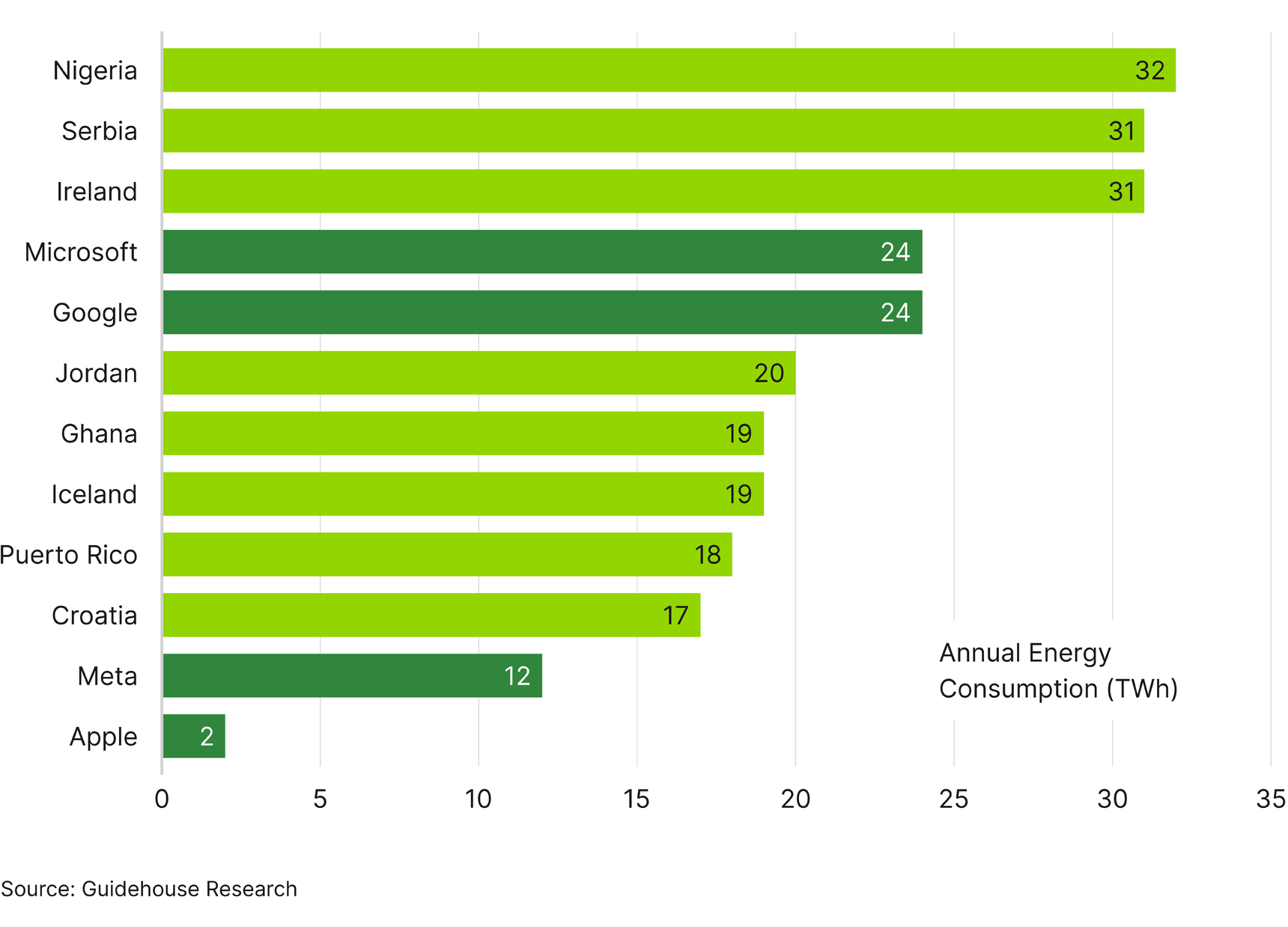

Guidehouse predicts that AI data centers will triple their load by 2035, potentially consuming nearly 15% of U.S. electricity. The largest hyperscalers already consume more electricity than some nations, and forecasts for future demand are continually revised upward.

To meet that demand, hyperscalers today are investing in small modular reactors, geothermal technology, natural gas, and off-grid solutions—in some cases, bypassing utilities entirely. As demand for firm power increases, resource constraints will outpace traditional utility planning cycles.

Even correcting for speculative or phantom large-load inquiries in their queues, utilities will need to move at a pace that exceeds their current capacity to deploy capital and interconnect large loads—and hyperscaler demand growth will continue apace for at least the rest of this decade. The opportunity costs for utilities (and their shareholders) that miss out on these new large load installations stand to be immense.

Responding with intelligence, not infrastructure

A fully AI-enabled energy system will bear little resemblance to the one we know today. It will be largely invisible—operating in the background, continuously learning and adapting. The grid and supporting utility operations will be fully automated, capable of self-healing, self-optimizing, and self-regulating. And the system will be defined not by centralized control, but by distributed intelligence, flexibly managing supply and demand from disparate sources in a holistic manner. In this future, AI-enabled utilities are not just energy providers that manage assets—they are system orchestrators, data stewards, and resilience partners.

For regulated utilities, the rise of AI adds new dimensions to the Energy Cloud. With an AI-enabled grid and AI-powered workforce, utilities will be able to manage an increasingly diverse energy supply and compete effectively with less regulated third-party providers. A decade ago, our Energy Cloud analysis predicted a potential $1.3 trillion in new investment in energy transition–related investments between 2020 and 2030, beyond a business-as-usual scenario. Guidehouse sees the potential for $500 billion or more in additional utility investment attributable to data center and AI load growth in the U.S. over the next five years. Either utilities will capture ROI on related investments or cede ground to more nimble, well-capitalized private sector parties. The potential is great, but so are the challenges.

In the 2025 Pulse of Power Survey conducted by Guidehouse and Public Utilities Fortnightly, utility executives cited policy volatility and accelerating load growth as the most disruptive forces facing the industry. These concerns are well-founded. Yet many executives remain cautious. More than a quarter of industry executives surveyed saw the grid as ill-equipped to handle this rate of growth. Another 61% acknowledged readiness for some growth but warned that system reliability would likely temper upside potential.

This tension—between opportunity and constraint—is the defining challenge of the AI era. But it also represents the greatest opportunity, providing the potential to transform utility operations from the role of a centralized supplier of a commodity product to that of a highly distributed, customized, and responsive energy services provider.

The traditional utility model—CapEx-heavy, regulatory-driven, and asset-centric—is ill-suited to compete in this new environment. The future belongs to AI-first utilities that can:

The winners will be those who act now—embedding AI into strategy, operations, and culture—and with an unwavering commitment to lead.

Five leverage points for building competitive advantage

The AI transformation confronting utilities is not just technological. It is cognitive. It demands a fundamental rethinking of long-held assumptions about stability, regulation, customer engagement, planning, and infrastructure value.

The utilities that are positioned to lead in the AI era will not simply adopt new tools. They will embrace new roles and capabilities. These are not incremental upgrades. They are foundational shifts. Guidehouse has identified five such shifts that will define the AI-enabled utility of the future—each offering a pathway to transform today’s constraints into tomorrow’s competitive edge.

Shift 1: From stabilizers to flexibility platforms

For leading utilities, preserving grid stability has long justified centralized control. But what if decentralization—enabled by AI—actually enhances resilience? In a world of DERs, electric vehicles (EVs), and transactive energy, utilities that cling to central control risk becoming friction layers. Utilities must learn to orchestrate, not dominate, in order to become a competitive energy services provider.

The AI-enabled utility operates less like a command center and more like a distributed intelligence network. Borrowing from military and logistics systems, this architecture allows teams of AI agents to coordinate across edge devices, DERs, and customer systems, continuously learning and adapting. The result is a grid that behaves more like a hive than a hub—resilient, adaptive, and self-optimizing. This shift enables utilities to evolve from infrastructure owners to orchestrators of dynamic, decentralized energy ecosystems.

Shift 2: From regulatory constraint to strategic advantage

Regulation is often seen as a brake on innovation for utilities. But AI can flip this narrative. In a policy environment defined by volatility and complexity, compliance becomes a strategic asset. AI-enabled utilities will embed regulatory intelligence into their operations, automating reporting, simulating policy impacts, and enabling real-time data exchange with regulatory agencies and other utilities. This becomes a “triple play” win for customers, regulators, and utilities, increasing transparency and efficiency for more cost-effective operations, improved outage prevention, and faster, more efficient response times to natural disasters.

In much the same way that biotech firms use AI to accelerate clinical trials under FDA oversight, utilities can use AI-enhanced scenario modeling to anticipate policy shifts, simulate compliance pathways, and engage regulators proactively. In this model, regulation becomes a design constraint that sharpens strategy—not an impediment to innovation. The most innovative utilities will be those that design for compliance from the start.

Shift 3: From ratepayer to “gridizen”

Utilities have long struggled to differentiate themselves in the eyes of their customers. In today’s era of digitally enabled personalization across software, apps, and services, the transactional model of customer engagement is obsolete. GenAI enables hyperlocal, adaptive energy experiences tailored to individual behaviors, preferences, and even emotional states.

The AI-enabled utility will deliver energy as a service, not a commodity—building trust, loyalty, and differentiated value in the process. Drawing from fintech and wellness platforms, AI-enabled utilities will deliver emotionally intelligent, individualized energy experiences. Interfaces will adapt to customer sentiment, usage patterns, and preferences, offering tailored recommendations, cost-saving nudges, and proactive support. Utilities will shift from transactional service providers to trusted energy partners, or “gridizens.”

Shift 4: From linear planning to dynamic blueprint

The 10-year integrated resource plan (IRP) is a relic of yesterday’s energy system. Static planning models are ill-suited to a world of accelerating change. Data from the Federal Energy Regulatory Commission (FERC) shows that grid planners now expect nationwide power demand to grow 4.7% annually over the next five years, compared to the previous year’s estimate of 2.6%. Between 2022 and 2023, total five-year peak summer demand projections nationwide rose by 17 GW—enough to power nearly 13 million homes. AI will enable rolling replanning, fed by dynamic input streams—from weather and load forecasts to policy and market signals. This is not just faster planning. It’s adaptive governance.

Drawing inspiration from algorithmic policymaking in urban mobility, these continuously updated planning systems will simulate multidimensional futures, adapt to real-time data, and align with shifting policy landscapes. Planning becomes a living process—faster than politics, more dynamic than spreadsheets.

Shift 5: From copper and steel to intelligence

Capital investment has long been equated with long-term advantage. But in the AI era, software-first challengers are redefining infrastructure value. A 40-person AI startup can outmaneuver a $4 billion grid investment by optimizing demand, orchestrating DERs, and delivering superior customer experiences. Utilities must reconceive their physical assets as cognitive infrastructure—nodes in a software-defined energy network.

Similar to how cloud-native firms disrupted hardware incumbents—not by building more, but by making infrastructure smarter—AI-enabled utilities will embed intelligence into the grid, unlocking new value streams: predictive maintenance, real-time optimization, and software-defined flexibility.

The shifts described above are not theoretical. They’re already playing out in data center hotspots, DER-rich markets, and AI-forward utilities. For utilities willing to challenge their own orthodoxy, evolving for the AI era is not just a means of survival. It’s a path to strategic reinvention.

That reinvention will require investing in more than customer service chatbots and AI-enabled load-forecasting analytics. It will require planning for the widest possible range of potential scenarios in a future where AI permeates all facets of the energy system.

By breaking down silos and optimizing processes, AI will push the boundaries of utilities’ operations, from integrating new energy sources such as nuclear and geothermal to enabling system-wide self-healing to creating an enhanced customer experience. The AI utility will no longer be a system of poles, wires, and pipes. It will be an orchestrated platform operating at the nexus of customers, regulators, and other energy stakeholders—an automated energy-services provider powered by previously unattainable intelligence and efficiency.

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.