Search

Search

A growing number of national governments and gas infrastructure companies across the globe are developing plans for the construction of national hydrogen transmission networks. Germany’s energy regulator recently approved the country’s updated network plan targeting about 9,000 kilometers of hydrogen pipelines by 2032.1 Other European countries, including the Netherlands and Spain, have also established near-term plans for building their national hydrogen networks. Another prime example is the European Hydrogen Backbone, a collaboration among 33 European energy infrastructure operators. Supported by Guidehouse, the project’s goal is to build a 31,000-kilometer network by 2030.2

Closer to the Gulf region, Hydrom, Oman's green hydrogen orchestrator, has set out a master plan to connect Oman’s key economic and industrial zones by building about 2,000 kilometers of pipelines by 2050.3

Amid the backdrop of this trend lies a vision set out by the UAE, whose National Hydrogen Strategy was issued in 2023 to position the region as a top global producer of low-carbon hydrogen as early as 2031.4 The strategy, which defines near-term demand and supply targets, recognizes the importance of developing a hydrogen transmission network for the creation of a local and export market. It also acknowledges that transmission pipelines are the cheapest alternative for transporting large volumes of hydrogen.

In its 2022 Abu Dhabi Low Carbon Hydrogen Policy (2022), the Abu Dhabi Department of Energy (DoE) defines the high-level governance and industry structures that will guide and support hydrogen development activities across Abu Dhabi.5 The policy also notes that future hydrogen transmission pipelines will likely be a natural monopoly arrangement regulated by the Abu Dhabi DoE.

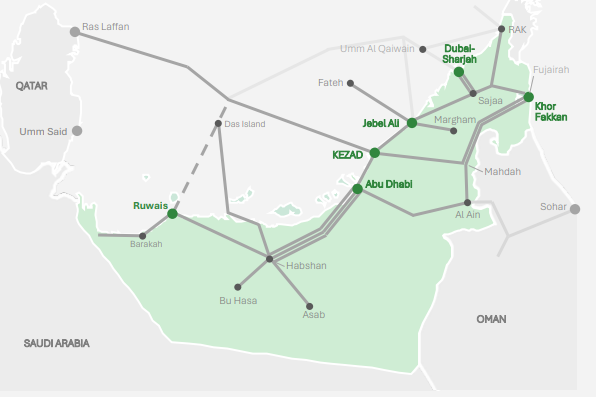

The prospect of a UAE-wide dedicated hydrogen transmission network is largely based on the potential to repurpose the UAE’s existing gas transmission network. Today, the UAE’s gas network covers about 3,200 kilometers, transporting natural gas from offshore and onshore gas fields to major power and water production facilities and heavy industry across the entire country.

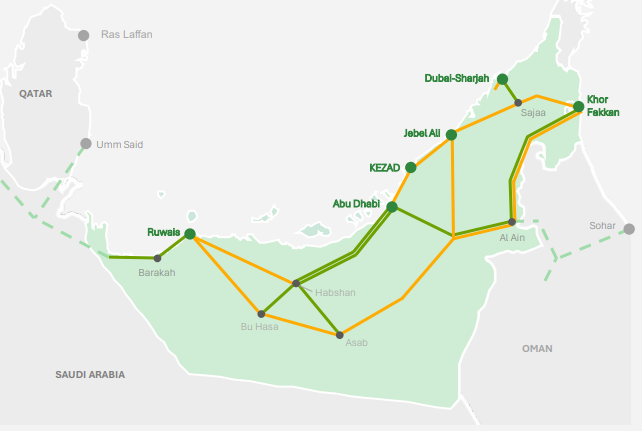

The hydrogen transmission network proposal is based on an analysis of the UAE’s natural gas transmission network, pipeline capacities, locations of critical power and water production facilities, and projected hydrogen demand across the country.

This vision offers snapshots of what a dedicated hydrogen network is projected to look like by 2030, 2035, and 2040.

Figure 1: Natural Gas Transmission Network

You can activate magnify by hovering over an image and pressing Ctrl twice.

The proposed hydrogen transmission network would benefit from the UAE’s offshore blue hydrogen potential, vast solar photovoltaic technology resources, untapped offshore gas storage potential, and strategic export terminal infrastructure.

By 2040, the network would expand across the entire country to a projected total of 2,200 kilometers—including 1,300 kilometers of new pipeline and 900 kilometers of repurposed gas pipeline. The expanded network would enable transport of low-cost hydrogen supply to all six of the UAE’s hydrogen oases along with export terminals at KEZAD, Jebel Ali, and Khor Fakkan.6 It would also potentially interconnect with neighboring hydrogen networks in Oman and Saudi Arabia.

The network would feature two main pipeline corridors originating in the western part of the country near the industrial city of Ruwais and terminating in Khor Fakkan near Fujairah:

Figure 2: Proposed Hydrogen Transmission Network by 2040

You can activate magnify by hovering over an image and pressing Ctrl twice.

Successful development of a national hydrogen network in the UAE will require a unified, integrated planning approach, as well as greater market and regulatory clarity. Stakeholders will need to focus on:

With the right guidance and collaboration, stakeholders can help the UAE achieve its hydrogen goals and position the country as a leader as it generates hydrogen supply and demand.

1. Hydrogen Insight, “German government agency approves core hydrogen pipeline network, allowing construction to begin.”

2. The European Hydrogen Backbone initiative, “European Hydrogen Backbone: Boosting EU Resilience and Competitiveness.”

3. Hydrom, “Oman Green Hydrogen Strategy.”

4. United Arab Emirates, “National Hydrogen Strategy.”

5. Abu Dhabi Department of Energy, “Abu Dhabi Public Policy on Low-Carbon Hydrogen.”

6. Guidehouse, “The Emergence of Hydrogen Clusters in the United Arab Emirates.”

7. Enagás, “Call for Interest: towards the development of a renewable hydrogen network in Spain.”

Guidehouse is a global AI-led professional services firm delivering advisory, technology, and managed services to the commercial and government sectors. With an integrated business technology approach, Guidehouse drives efficiency and resilience in the healthcare, financial services, energy, infrastructure, and national security markets.